Money Mind Games, Futures, and the Future

Stock-Markets / Financial Markets 2016 Jan 25, 2016 - 03:50 PM GMTBy: Doug_Wakefield

“In markets, usually when you see massive buying and selling and people piling into trades, it is time to step back, get some perspective, and let the move play out before jumping in or out one way or the other. As we know, trades can get very crowded and almost too tempting to resist.” – Mind, Money & Markets, Dr. Janice Dorn, pg 47

“In markets, usually when you see massive buying and selling and people piling into trades, it is time to step back, get some perspective, and let the move play out before jumping in or out one way or the other. As we know, trades can get very crowded and almost too tempting to resist.” – Mind, Money & Markets, Dr. Janice Dorn, pg 47

“Reaction to the FOMC news was instant. Within a thousandth of a second, the move was already over. Trades in 8,000 NMS stocks. Nothing to buy after a few milliseconds.” – Buy All The Stocks Now!, Nanex Research, Sept 18, 2013

Dr. Dorn’s comments are at the root of true contrarian thinking. It becomes extremely challenging, as she certainly knows, when the lead trader in all markets today is a computer trading futures in milliseconds based on news algorithms that often set up markets for big moves BEFORE the regular trading day starts. These enormous swings over the last few days and weeks redefine the word “challenging” for traders and managers.

Viewing The Financial Futures Battle

I read Jason Goepfert’s blog, www.sentimentrader.com on a regular basis. His findings over the last several days have made it clear we have seen behavior way outside the normal market environment, but which do have a basis in the historical record when looking at bearish extremes.

The plethora of data and comparison to other extremes through Sentimentrader is what I continue monitoring. One area I watch on an ongoing basis are the positions held weekly by the group of commercial hedgers across various major markets as we come through these big ups and downs in stocks. Anyone who has read futures legend Ed Hadady’s book, Contrarian Opinion (2000), understands why the ongoing battle between the “heavily financed” and the “lightly financed” in market trends is critical now that we find ourselves looking up at the “nirvana line” (200 day moving average) rather than down at what seemed as an almost “impenetrable line” since 2012, other than early last fall.

But at some point we begin to expect at least a bounce after watching the Dow decline 2,300 points in 14 trading days. So think with me.

Yesterday ECB’s Mario Draghi makes a regular scheduled announcement, I am informed the previous day that “big money” participated in the power recover rally on Wednesday, and voila, we have a global rally in Asia, Europe, and the US today.

4 Key Takeaways from Draghi’s ‘no limits’ statement, Marketwatch, Jan 21

With what we have seen going into this week, those trading in the futures markets or watching for extremes in the battle between the “heavily financed” and “lightly financed” in major global markets know that by Wednesday, pressure was at rare historical extremes.

For this reason, Dorn’s comment of “trades can get very crowded” rings in my head daily right now.

Is this bounce sustainable? We continue.

Next we move away from the technical side of the near term picture. This has and continues to be critical when dealing with the ability to switch the trade powerfully as we have seen twice in the last 18 months, and at major bear market bottoms.

Yet here is the rub. As of Wednesday’s intraday low, the S&P 500 was only down 15% from its highest reading ever, reached last May.

How can we be at the end of a major bear market? Answer, we can’t.

A View of The Future

Next I turn to the big historical picture. One individual I have read for years is James Rickards. I mean, how many people do you know that the Pentagon asked them to head up the first ever financial war games in 2009. Let’s just say this is list is very, very small.

Having read his books written since 2007, I am always walking away with ideas of where to look across global markets for yet another pressure point in this global house of cards. This past Monday I was learning from him once again during a live video presentation he gave sponsored by Agora Financial about another set of “first in history” events involving the dollar, oil, and the Middle East.

Those at the management and trading level that are constantly aware of the many “first in history” events, understand that we are entering 2016 with plenty of evidence assembled in 2015 that the breakdown of the 3rd financial bubble since 2000 is clearly underway.

Most outside the trading world are only now waking up to the fact that having a central bank supported rally was not a long-term sustainable idea from the start.

