Stock Market Bounce, But No Overlap

Stock-Markets / Financial Markets 2016 Jan 26, 2016 - 03:57 PM GMT Good Morning!

Good Morning!

SPX bounced in the Premarket, but did not overlap, which is a condition of a declining impulse. Confirmation of that would be

Evident only after the open. A gap down open would suggest Wave 3 may be underway.

You can read about the overnight whipsaw in the e-mini.. The upshot of that was ZeroHedge’s blaming the ramp on Dennis Gartman, who seems to be the whipping boy for his attempts to call the market. Of course we know that isn’t true, but someone who is in the limelight as Dennis is, is bound to be poked fun of.

The VIX futures are down at the present time, but no new low. It is possible to take another dip to mid-cycle support at 21.30 to make Wave v of (c) more in line with the length of Wave I of (c).

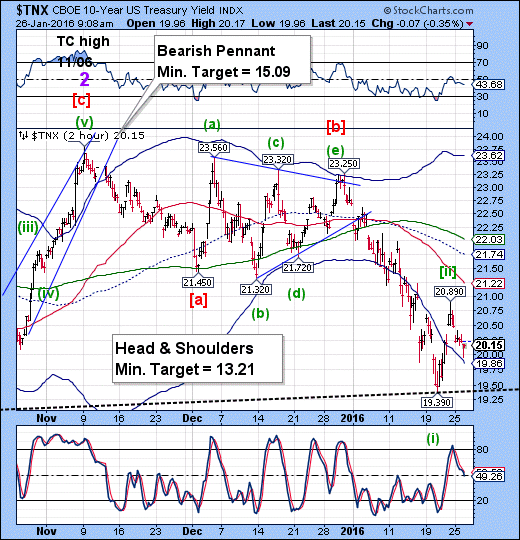

TNX has bounced off its 2-hour Cycle Bottom support this morning. Should it break into positive territory, it raises the probability of a Wave (c) bounce to 21.22. All is not certain yet, so we will be watching this action. The Cycles Model suggests that the period of strength may have already passed as of last Friday morning when it peaked out at 20.89.

Filling the gap at 20.62 will tell us whether TNX may go higher in this retracement or not.

Much of the influence on our markets comes from the China markets. The Shanghai Index made a new 14-month low last night, closing at 2749.79, a 6.42% decline. This may mitigate against a new high in the SPX.

ZeroHedge reports, “It has been another volatile, illiquid, whipsawed session, driven by the only two things that have mattered so far in 2016, China and oil.... and stop-hunting algos of course.

A quick look at the former first reveals that after sliding gradually all session, Chinese stocks puked in the last hour of trading with the China's Shanghai Composite Index plunging 6.4% to 2,750, the most since the first week of January, and falling to the lowest level since December 2014. The composite has now plunged 22% in 2016 alone and is the world's worst-performing primary equity index this year.”

One consideration is that this may be an extended Wave [b], in which case, the Shanghai Index would need a 9% rally in two days to complete a probable period of strength that may last until Thursday. Don’t discount anything in a bear market.

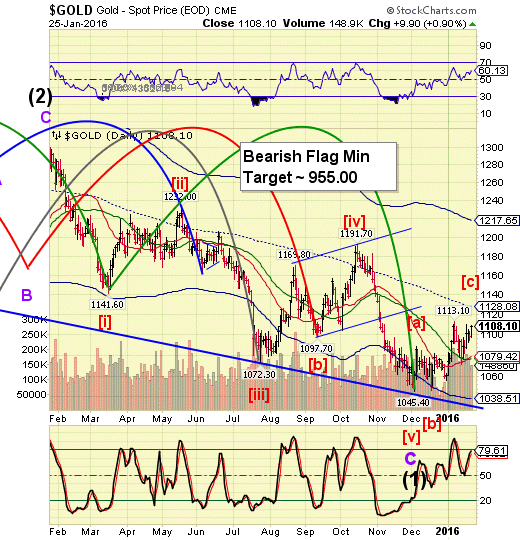

Gold forged higher in the overnight markets and made a new high of 1118.00. It has since pulled back to 111.80 in a probable Wave iv of (v). There appears to be one more probe higher to the probable target of the mid-Cycle resistance at 1128.08. Once accomplished, the decline resumes. I will try to keep you informed when that occurs.

WTIC challenged its Cycle Bottom this morning at 29.80, but did not remain below it. Despite the giant rally and decline, don’t dismiss the possibility of another ramp toward the neckline at 34.50.

The Cycles Model is not suggesting any moves for this week but has a quadruple Primary Cycle low on or near February 10.

A decline that sticks beneath the cycle Bottom may confirm the decline to an epic low is confirmed.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.