Crude Oil Price Crash Triggering Global Instability, Trend Forecast 2016

Commodities / Crude Oil Jan 17, 2016 - 05:41 AM GMTBy: Nadeem_Walayat

The crude oil price collapse of 2015 has continued into 2016 with the price of oil plunging to a 12 year low of just under $30 per barrel as a consequence of a perfect storm of falling demand, primarily due to the slowing Chinese economy and relentlessly rising output that is not just limited to the usual OPEC suspects but is as the natural consequences of the fracking boom that continued to ripple out from the US to across the world during 2015.

The crude oil price collapse of 2015 has continued into 2016 with the price of oil plunging to a 12 year low of just under $30 per barrel as a consequence of a perfect storm of falling demand, primarily due to the slowing Chinese economy and relentlessly rising output that is not just limited to the usual OPEC suspects but is as the natural consequences of the fracking boom that continued to ripple out from the US to across the world during 2015.

This article seeks to update my last in-depth analysis of 1st Sept 2015 that concluded in expectations for the oil price to have entered into trading range of $64 to $40 with main risk being of downward spikes to $30 :

Sep 01, 2015 Crude Oil Price Forecast 2015 and 2016

Crude Oil Price Forecast 2015, 2016

Whilst it is highly probable that my original forecast low of $36 has now been achieved at $37.75. The over riding message from this analysis is that the crude oil price looks set to enter into a prolonged trading range of approx $64 to $40 for the next 12 months. Therefore my forecast conclusion is for crude oil to trend higher in the immediate future to the upper end of this trading range before turning lower and to remain within this trading range for another year. The range could also exhibit very short-term spikes to outside of this range i.e. to $70 and as low as $30, though I would expect downward price spikes to be far more probable than upward spikes above $64.

In terms of investing, with a sustained low oil price oscillating within a trading range for at least another year then this suggests that the oil sector is going to continue to contract with many players going bust due to unserviceable debt mountains built up during the boom years. Therefore it is going to be difficult to find the few golden nuggets that buck the trend amongst all of the junk so it is probably better to wait a year or so for the dust to settle then take a gamble today. However, if one does want to invest then accumulating positions at the bottom of the trading range is probably the best strategy.

Accompanying video analysis:

The severe oil bear market has not only caught most market commentators off guard but has had a devastating impact on the oil producing corporations and nations that are heavily reliant on high oil prices such as Russia, the gulf states, and other emerging markets which rely on their energy sector tax revenues to finance government spending and of course Britain's very own Scotland that 15 months ago was seriously considering committing economic and social suicide (independence referendum).

The following video aptly illustrates what would have happened not only in Scotland but in much of the UK during the past 15 months had the SNP separatist fanatics succeeded in convincing the Scottish electorate to vote for Scottish Independence that would have unleashed forces that literally would have torn the UK apart, something that the SNP fanatics continue to remain ignorant of to this day, despite the fact that the oil price collapse of 2015 alone would have collapsed the Scottish economy and thus accelerating the process for the disintegration of first Scotland and then the rest of the UK.

UK During the Year After Scotland Voted YES to Independence:

by SaveTheChildren (youtube)

At the time I warned in a series of articles and videos that the Scottish Nationalist fanatics were trying to convince the scottish people to jump off the edge of a cliff, effectively committing economic and social suicide as excerpted below:Sep 07, 2014 - Scottish Independence YES Vote Panic - Scotland Committing Suicide and Terminating the UK?

Opening Pandora's Box of Disintegration, the Balkanisation of Britain

The peoples of the United Kingdom are literally being sleep walked towards the edge of the cliff, most completely unaware of the potentially disastrous ramifications for not just Scotland but for what lies in store for the remainder of the United Kingdom following a Scottish Independence YES vote that would break start the process for ripping apart a 300 hundred year old entity of an United Island of Great Britain, which as I have repeatedly warned of during 2014 that a YES vote would literally sow the seeds for the balkanisation of Britain as this Island would literally tear it itself apart as the status quo of what had been taken for granted would no longer exist.

A whole host of news during the past year illustrate that the approaching Scottish Independence vote has already galvanised agitants right across the UK, for instance blowing on the embers for Cornish independence as they wave their aptly coloured Cornish black funeralesk flag that continues with calls of autonomy literally right at the other end of Britain from the Northern and Western Isles with calls for their own devolution from Edinburgh and even calls for their own parliament that sows the seeds not only for the balkanisation of Britain but also for breakup of an newly Independent Scotland that following a YES vote would soon start to disintegrate, as for instance the bordering regions would reassert their separate identity that has far more in common with the North England than much of Scotland, formerly known as the Kingdom of Northumbria that stretches from Edinburgh in the north all the way to the city of Sheffield in the south.