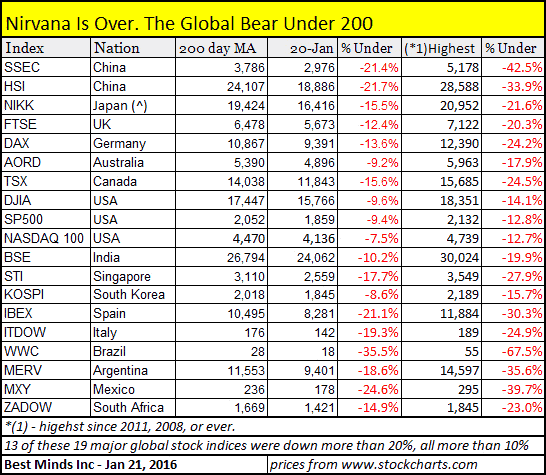

Take a look at where world equity markets have come from recent highs, some of which were their highest price ever.

With this much red, it is getting harder for anyone with an open mind to deny the fact that the global picture has changed dramatically from just 2 years ago.

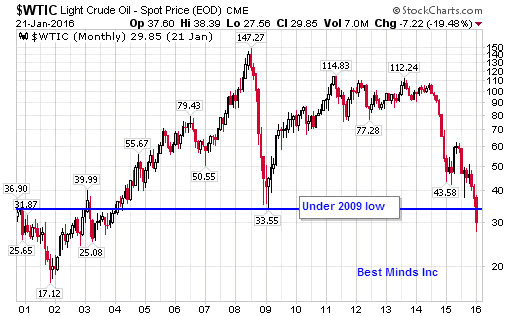

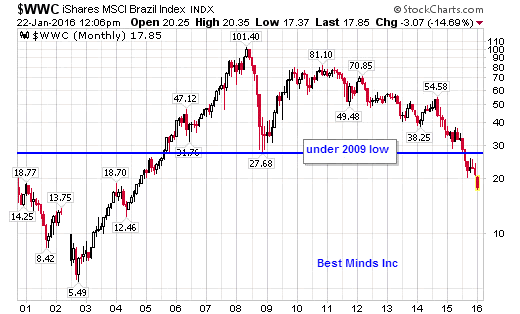

When one looks at the two charts below, we are reminded that those with heavy US stock exposure are sitting ducks for what should unfold this year. One need not return to the lessons from history about the collapse of 2000 and 2008 to see that big markets have already produced massive losses for entire countries and industries.

These are not merely declines in markets, but changes that are having serious consequences to lives around the world.

So where will the major stock markets go in the near term? Do the actions of the most powerful central banks in the world really have a “no limit” to their arsenal?

Bank of Japan’s Kuroda Faces Mounting Pressure To Act, WSJ, Jan 21 ‘16

Minds Under Pressure

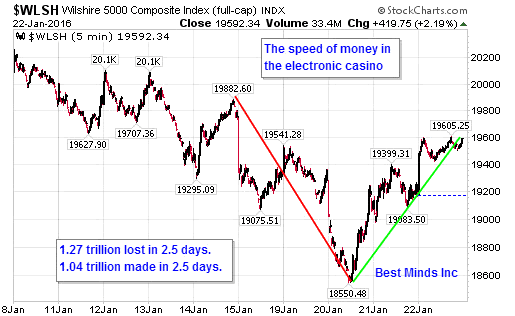

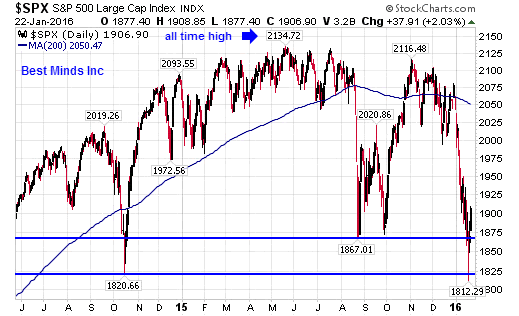

Look at the chart above. What do you see?

As of Friday, January 22nd, we can see that the computers and humans had found the October 2014 low as a close proximity for a big bounce.

Will it last and start a move up for several weeks like we saw last October?

