FOMC Dovish: Gold to Go Higher and Stocks to Bounce

Commodities / Gold and Silver 2016 Jan 28, 2016 - 12:03 PM GMTBy: Bob_Kirtley

The worsening of financial conditions this year led markets to price in rates to remain unchanged at the January FOMC meeting, with many speculating the Fed to deliver a dovish statement. This has now been realised. Language used described that the FOMC recognised that economic activity had slowed and that inflationary pressures and expectations had “decline further”. As a result, it will now take an improvement in financial market conditions for the Fed to hike again at their next meeting, which is in March.

The worsening of financial conditions this year led markets to price in rates to remain unchanged at the January FOMC meeting, with many speculating the Fed to deliver a dovish statement. This has now been realised. Language used described that the FOMC recognised that economic activity had slowed and that inflationary pressures and expectations had “decline further”. As a result, it will now take an improvement in financial market conditions for the Fed to hike again at their next meeting, which is in March.

Markets are currently only pricing in a 25% probability of a hike in March. Yet, the Fed has indicated that their March meeting will hold a rate increase if conditions recover. This means that markets believe there is only a quarter chance of the market and economic situation improving. We agree with this for the key reason that there is unlikely to be a catalyst to improve conditions enough over the next two months.

Potential Positive Catalysts

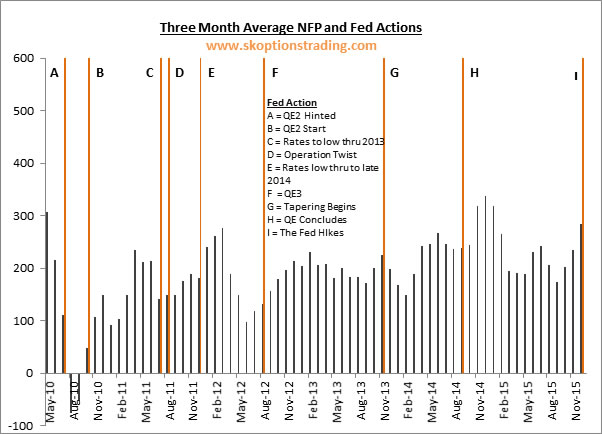

The payrolls print at the beginning of January was particularly strong, showing upward revisions for the previous two months and brining the three months average up to 284,000 new jobs a month. However, markets failed to react positively to this data. The continued risk off tone despite employment strength indicates that markets believe other factors are much more important in the current economic climate. This means that future payrolls prints are also unlikely to have a positive effect.

Although employment data may not have the potential to be a catalyst for better conditions, growth may. However, the next GDP report, released this Friday, is expected to show soft economic performance. Meaning that growth as a whole is unlikely to have a positive effect over the coming months.

Considering inflation, there is little to be optimistic about. Oil continues to stay close to the lows while other commodities, such as copper, also show weakness. These factors unlikely to drive costs higher, and the lack of expansion in the oil industry flows over to other support sectors, such as the industrials. Collectively the inflationary pressures from these factors are unlikely to improve.

Longer Term Macro Risks

There is also the longer term effects of China’s currency devaluation to consider. This has kept the US dollar at the highs, making exports less competitive. Therefore there is the potential for this to have a yet to be seen negative effect on the US economy that would see data weaken and thus drag markets lower again.

Therefore we do not believe there is a major catalyst that can improve the situation enough in the coming months to justify a rate hike. This means the Fed will likely have to delay hiking at the March meeting and continue to deliver a dovish message, as they did this week.

There is the possibility for a hike at the April FOMC meeting. However, it is unlikely that the Fed would hike at a meeting without a press conference after delaying hiking for two meetings. A statement lacks the depth to assure markets of the reasoning behind market conditions being too poor to hike for two meetings, and then suddenly improving enough in a month to require a hike. Accordingly, we believe the Fed will be unlikely to raise rates again until their meeting in June.

Dovish Fed Will Support Risk Assets

A dovish Fed over the coming months is likely to have a number of effects on the financial markets. Already, the statement has caused gold to rally and this is likely to continue. Just as continued, highly dovish policy from the Fed fuelled the last long term bull market in gold, the current stance is likely to push the yellow metal higher in the near term.

We believe gold is likely to continue rallying from here, challenging resistance at $1150 and from the medium term downtrend line this week. Following this we believe the yellow metal has the potential to test strong resistance at $1180 and the long term downtrend. If this level breaks, we will look to initiate aggressive longs on gold.

However, gold is not the only market offering trades with positive risk reward dynamics. Equity markets are likely to benefit from a dovish Fed also. Stocks performed exceptionally well throughout the Fed’s QE programs, with volatility also remaining low during that time. Although the Fed’s stance is not going back to that which drove stocks continually higher, we believe that it is likely to cause equities to maintain their current levels and even give them the potential to bounce back.

A bounce will be largely technically driven at this point. The S&P has found a base at the support level of 1880 and the RSI has begun to rebound from oversold levels, but still shows stocks to be oversold overall. This means that stocks have the potential to rally and a base to do so from.

The key indicate that a bounce is likely is that the MACD is poised for a sub-zero bullish crossover. This has historically been a key indicator that a rally is imminent. The dovish statement from the Fed coincides with this to allow a bounce to take place from a fundamental perspective also. Therefore we will look to initiate a long trade once the crossover takes place.

Trading A Dovish Yellen

The exact details of our trades are available only to the subscribers of our premium service, SK OptionTrader. However, we can provide an overview of the type of trades we are considering.

We believe a bounce in stocks is likely to take place in the near term, and the most aggressive rallies in stocks follow selloffs. However, without a clear catalyst to cause conditions to improve it is much less likely that the ground gained on a bounce will be maintained. This means that holding an aggressive long term strategy has poor risk reward dynamics.

However, a quick play does have the potential to offer considerable returns with much less expected downside. Buying calls, or call spreads to reduce time premium costs, on SPY with strikes around $205 currently offer favourable risk reward dynamics. If stocks rally as we expect, then this type of trade is could outperform equities by ten times.

Regarding gold, we are considering aggressive long trades, such as buying calls on GLD, if the yellow metal breaks through major resistance at the long term downtrend line. However, there is still opportunity ahead of this. If gold fails to break higher through $1180, it is still likely to challenge the metal and remain high over the coming months. This means that selling downside protection offers favourable risk reward dynamics, which we discussed in much more depth in an article earlier this week.

If you wish to know the exact details of our trades and when they are executed, please visit www.skoptionstrading.com. For those considering subscribing to SK OptionTrader, please be aware that we are closing to new clients on February 20th to ensure that the quality of our service is not diluted. Therefore if you wish to become a subscriber, we recommend doing so sooner rather than later.

Sam Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

Disclaimer: www.gold-prices.biz makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents our views and replicates trades that we are making but nothing more than that. Always consult your registered adviser to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this letter. Options contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. Past performance is neither a guide nor guarantee of future success.

Sam Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.