Whilst Alex Salmond, Scotland's Nigel Farage repeatedly plays the Scotland is rich because of North Sea oil card, what he convientely omits is that a significant portion of Scotland's oil reserves lie in the waters of the Northern Isles (Orkney and Shetland). Many people of the Northern Isles see themselves as having far more in common with Norway than Scotland which given the near immediate currency, financial and economic crisis that would follow independence would be fast pulled towards sharing sovereignty for far greater stability with the likes of Norway that could achieve what it could never have done militarily, namely expanding its borders and gaining many western north sea oil fields. Though in all probability the Northern Isles would probably eventually settle as becoming a protectorate of the United Kingdom along the lines of the Isle of Man.

So if Alex Salmond 'King of the Scots' does succeed in his tunnel vision mission for an Independant Scotland then he will likely go down in history as the first and last Prime Minister of Scotland as we know it today, which effectively means a Yes vote on 18th September will be Scotland voting to commit suicide as when the dust settles what remains would be a mere fraction of its current size.

Oil Price Crash and SNP Independent Scotland

We'll 15 months on and this is what an Independent Scotland's fantasy oil revenues would now be looking like, which for the duration has been met by delusional propaganda from Scottish nationalist vested interests that the fall in the price of oil was always just temporary and that a rebound was just around the corner, instead the oil price has continued to grind lower, slowly turning the Scottish oil industry and Independence finances into dust as the fantasy expectations for oil revenues of £11bn a year would now have resolved into a loss of £2 billion a year. And that today Scotland's economy is only being kept alive by a £9 billion annual subsidy from England that is being supplemented by emergency life support for Scotland's oil industry to the tune of £2 billion, which illustrates the catastrophe that Scotland only just avoided by a whisker.

Here's a glimpse of SNP propaganda during the referendum campaign that nearly convinced Scotland to commit suicide -

"There can be little doubt that Scotland is moving into a second oil boom. Even with a cautious estimate of prices remaining at $113 a barrel being used, it's clear that Scottish oil and gas could generate more revenues than has previously been assumed." Alex Salmond, SNP Leader and First Minister.

Despite heavy English support of the Scottish economy the oil price crash has resulted in the Scottish economy effectively flat lining during 2015 which compares against estimated UK GDP of 2% for the year. Despite this the Scottish people mostly remain in a delusional state as evidenced by expectations for another probable landslide for the Nationalists at the May 2016 Holyrood elections as apparently the lack of growth in Scotland is somehow by default England's fault, rather than that of the clueless nationalist fanatics whose blinkered view remains determined to destroy Scotland.

The recent news of another 4,000 job losses at BP, including a fifth of its North Sea workforce further illustrates the crisis that Scotland is facing as there is no sign of the oil price rebounding to anywhere near the $113 that the likes of Alex Salmond were fantasising about as required for Scotland's expensive offshore oil industry to recover. Instead Scotland's oil industry is being slowly ground to dust with an estimated 20% of oil sector jobs lost to date.

The inconvenient truth that the Scottish nationalists will never admit to is that if Scotland had voted to commit suicide in September 2014 then today the people of Scotland would be literally begging to rejoin the United Kingdom. With bordering regions in open revolt, much as I warned would transpire in the run up to the Referendum, the only difference being that I thought that the breakup of Scotland would take place over 3 years or so, instead it would now have all happened in less than half the time!

So the Scottish nationalists instead of moaning and complaining and blaming others for their own ineptitude for once need to get off their high horse and say THANKYOU to England for saving their sorry asses. Given the oil price collapse, the chances of another referendum are ZERO, so instead now it should be England's turn to seriously consider cutting the Scottish noose loose from around England's neck which at the least should mean scrapping the Barnett Formula that funnels £10 billion or so to Scotland each year. Nevertheless the EU referendum looks set to offer the people of England at least some degree of self determination after decades of a pseudo democracy bat and ball game between the Conservatives and Labour.

The bottom line is that Scotland's North Sea Oil Industry appears to be in terminal decline because it just cannot compete against the likes of fracking!

