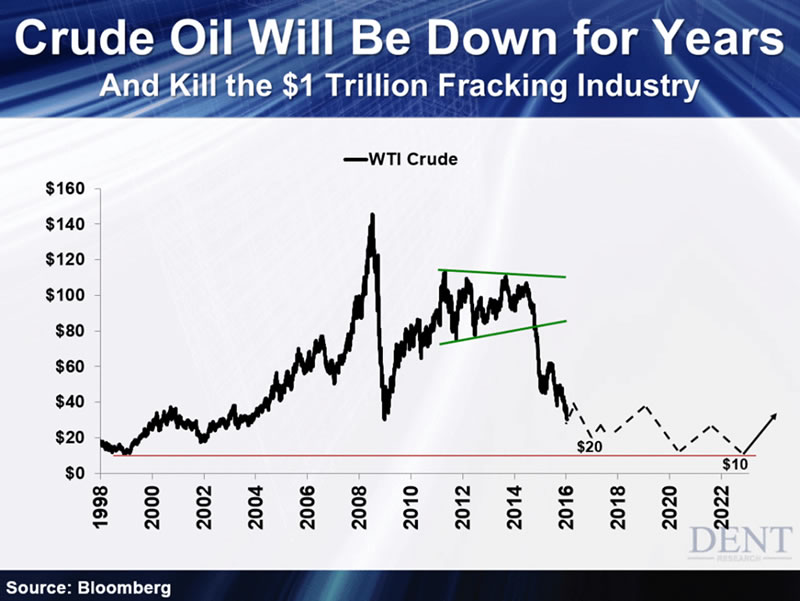

Crude Oil Hit $32... But The Worst Is Yet To Come

Commodities / Crude Oil Jan 20, 2016 - 08:01 AM GMTBy: Harry_Dent

On August 5 last year I forecast that oil would hit $32 or a bit lower by January.

On August 5 last year I forecast that oil would hit $32 or a bit lower by January.

And it’s happened right on cue!

Along with iron ore and coal (down 70%-plus), oil has been one of the worst-performing commodities – down 80% from its 2008 top. And ultimately it’s headed lower, all the way to $10 or $20. I’ve been saying this since oil was $115, and look where we are now!

The reason I’ve been so bearish on commodities, including gold, is simply my 30-year Commodity Cycle. It works like clockwork, which is why I’ve been forecasting since early 2013 that the continued commodity collapse would be one of the key triggers for the next larger crisis. No one else saw it coming, and sure enough it’s turning out to be the next stealth crisis in a global economic turndown – like the U.S. subprime crisis before it.

Falling oil prices might seem pretty okay right now since you’re not paying as much at the pump. But just you wait!

Whatever consumers might be able to save from low oil prices, it doesn’t make up for the devastating net effect to the economy and markets.

Low oil prices basically ensure the demise of the U.S. fracking “revolution” as well as the tar sands in Canada.

These two alone have added six million barrels of oil a day to global supply just since 2009, with another million about to come out of Iran with sanctions being lifted.

How is that supposed to play out with Saudi Arabia hell-bent on wiping these high-cost producers out by refusing to cut production to prop up prices like in the past? Global supply keeps going up while prices and demand are falling.

This doesn’t end well for the frackers, or the U.S. economy. Fracking is a $1 trillion industry – and worse, it’s a bubble industry. The only reason they’re still around is because global QE helped prop up the price of oil and made junk bonds so affordable. Now that the bubble is clearly popping, the frackers don’t stand a chance as they have always been among the highest cost producers! They’ll keep pumping their wells until they run dry because their operating costs are low. But their up-front costs of creating new wells are gargantuan. And with the junk bond market cratering, who in their right mind would give this doomed industry a loan? Nobody!

Just think: the fracking industry in the U.S. is a trillion-dollar sector, with hundreds of trillions of junk bond and leveraged loans, and many jobs in high growth states like Texas. All of it’s going to disappear.

And it’s even worse for the emerging countries that are big commodities exporters.

So where is oil likely heading next? To our original target near $20. I was thinking this would happen in 2017 or even later in the next great downturn. But this could happen after a near-term bounce later this year. And like Rodney said yesterday – don’t be surprised if oil stays down for years. This Commodity Cycle points down into 2020 to 2023, and demand won’t come back in a depressed global economy.

Oil is likely to bounce from this $30 level or a bit lower merely from being oversold. But any sign of the global recession worsening – which is very likely between now and the summer – should send oil to the next support level between $18 and $20.

Ultimately oil could go all the way down to its previous low in 1998 of $8 to $10...

Don’t tell me that will help consumers more than it hurts the economy. We’re talking about the destruction of a major industry in the largest oil producing countries like the U.S., Saudi Arabia and Russia. Those top three produce 36.5 million barrels of oil a day. The next 12 produce about the same at 37 million. That includes China, Canada, UAE, Iran, Iraq and Brazil. It’s not like these countries don’t have enough problems already.

In a growing world not awash with debt, falling oil prices could be a net positive, or if China and the emerging country commodity exporters were not already at the center of the emerging slowdown.

But that is not what we have today. The whole world has unprecedented debt concentrated more than ever in the emerging countries, especially China. And this global debt is most leveraged in the energy sectors that have both been further magnified by endless QE and zero interest rate policies.

If the minor subprime crisis of 2008 could trigger a global financial crisis and meltdown, what do you think the collapse of the highly leveraged global oil industry could do?

Like 2008, the stage has already been set. All we’re waiting for is the trigger.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2015 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.