High Food Pricing Killing Benefits of Low Energy Prices

Commodities / Food Crisis Jan 24, 2016 - 04:09 AM GMTBy: Richard_Mills

Lesson Learned

Lesson Learned

One of the places the decline in the Canadian dollar is most evident is in our grocery stores.

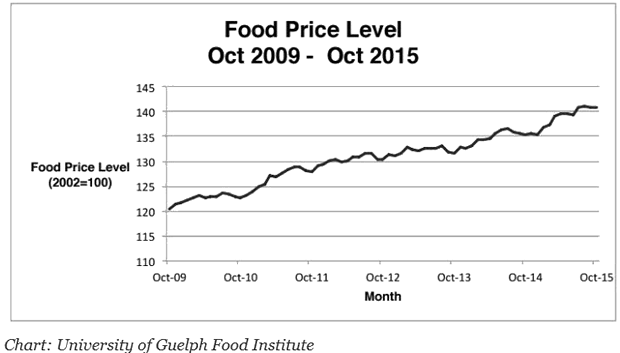

The University of Guelph's Food Institute estimates the average Canadian household spent an additional $325 on food in 2015 with meat rising 5% and fruit and vegetable prices rising between 9.1-10.1%.

Consumers should expect an additional annual increase of about $345 in 2016 with meat expected to increase up to 4.5%, fish/seafood rising up to 3% and dairy, eggs and grain rising 2%.

The Bank of Canada is playing its role in killing the Cdn$, talking about negative interest rates as if the two rate cuts in 2015 weren't enough. Budget deficits, possibly as high as $25B and American style QE are coming from Canada's Federal Liberal governing party. All this is a bid to strengthen our economy.

U.S. dollar strength is a major factor in a lower loonie...

Our dollar is certainly weaker then the US$, far from the parity it enjoyed so recently.

El-Nino caused flooding has contributed to supply shortages and price increases on produce from both California and Mexico.

But a weaker currency should be good news for us Canucks right? After all, when our currency is weak exports to our southern colossus neighbor, and others, should strengthen. At least that's current government think.

Yeaaahhhh...no. We never were strong on manufacturing and having lost 10,000 factories we're weaker than ever in that sector. We've even allowed food processing to be moved offshore. We produce the wheat, offshore our food processing, end up paying through the nose when our currency weakens.

We live in a northern climate, long winters and short growing seasons take their toll on our food costs - i.e. Canada imports over 80% of its fruit and vegetables. We don't manufacture much of what we want/need so a weak currency means all the things we import get more expensive. We do of course have a lot of oil and natural gas and precious and base metals. The companies who dig, saw and pump to find the world's resources have huge problems of their own.

Corporate Canada's resource sector is in the gun sights of Moody's Investors Service. The service is looking to downgrade a sizeable chunk of energy and mining company corporate debt worldwide. Below is their reasoning.

Moody's scaled back its projections for oil prices saying...

"Iran is poised to add more than 500,000 barrels per day to global supply while OPEC and many non-OPEC producers continue to produce without restraint as they battle for market share. Lower oil prices will further weaken cash flows for E&P companies and the upstream portion of integrated oil and gas companies. This will cause further deterioration in financial ratios, including deeper negative free cash flow. Most companies are unable to internally fund sustaining levels of capital spending at currency market prices."

Moody's senior analyst Jamie Koutsoukis says...

"Slowing growth in China, which consumes and produces at least half of base metals, and is a material player in the precious metals, iron ore and metallurgical coal markets is weakening demand for these commodities and driving prices to multiyear lows."

Many, many years ago during a lengthy argument with a friend he told me to 'give it a doubt' - he meant I was wrong.

Jamie needs to give it a big doubt regarding:

- China's precious metal demand.

- Precious/base metal historical pricing, at least in Cdn dollar's.

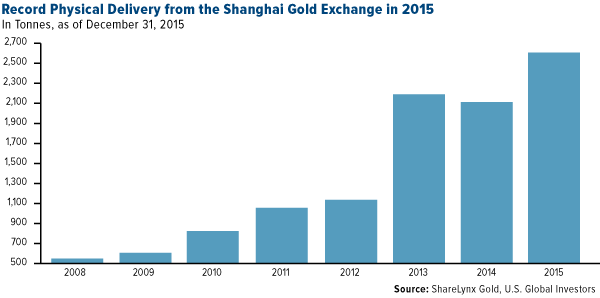

In China, physical delivery from the Shanghai Gold Exchange reached a record 2,596 tonnes, or 80% of total global gold mine output for 2015.

The People's Bank of China bought 19 more tonnes in December, bringing the total amount the bank purchased to over 1,762 tonnes in 2015.

Chinese love their gold and silver. They buy it to protect their wealth. They know fiat currency, paper money, can go to zero. They know gold can't.

As for precious metal pricing today in Canadian dollars let's check:

Gold - US$1,098.60 = CDN$1,564.74

Remember when the Canadian dollar was at par with the American dollar in the spring of 2013? Gold was US/Cdn$1,594.80. Since then the Loonie has lost 30%. Gold might be in a bear market in U.S. dollars but it's not in a bear market in Canada.

Conclusion

High food pricing is killing the benefits of low energy prices for Canadian consumers.

Owning gold would have saved Canadians a lot of financial destruction. The Chinese, Asians, have known this for thousands of years. We use to as well, maybe for not as long but oh yeah we knew. Today there's a whole generation who grew up thinking of gold as a relic from their grandfathers day. Was a lesson learned?

Is the Cdn$ set to drop further? I've got its future direction, lessons, and gold ownership, on my radar screen. Do you?

If not, maybe it should be.

By Richard (Rick) MillsIf you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2016 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.