The oil price collapse is having a devastating impact on ALL of the worlds major oil producers as it's not just a case of what is the break-even price but the price necessary to finance government budgets that have now fallen into deep deficits which has been triggering increasing global instability as the price has slid to $30. In fact the budgets of virtually every major oil producer requires an oil price north of $80 just to break-even. With several such as Russia requiring $100+. Furthermore the oil price slump of 2015 has played a large part in sparking economic mass migration out of African oil producers such as Nigeria whose government requires an oil price of $120 to balance it's budget.

Russia - $110 Government Budget (52% of revenues), $20 Break even

Russia, the worlds third largest oil producer and second largest exporter remains in war, war mode so as divert the attention of the Russian people away from an economy in meltdown as Czar Putin turns his military ambitions far beyond the Ukrainian war zone by expanding his military operations into Syria under the cover of fighting jihadists when the truth where Russia is concerned has always been one of first countering the U.S. Military Empire and secondly to undermine the European Union at every opportunity which have always been seen as the two main threats to the Russian Empire and not some high on religion fanatics roaming the Syrian desert. Thus Russia's war in Syria is primarily concerned with doing damage to the European Union and Secondly undermining the U.S. presence in the region.

To illustrate the crisis that Russia faces is the fact that Russia requires an oil price north of $110 to balance its finances and for every $1 below $110 Russia loses an estimated $2billion in revenues, worst still is that the Russian industry needs an oil price of $20 just to break-even which could be hit this year. With crude oil currently trading at $30 that's a a huge revenue loss of well over $160 billion per annum that has plunged the Russian economy into recession for the whole of 2015 that looks set to further intensify during 2016 as Russia's hard earned foreign currency reserves look set to have completely evaporated before the end of 2016. Whilst the cowering in fear population may be calm today, however if the oil price fails to recover or worse dips to as low as $20, then Russia is in for a perfect storm of a totalitarian state on the edge of major civil revolts as the population panics, prompting troops on the ground Ukraine style.

China - $30 break even

Most will be unaware that China is the world's fourth largest oil producer, though all of it is for domestic consumption and even more is imported. The economic slowdown in China is one of the primary drivers for the collapse in the global oil price which is also making itself felt in the global stock markets. So whilst lower oil prices should act to support the Chinese economy, other drivers such as over capacity far surpass the low oil price stimulus that shows no signs of recovering for much of 2016. In fact low oil price will be hurting Chinese producers and refiners just as badly as western oil majors, that likely are already being propped up by the Chinese government which means despite being a heavy consumer, China also needs an oil price floor of about $40 below which the pain tends out weigh the gain. So China does not look set to spark a fundamental turn around in crude oil demand for much of 2016.

In terms of instability, a weak economy is likely to further encourage the Chinese Empire emboldened by a new fleet of air craft carriers to continue to assert its dominance over the asian region the most evident example of which is the construction of artificial islands on reefs in the South China Sea an area claimed by several other nations including the Philippines and Malaysia that could prove a flash point between U.S. and Chinese vessels.

Iran - $70 Govt budget, $25 break even

The continuing thawing of Iran / U.S. relations implies the potential for an huge increase in the supply of oil out of Iran which has the worlds fourth largest oil reserves and second largest gas reserves. Whilst it will probably take the whole of 2016 for Iran to ramp up production by even anything near 1m b/d. However a more immediate supply boost will likely come from the release of 50 million barrels of oil in storage for the hoped for economic boost which is fast evaporating given an oil price of just $30, which is well below the minimum of $70 required for Iran to cover government spending.

The lifting of the Iranian sanctions in response to reducing it's nuclear Plutonium and Uranium stockpiles as well dismantling infrastructure such as reactors and centrifuges is going to result in a huge economic boost for the Islamic Republic, not only in terms of trade, but the release of $150 billion of frozen Iranian assets that are is now free to be spent on both armaments and on upgrading Iran's oil industries production capacity.

Whilst Iran so far complying with its agreement for nuclear disarmament being great news for the world, as I warned would be one of several necessary steps so as to avert the gallop towards armageddon in this November 2013 video -

However, the usual suspects have once more cropped up to spout propaganda in an attempt to undermine the trend towards a more peaceful world, such as the Israeli Prime Minister, Benjamin Netanyahu stating "Even after signing the nuclear deal, Iran has not relinquished its ambitions to obtain nuclear weapons"' This spouting out of the mouth of someone who heads an Jewish fundamentalist state that is armed with over 300 nuclear weapons, more than enough to destroy the whole of Europe AND the Middle East as part of Jewish fundamentalist Messianic End Times Prophecies, that over 100 million American Evangelicals encourage at every opportunity as they too are trying to make manifest the Second Coming for their own End Times agenda.

