A Stock Market Bounce is Due

Stock-Markets / Stock Markets 2016 Jan 20, 2016 - 05:22 PM GMT SPX hit its Ending Diagonal trendline, making a throw-under at 1812.25. A bounce that re-enters the trading band currently at 1833.69 and retests the Cycle Bottom constitutes a reversal pattern that may be traded. In the meantime, the pattern calls for an exit of short positions.

SPX hit its Ending Diagonal trendline, making a throw-under at 1812.25. A bounce that re-enters the trading band currently at 1833.69 and retests the Cycle Bottom constitutes a reversal pattern that may be traded. In the meantime, the pattern calls for an exit of short positions.

ZeroHedge writes, “History repeats, if you're just willing to listen. The "Dead-Cat-Bubble" is dead as global stocks enter a bear market (down 20% from May 2015 highs) and US equities catch down to the rest of the world.

*MSCI'S ALL-COUNTRY WORLD INDEX EXTENDS DROP TO 20% FROM RECORD

It would appear the business cycle trumps central planning after all...”

This appears to be that investors have “thrown in the towel.” However, looks can be deceiving. This may be the Master Cycle low we have been looking for. Stay tuned!

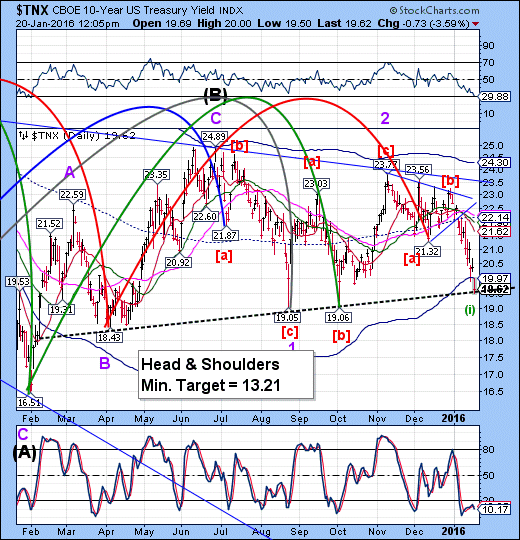

Here is a look at the revised Head & Shoulders formation. The decline may be over for now, but there is more where this came from. The Cycle Model still calls for a retracement to 1950.00 – 1968.00, while the 50% Fibonacci retracement level is at 1964.00.

The VIX pattern has changed somewhat. I am not satisfied with the outcome, but will approach the pattern when I have more time..

NYSE Hi-Lo Index made a lower low, so confirmation of a reversal may not come until tomorrow, at the earliest.

TNX hit its Head & Shoulders precisely at 19.50. It seems to be hovering. A bounce is due.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.