Janet Yellen "Peddling Fiction" on a Worsening Economy... Doesn’t Raise Rates and Downgrades Outlook

Interest-Rates / US Interest Rates Jan 29, 2016 - 05:55 AM GMTBy: Jeff_Berwick

We have made some very bold claims in the past. Since 2010, to many jears, we said that the Federal Reserve would never raise rates significantly again. Most laughed. They said that surely this crazy, emergency 0% interest rate policy was only temporary. Five long years passed, and even a Fed Chairman later, before finally, after seven years-to-the-day, on December 16th, Janet Yellen took the bold move to raise rates 0.25%.

We have made some very bold claims in the past. Since 2010, to many jears, we said that the Federal Reserve would never raise rates significantly again. Most laughed. They said that surely this crazy, emergency 0% interest rate policy was only temporary. Five long years passed, and even a Fed Chairman later, before finally, after seven years-to-the-day, on December 16th, Janet Yellen took the bold move to raise rates 0.25%.

“There, you see!” said some. But we retorted that we meant the Fed would never significantly raise rates again. 0.25% isn’t exactly a massive move.

We responded that the Federal Reserve would soon begin backpedalling on future rate hikes. We also had said, since the summer of 2015, that even a 0.25% rate hike could be enough to cause a major collapse in the markets.

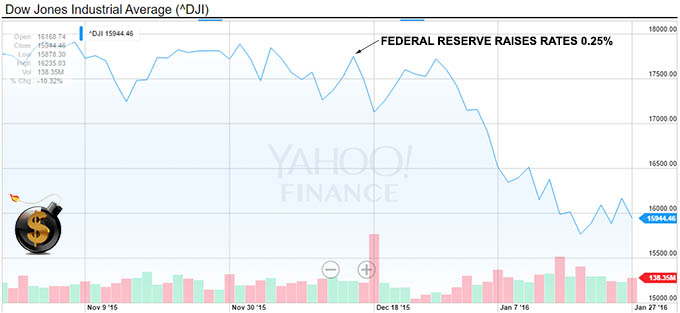

And since they rose rates 0.25% on December 16th, what has happened?

World markets have dropped more than ever in history to start the year and the Dow Jones has dropped 1,805 points.

Today, the Politbureau, called the Federal Open Market Committee (FOMC), cooled, as expected, from their economic outlook for a further raising of rates.

They recanted on their glowing outlook on the economy made just six weeks ago, saying, “labor market conditions improved further even as economic growth slowed late last year.”

It has only been two weeks since Barack O’Bomber’s State of the Union where he said, “Anyone saying America’s economy is in decline is peddling fiction.” And now, Janet Yellen said that America’s economy declined late last year.

Someone’s peddling fiction, that’s for sure.

The next FOMC meeting is on March 16th and I am going to make a prediction. Either the markets and the economy will be in such poor shape that they will again put off a rate rise… or, if not, and they raise rates, it will set-off yet another massive collapse that will have the Fed backpedalling to the point of lowering rates again soon after.

The reason they can’t raise rates is because the US federal government’s debt has grown to such a level that even an interest rate of a few percent will make its insolvency clear. Total US government debt has doubled since 2008… during the crisis caused by too much debt.

The markets fell again today, after Janet Yellen spoke from her pulpit, another 200+ points on the NYSE.

The wheels are quickly coming off this wagon. And, as this year progresses, it will become even more brutally clear that we are in a crisis that will be far, far worse than 2008.

Since we made our other bold call, that this collapse would begin in the fall of 2015, world markets have lost a total of over $17 trillion.

The scary part? This is just the beginning. Mark our words.

And don’t forget to subscribe to TDV to get the best market analysis and recommendations before our rates rise, due to demand, on February 1st. We’ve been short the markets since last summer, with gains in the hundreds and thousands of percent, and long bitcoin, which has since doubled and are long gold and silver, which have both begun to rise since the beginning of this year.

And/or join us at our upcoming TDV Internationalization & Investment Summit on February 18th to hear from top experts on how to survive and profit from this ongoing collapse.

This is not the year to be taking your eye off the ball.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.