Will the move stall in the next few days, and global developments pull the S&P 500 lower toward a 20% loss from its May 2015 watermark?

From the technical and political picture across various markets, I believe it argues for a bounce more than a few days. However, from a fundamental picture that is loaded with massive problems, we are still way too high for these prices, whether in China or the US.

All this says be on your toes and don’t go to sleep. The boring days of bouncing repeatedly at the 200 day moving average in the S&P 500 are over.

In the global game of “if they feel wealthy, they will go out and borrow and spend”, the last few weeks have flipped the environment into “if we even barely raise rates after years at zero, and the global picture has already been looking more unstable, they will know they are not as wealthy?”

Fed Seeking to Create Wealth, Not Just Cut Rates, Yahoo Finance, Sept 14 ‘12

Shipping Index Plunges To Fresh Record Amid China Steel Slump, Transport Topics, December 15, ‘16

Last week, one day after the bottom, we were presented with Draghi’s “no limits” solutions that could come in March.

Draghi: No Limits How Far We Will Go, Business Insider, Jan 21

Next week we wait to hear from Yellen on Wednesday and Kuroda on Thursday. Considering the fact that the Fed’s raised rates for the first time in 7 years a month ago, would it make sense to launch another QE now? Heck, we have already seen massive sums of liquidity REDUCED at the market maker level since 2007, even as big players in the world have hoarded cash at unprecedented levels during this same period.

“Another Crisis Is Coming”: Jamie Dimon Warns of Next Market Crash,

ZH, Apr 9 ‘15

That seems to leave it all up the Bank of Japan to follow Draghi’s lead this week, when they present their next press release, while having the Federal Reserve make some worthless statement about, “not in a hurry to make the next rate hike” mumbo jumbo.

“I don’t think that the BOJ can stop emerging negative factors — from a renewed decline in oil to yen gains — by additional easing now,” said Hiromichi Shirakawa, chief economist for Japan at Credit Suisse Group AG and a former BOJ official. “But can the BOJ remain inactive? I don’t think so. They will have to move again, probably in March.”[Bold text, mine]

BoJ on Verge of Fresh Inflation Target Delay, Putting Monetary Policy Under Scrutiny, The Japan Times, Jan 22

So what observations can be drawn from the battle between the fight to artificially inflate markets, overcome gravity, and delay the evaporation of capital that got underway in some markets as early as 2014? Let’s return to that summer when oil began its steep descent to see what the Bank of International Settlements was saying at the time. Remember, the big four central bankers are also members of the BIS.

Central Bankers, Worried About Bubbles, Rebuke Markets,

NY Times, 6/29/14

‘Despite the euphoria in financial markets, investment remains weak’, the BIS said, ‘ Instead of adding to productive capacity, large firms prefer to buy back shares or engage in mergers and acquisitions.’

The overall, somewhat gloomy message from the central bankers was that the world is drunk on easy money and has already forgotten the lessons of recent years.

‘The temptation to postpone adjustment can prove irresistible, especially when times are good and financial booms sprinkle the fairy dust of illusory riches,’ the report said. ‘The consequence is a growth model that relies on too much debt, both private and public, and which over time sows the seeds of its own demise.’”[* from The Yuan Stops Here, July 15, 2014]

Practical Application

Step One – Our leaders, the financial industry, and the public at large must one by one start admitting we have a serious problem. Yes central banking policy has fueled the greatest debt schemes in history, but where has been the public outcry?

Anyone can find those individuals speaking out about these schemes for years, even going back before the 2000 top. However, when the state says, “more free money”, whether in the form of government benefits or artificially inflating markets, it is just too easy to ignore the problem until money into the trillions starts evaporating. This is not just a financial issue. This is not about who timed tops or bottoms. This is a moral issue.

“We admitted we were powerless over alcohol – that our lives had become unmanageable.” – Step One, Alcoholics Anonymous

This is not a story about me. This is a story about we. When markets become a reckless casino, everyone gets hurt in some way.

Step Two – We must remember that the conventional view by the public and most advisors in the U.S. is “it always comes back, that is why I never take these ‘scare tactics’ seriously. I have done well, so why change, why learn history?”

