Central Bank Created Silver Price Rally

Commodities / Gold and Silver 2016 Feb 01, 2016 - 05:07 PM GMTBy: DeviantInvestor

Central banks have created a mess, unless you enjoy unemployment, crashing economies, a wave of bankruptcies, and half of the world’s assets owned by only a few people.

Central banks have created a mess, unless you enjoy unemployment, crashing economies, a wave of bankruptcies, and half of the world’s assets owned by only a few people.

From Chris Martinson: The Deflation Monster Has Arrived

“Most of the bad decisions that will haunt our future were made by the Federal Reserve in its ridiculous attempts to sustain the unsustainable.”

“… looking at the next few years, we will experience this as a time of unprecedented financial market turmoil, political upheaval and social unrest. The losses will be staggering. Markets are going to crash, wealth will be transferred from the unwary to the well-connected, and life for most people will get harder…”

From Egon von Greyerz:

“In spite of a 50% increase in global debt since 2008 to $230 trillion and zero interest rates, the world economy is now deteriorating rapidly. Add to that $1.5 quadrillion of mostly worthless derivatives and a very serious geopolitical situation and we have the ‘perfect scenario’ that is going to lead to the most serious crisis that the world has ever experienced.”

From Ambrose Evans-Pritchard:

“The global financial system has become dangerously unstable and faces an avalanche of bankruptcies that will test social and political stability…”

Pritchard quoting William White, OECD, former chief economist of the BIS:

“It will become obvious in the next recession that many of these debts will never be serviced or repaid, and this will be uncomfortable for a lot of people who think they own assets that are worth something.” [emphasis mine]

From Chris Martinson: The Deflation Monster Has Arrived

“I’m not just calling for another run of the mill bear market for equities, but the unwinding of the largest and most ill-conceived credit bubble in all of history. Equities are a side story to a larger one.”

“It’s global and it’s huge. This deflationary monster has no equal in all of history …”

“Faced with the prospect of watching the entire financial world burn to the figurative ground (if not literal in some locations), or doing something, the central banks will opt for doing something.”

Repeat: The central banks will do something! The likely choices are: more QE such as “printing currencies,” bailouts, bail-ins where banks take depositor accounts to recapitalize banks, and helicopter money – money given directly to taxpayers, more giveaways, tax rebates, and whatever else politicians think will buy votes.

From Larry Edelson:

“We are entering a crash and burn phase for government. Especially Western governments and their socialist and safety net experiments of the last several decades.”

“It will manifest itself mostly in the sovereign bond markets of Europe and the United States…”

“… opportunities I see coming… A new, explosive bull market in precious metals and mining shares.”

Yes, but silver and gold have been dropping since mid-2011. Why an explosive bull market rally now?

From Taki Tsaklanos at Investing Haven

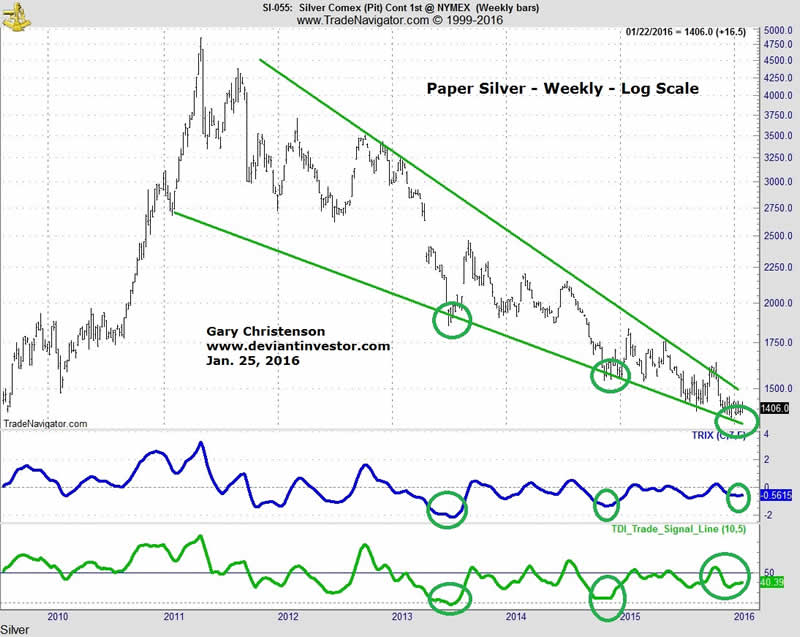

“Silver hitting major support.”