The question no one is asking is who is going to disarm Israel, the Jewish fundaments state of its 300 nukes? Before they press the nuclear button for Yahweh, their Bronze Age God of War, who originally started off as an Egyptian deity brought northwards via the caravan trade routes to Palestine, slowly replacing existing deities such as El by peoples who would eventually come to call themselves Jewish.

Back to to the oil price! Even if Iran chose not to increase oil production, just the ability to do so will be enough to keep oil prices depressed for virtually the whole of 2016. Especially given the internal and external pressures pulling on Iran to raise more revenues such as the Iran's proxy wars against Saudi Arabia in Syria and Yemen whilst at the same time retaining its influence and network of control over Shia Iraq.

Saudi Arabia - $100 Govt Budget (85% of revenues), $10 break-even

Those who have been looking to Saudi Arabia for signs for a cut in production have been greatly disappointed as instead Saudi Arabia has ramped up production to 10.2m b/d compared to 9.6m b/d a year ago and thus further contributing to the worlds crude oil glut that is seen by much of the media as part of a 'War on U.S. Shale oil industry' aimed at annihilating competition such as that from the fracking industry. However, despite $620 billion of reserves most of which is parked in its sovereign wealth funds, Saudi Arabia is not immune to the instability triggering consequences of the oil price collapse which is seeing Saudi Arabia's wealth disappearing at the rate of about $100 billion per annum as the Kingdom is reliant on oil exports for 85% of its revenues.

In fact rather than reigning in government spending, Saudi Arabia is engaged in two costly major proxy wars against Iran in Syria and Yemen and each passing day brings increasing risks of a hot war between Iran and Saudi Arabia that would probably trigger at least a temporary speculator driven spike in oil prices. Especially given that despite all of the hype, militarily Saudi Arabia is just no match against Iran, for instance Iran's population is near three times that of Saudi Arabia, and thus has plenty more cannon fodder to throw in a war of attrition which is illustrated by Iranian militias totaling 2.25 million, against Saudi Arabia's 250,000. What's worse for Saudi Arabia is that its not a done deal that most of the Saudi military would be willing to die for the Al-Saud family dictatorship and so given an Iranian invasion may just choose to melt away into the civilian population and let the Iranians dismantle the Al-Saud dictatorship for them, hoping that it will result in an Arabia that is free of the Al-Saud leeches. In fact it is even possible that there could be a military coup against the Al-Saud regime, especially if war between Arabia and Iran appeared imminent so as to prevent the destruction of Saudi Arabia's oil production and refining infrastructure.

So despite the fact Saudi Arabia spends more than six times Iran on expensive western military toys. In an all out one one conventional war, Saudi Arabia would not stand a chance without heavy U.S. support, which given the thawing of relations no longer appears probable, especially given the bloody experience of the Iraq war and occupation.

So rather than Saudi Arabia using oil prices to kill off the oil competition the real story is more of a totalitarian state being destabilised by the oil price collapse that is fighting multiple proxy wars and an internal insurgency, as it should not be forgotten that Saudi Arabia is a family dictatorship that is only able to retain power by means of fear and bribery of ordinary Saudi citizens with oil money that it is fast running out of. So in the grand scheme of things the U.S. shale industry is way down on the list of priorities for the Saudi totalitarian regime.

The reality of the Saudi Arabia is one of a regime that is rotten to its very core, that literally has hundreds of wannabe Al-Saud Saddam Hussain types running around trying to stoke the fires of sectarian conflict both in neighbouring states and within Saudi Arabia itself, who are increasingly wielding power against a fragile centre that sows the seeds for what is unthinkable today that of a revolution or even civil war, let alone the possibility of a hot war against Iran.

Given the fact that Saudi Arabia has not cut oil production to date is very telling, in that it shows that the Saudi totalitarian Islamic fundamentalist regime fears three things -

1. It's people

2. I's oil becoming obsolete / worthless as a consequence of new renewable energy sources prompted by climate change.

3. Anything Shia, which the Saudi wahabi ideology perceive as apostates. Which given the dropping of Iranian sanctions now Saudi Arabia fears an emboldened Iran will intensify it's efforts to destabilise Saudi Arabia and thus Saudi Arabia's Shia population will pay a heavy price as the Al-Saud families henchmen crack down hard on the civilian population.

