The Stock Market Punch Bowl is Gone

Stock-Markets / Stock Markets 2016 Jan 18, 2016 - 07:59 AM GMTBy: Dan_Norcini

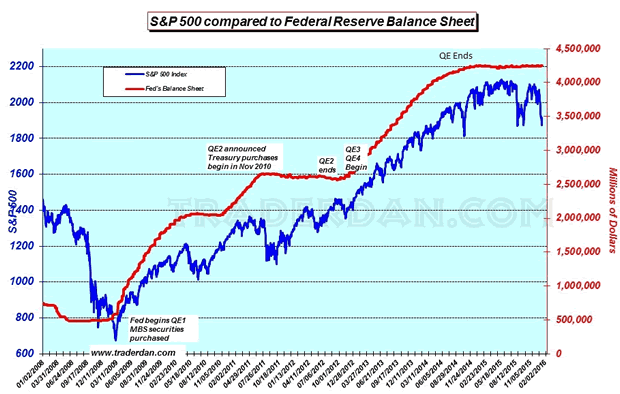

It has been a long time since I put up this chart comparing the S&P 500 index with the size of the Federal Reserve's Balance sheet. The old adage that "a picture is worth a thousand words" is most appropriate in this instance.

As long as the size of the Fed's balance sheet continued to increase on account of their purchases of both US Treasuries as well as Mortgage Backed Securities, the liquidity boosted stocks inexorably higher, in spite of the fact that the underlying economic growth was mediocre at best. In other words, the seeming disconnect between what we were seeing on Wall Street and what Main Street was experiencing was most baffling to many observers. If one looked only at the stock markets, they would no doubt come away believing that this economy was one of the best in decades. That was in sharp contrast to the struggling US consumer dealing with relatively stagnant wages and rising health care costs and a employment picture that was not nearly as robust as the headline numbers coming out of DC would suggest.

However, that liquidity ( massive amounts of it) had to go somewhere and since it was not going into Main Street, it ended up going into Wall Street. After all, what else are money managers supposed to do in a near zero interest rate environment except to buy something that is going higher, regardless of whether or not the economic realities actually supported it.

Now that the liquidity that has been supporting this market is drying up, the failure of QE to actually pass through and benefit Main Street is being disclosed. Throw on top of that the similar failure of QE in both Japan and in the Eurozone to produce anything more than an "L" shaped recovery in their respective economies, and investors are getting rightfully worried. What is the next trick that the Central Banks are going to be able to pull out of their magic hat if nothing works?

Further compounding the problem has been the woes besetting the Chinese economy. Perhaps the straw that broke the camel's back was the Fed rate hike of 25 basis points in December. Since that time, equities have moved generally lower.

My view all along has been the monetary policy can only do so much. It can perhaps prevent things from imploding but as to producing any SUSTAINED, ROBUST Growth, forget it. That requires STRUCTURAL REFORM And solid economic policy. Those of course have to make it through Congress here in the US but they first have to be endorsed or at least proposed by the executive branch. Given the current leftist occupant of the White House, that has ZERO chance of happening. In other words, I am of the view that this economy is going to remain moribund until late in 2016. Even then it might not see any solid growth depending on the results of the 2016 election in November. A Hillary Clinton presidency would spell disaster for the US economy since most believe she would merely continue the current policies that are crushing economic growth here in the US.

Fasten your seat belts - the punch bowl that has supported all this giddiness in equities is gone and now the market is going to be forced to deal with reality. None of this is going to go away anytime soon. I expect we will see rallies in equities as we move forward but I also expect that they will be viewed as selling opportunities. The mentality of "BUY the DIP" has given way to "SELL the RALLY". Such are the ingredients of Bear markets.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2016 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.