“…somewhere in 2016 silver has to break out or break down.”

Silver prices are at support near the bottom of a triangle. A break out seems likely.

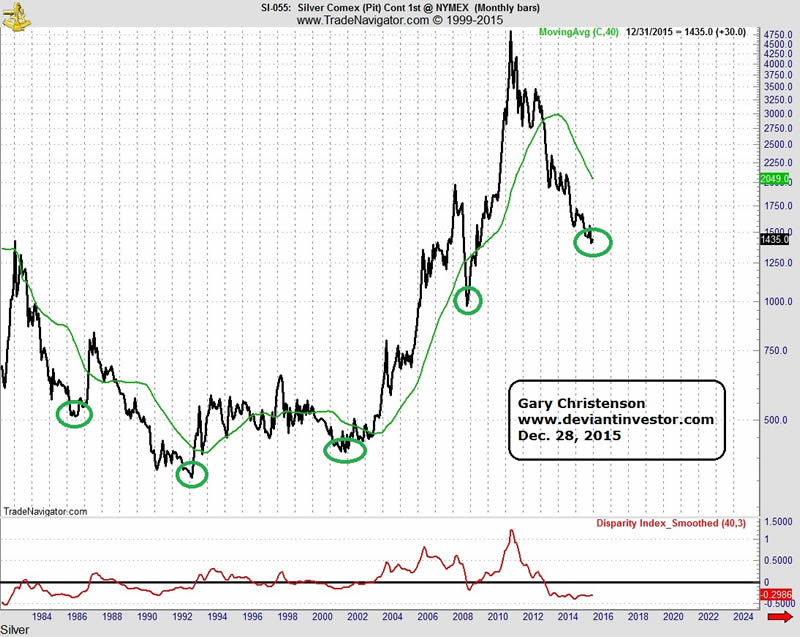

Silver prices are bottoming in a seven year cycle which means their next important move is probably up.

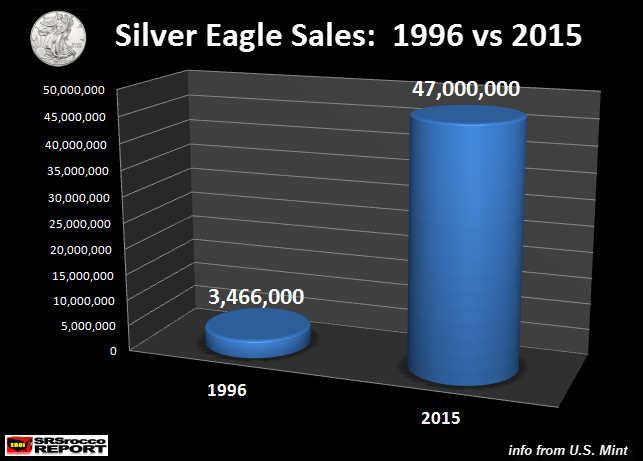

Silver Investment Demand is strong: Steve St. Angelo has pointed out the strong investment demand for silver in sales of Silver Eagles. He has also reported on the collapse of registered gold and silver at COMEX. See Silver Eagle sales chart below from srsroccoreport.com.

CONCLUSIONS:

The central banks of the world have made a mess of global economic systems, although they have successfully enriched the financial and political elite. But systems are collapsing, the deflation monster has arrived, and more QE, negative interest rates, bailouts, devaluations, and bail-ins are coming.

The central banks of the world will “do something” rather than watch economies crash and burn, along with the assets of the financial and political elite. Doing something almost always means devaluing their currencies, repressing the prices of silver and gold (if they can), levitating stock and bond markets, and lowering interest rates to penalize savers, retirees, pension funds, and others.

Inflation and war are the likely consequences, probably after more deflation and defaults in the financial markets. Silver and gold prices will benefit:

- There is massive demand for investment silver and gold.

- Central banks are, so it seems, running out of gold to sell or “lease” to maintain price suppression.

- Eventually people will realize that silver and gold are a good store of wealth while fiat currencies, which will be aggressively devalued by central banks, are not.

- Silver and gold are currently at the bottom of triangle patterns and silver is at the bottom of a seven year cyclic.

- Would you rather own physical silver or paper dollars, euros, pounds, or yen?

- Would you rather own physical gold or a bond “paying” negative interest rates backed by an insolvent government?

- The reality of devaluing fiat currencies will become devastatingly clear to the middle classes of the US, Europe, the UK, and Japan. By that time the prices for silver and gold will be much higher than they are today.

Silver thrives, paper dies!

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2016 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.