Which means no matter how loudly other OPEC members such as Nigeria scream at Saudi Arabia to cut production, it's just not going to happen, in fact I would not be surprised if we find out in a few months time that Saudi Arabia has further INCREASED production in an attempt to monetize the oil in the ground whilst it still has customers for it and ahead of Iran flooding the market and thus driving the oil price lower.

This illuminates why Saudi Arabia this week announced intentions to put its oil industry (Aramco) on sale, which is because it understands that the nations 266 billion barrels of oil in the ground could become worthless long before it can be produced and sold, so instead the Al-Saud family is trying to forward sell Saudi Arabia's oil reserves to clueless investors, preparing to run off with the nations loot, as is usually the case with dictatorships that fear loss of power.

By the end of 2016 some of these Al-Saud wannabe Saddam Hussain's will have made enough of a name for themselves as they engage in violence both within and in the neighbouring states that they will make it into the mainstream media as they leave their finger prints of regional instability through-out the region, when increasingly there will be a blurring of the lines of between Islamic State and the Saudi Regime as the recent executions were just a taste of.

Iraq - $80 budget, $12 break even

Iraq still desperately trying to rebuild its devastated cities after the U.S. and allies went on a decade long rampage across the nation all on the basis of lies such as that the war was for 9/11 or that there were weapons of mass destruction ready to hit Europe within 45 minutes, the consequences of which still continues plague Iraq to this day which remains a divided nation of between Sunni's and Shia's. After America's departure the one hope that Iraq had towards building a better more stable future was Iraq's huge oil reserves which given a price of $100 would be more than enough for the central government to paper over the cracks and buy off the various competing factions with petro dollars.

However, again despite a low break even price of $12, $30 is just not enough to meet the requirements for a fragile Iraq which implies that 2016 could turn out to be just as bad a year for Iraq as was 2015, as the factions such as the Kurds, and various Sunni and Shia militias attempt to seize control of the oil producing regions resulting in continuing sectarian warfare. In fact the Kurds by the end of 2016 could come to be seen in a similar manner as ISIS is today, as Kurdistan seeks to control Iraq's northern oil fields and take all of the revenues from themselves therefore risking a Shia Iraq / Kurd war.

United States - $65 break even

The consensus view in America is that Saudi Arabia is engaged in an oil war to knock out America's shale oil industry. However, when one looks at the facts the reality is more like a US oil war on Saudi Arabia as evidenced by the fact that it is the United States which has effectively doubled its oil production over the past 10 years from 4.5 million barrels a day to over 9 million today that virtually rivals that of Saudi Arabia which is producing little more than it was 10 years ago (10.2 against 9.7 10 years ago).

This view whilst obvious remains invisible to a propaganda driven mainstream press that instead of reflecting reality instead peddles and regurgitates the view that it is all Saudi Arabia's fault. Which as my earlier Saudi analysis illustrates is being financially wiped out by the oil price crash, as low oil prices risk an implosion of the Saudi Regime and so is not something that Saudi's would risk by instigating a war on the U.S. shale oil industry.

The U.S. shale oil production peaked during 2015 at approx 5.7 million barrels per day and today has declined to 5.15 million barrels a day, with expectations for the decline to steepen during 2016 in response to a sustained low oil price resulting in a bloodbath amongst the US shale oil industry that could kill off half of the industry this year leaving output at least 2m b/d lower at approx 3m b/d. Therefore US total oil output could fall to approx 7m b/d by the end of 2016. Whilst the majors should fair better having locked in prices for multiple years as high as $60, nevertheless will be scrapping hundreds of billions in exploration and drilling projects during 2016 resulting in further job losses.

So on the basis of fundamentals there is little sign for an end to low oil prices any time soon as it will likely be a slow grinding process of wiping out approx half of the US shale industry supplemented by significant cuts amongst the worlds oil producers, even if OPEC appears determined to keep pumping. Which means that whilst the crude oil price is probably near a bottom, however it is unlikely to spark a return to anywhere near the likes of $100 with even a risk that the crude oil price could sink lower still, as given these fundamentals a spike to $20 is very possible (50% probability), and whilst today it is difficult to imagine the oil price trading as low as $10 as some are forecasting (Standard Chartered), nevertheless it is no longer impossible (15% probability), especially given the fact that Iran has now had oil export sanctions lifted.