2016 has already started out as a blood bath. If the big four central banks are going to convince the world that THEY have the power to stop this, a rally must ensue as we come to the end of January.

However, when China burns through more than $500 billion of their estimated $4 trillion in foreign exchange reserves while the Hong Kong and Shanghai stock markets shave off more than 1/3rd of their value in under three quarters, optimistic thinking and more debt schemes will not fix these structural problems.

When Russia’s Money Runs Out, The Real Problem Starts, CNBC, Jan 21

Step Three – Learn from the ultimate contrarian trade as these bubbles keep bursting, short sellers and gold. This month is the 10th anniversary since I released my research paper Riders on the Storm: Short Selling in Contrary Winds, and launched the first issue of The Investor’s Mind. Examine the insights anyone can gain from interviews with managers “hardwired differently” in search of what can go wrong. Based on the last 3 weeks, I cannot think of a better time to dive in.

If you don’t have time to read the entire work right now, make sure you read chapters 4 and 5. They contain great insights from managers as well as a history on short selling since the 1600s.

I have left the document free to the public because I have always known from my Austrian influence, that every boom fueled by an expansion of cheap credit in a fiat currency system must inevitably bring about the next bust.

“If one wants to avoid the recurrence of economic crises, one must avoid the expansion of credit that creates the boom and inevitably leads to the slump.” The Theory of Money and Credit (1953), Ludwig Von Mises

“Globally, interest rates have been extraordinarily low for an exceptionally long time, in nominal and inflation-adjusted terms, against any benchmark. Such low rates are the most remarkable symptom of a broader malaise in the global economy: the economic expansion is unbalanced, debt burdens and financial risks are still too high, productivity growth too low, and the room for maneuver in macroeconomic policy too limited. The unthinkable risks becoming routine and being perceived as the new normal.

This malaise has proved exceedingly difficult to understand. The chapter argues that it reflects to a considerable extent the failure to come to grips with financial booms and busts that leave deep and enduring economic scars” – Is The Unthinkable Becoming Routine?, June 28, 2015, Bank of International Settlements

Step Four - Finally, we must remember, that while short selling has been seen as “vicious” traders who seek to prosper while the majority are getting hurt, I don’t remember any public outcry on the constant repetition of computer generated short squeezes that have almost destroyed this valuable side of our markets for years now, while feeding yet another financial bubble.

If the private sector does not learn to grow money, whether from markets that have been hammered for years and thus must produce a powerful rise in the future, or markets that have been artificially inflated that are now in the early innings of a bust, then the “heavily financed” will only grow more powerful, and the “lightly financed” will grow weaker, which ultimately, is destroying the very basis of the system serving the individual, rather than the individual serving the state.

“Now remember this thing, when stocks are moving up, as they now are, it's the worst sort of time to buy either for investment or speculation. But you people out West will never learn that fact, no matter how hard you get hit, no matter how much you may suffer. You come back again to the game on each rising market, only to be among the losers when the next bear market comes along, as it inevitably does. ...You are like a flock of sheep following after a bell weather. You never sit down and think and ask any questions. Now it's this fact that Wall Street banks on about once a year. The time to sell is when everybody out West is buying." [The Confessions of a Monopolist (1906) Frederic Clemson Howe, pg 54, pulled from Forgetting the Past, March 16 ‘12]

Be a Contrarian, Remember Your History

If you are reading this article, you are most likely very aware of the trillions that have been lost in the last 7 months. If you are unaware of the swift lost of these trillions globally, learning about “the game” has moved from good to critical.

Click here to start the next six months reading the paid research found in The Investor’s Mind newsletters and group emails as we continue through this highly volatile year together. Make sure and download the December newsletter, The Money Cliff, and January newsletter, Last Bounce?, as well as the January 20th group email, In a Panic, Take Time To Think.

On a Personal Note

Check out the posts at my personal blog, Living2024. There are few in number, but I believe you will find them thought provoking.

Doug Wakefield

President

Best Minds Inc. a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

http://www.bestmindsinc.com/

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.