Market Friendly BoJ Action Means more Unfriendly CNY Devaluation

Stock-Markets / Financial Markets 2016 Jan 29, 2016 - 04:42 PM GMTBy: Ashraf_Laidi

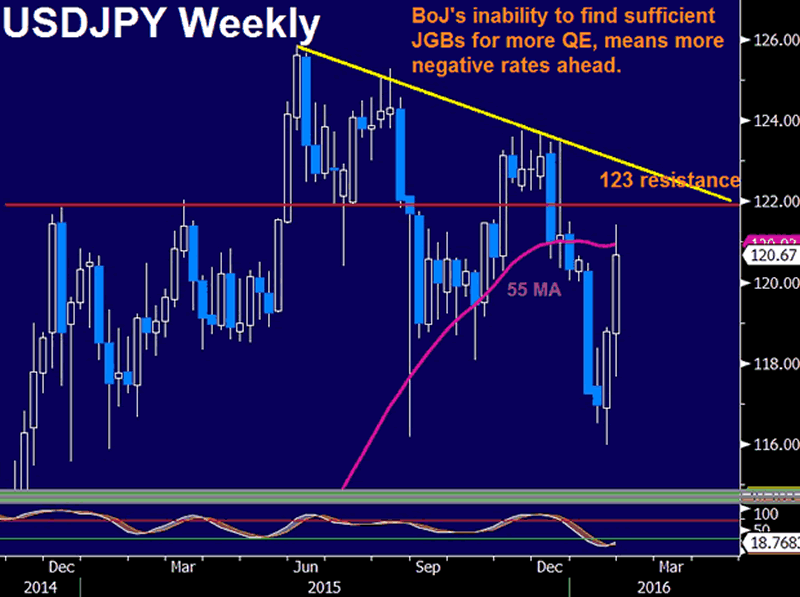

The BoJ's decision to cut the interest rate on current account balances to -0.10% highlights the beginning of the end of Japan's asset purchase program due to insufficient bonds held by banks, pension funds and insurance companies.

The fact that the BoJ voted 5-4 in favour of negative rates and 8-1 to keep monthly assets purchases unchanged exposes the controversial nature of the decision to re-enter negative rates and the unfeasibility of adding fresh QE.

At the current pace of asset purchases (which include Japanese Government Bonds and even equity ETFs), by end of 2017, the BoJ's holdings of JGBs would have risen from yen 200 trn to yen 500 trn. The BoJ will have to buy yen 40 trln from existing holders to hit its yen 80 trn per year goal in bond buying.

But where will it find the extra bonds when current holders of JGBs (insurance companies and pensions funds) will simply not sell?

Insurers need JGBs for asset-liability balancing, while pension funds such as the Japanese Pension Investment Fund have disposed of enough JGBs as part of their bonds-to-equities rebalancing.

Slashing rates to negative is aimed at encouraging banks to lend, rather than keep their funds at negative rates. If the BoJ means what it says and deepens the path to negative rates, it would risk endangering the financial system by as it exasperating the asymmetry between investing in equities and insufficient bank lending, while retail deposit rates will fall further.

Yen Implicit Devaluation means more Outright Yuan Devaluation

The yen's violent ascent of the past 5 weeks was instrumental in the BoJ's decision, but will also reduce the likelihood of Tokyo adopting structural measures and may even postpone the next tax hike. The BoJ said it is ready to slash rates further, a decision, which reflects total desperation from the central bank as all other methods have failed.

As Japan continues to devalue its currency via negative interest rates, China may well be able to continue weakening its currency, especially as JPY makes up for 15% of the CNY's CFETS basket. The negative market implications from further CNY devaluation versus the positive implications of JPY devaluation force an asymmetric reaction to these events.

China will have no choice but to further devalue its currency as CNYJPY rose 75% from 2011 to 2015 and fell by only 12% since June. Further devaluation is inevitable and its impact on global markets will be negative, including the rising yen.

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2016 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.