War is Coming!

The bottom line is a sustained low oil price far below levels necessary to finance government budgets means that something major is going to give during 2016 where not even the likes of Russia or Saudi Arabia or Iran are immune. The current trend is towards an escalation of the conflict between Saudi Arabia and Iran. However, either one of these totalitarian nations may implode into civil war during 2016 much as we have seen with Syria and Libya during the past few years. And even Russia is not immune to such a fate, which I am sure has many western intelligence agencies busy trying to engineer Russia's demise much as Russia is busy trying to disrupt the European Union and American influence in its bordering regions. Then there are a myriad of other nations across the world that are being destabilised by low oil prices, and at the top of that list is Venezuela, that is primed for a revolution that I am sure the CIA will be busy stoking.

Oil Price Economic Stimulus

Whilst the producers / exporters are hurting the oil consumers / importers are experiencing an oil price bonanza as the price drop amounts to an effective transfer of wealth from oil producers to oil consumers to the tune of over $1 TRILLION per year, a huge economic stimulus for every net importer of oil that has probably saved the Euro-zone economy from re-entering recession during 2015. Sectors that most benefit from the oil price crash are transportation, travel, food and of course the auto sector.

However on the other hand we have the oil producing nations running huge deficits drawing down their reserves held in the western markets i.e. liquidating assets and investments so as to finance their black holes and like wise instead of providing capital support to the debt markets are now issuing their own debt to sell on western markets thus competing for limited capital and thus forcing up bond market interest rates.

So fundamental analysis paints a bleak picture that suggests it would literally take a major oil producer such a Saudi Arabia or even Russia imploding for any significant turnaround in the oil price which would be a black swan event so not easy to pin down when, where and how, for instance it could just as well be the Nigerian economy that goes up in smoke triggering many of the 175 million Nigerians to seek economic asylum in Europe.

TECHNICAL ANALYSIS

The starting point for technical analysis of the crude oil price is my last in-depth analysis of 1st of September 2015 that concluded in expectations for a trading range coupled with risks of a downward spike to $30 that this analysis will seek to update.

Sep 01, 2015 Crude Oil Price Forecast 2015 and 2016

Crude Oil Price Forecast 2015, 2016

Whilst it is highly probable that my original forecast low of $36 has now been achieved at $37.75. The over riding message from this analysis is that the crude oil price looks set to enter into a prolonged trading range of approx $64 to $40 for the next 12 months. Therefore my forecast conclusion is for crude oil to trend higher in the immediate future to the upper end of this trading range before turning lower and to remain within this trading range for another year. The range could also exhibit very short-term spikes to outside of this range i.e. to $70 and as low as $30, though I would expect downward price spikes to be far more probable than upward spikes above $64.

TREND ANALYSIS

ELLIOTT WAVE ANALYSIS - The sept 2014 high of $112 was clearly a fifth wave peak that has subsequently ushered in a 5 wave decline to $29 that should be imminently near completion and likely to resolve into an ABC correction higher towards $50 over the next couple months. Which is likely to be followed by test of the lows in either an ABC or ABCD pattern that would set the scene for a probable higher bottom and start of a new oil bull market some time during the second half of 2016.

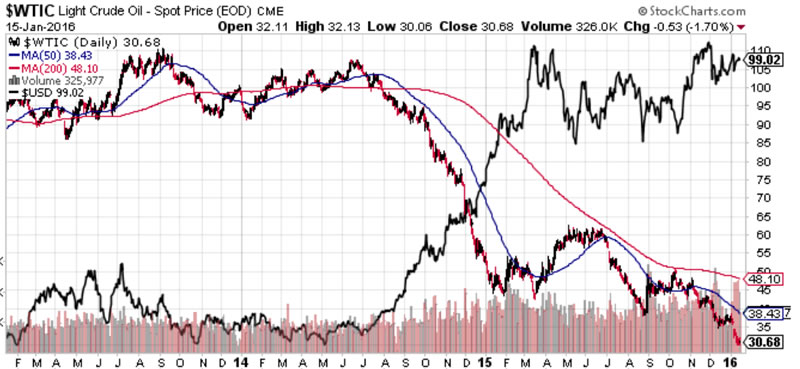

TREND ANALYSIS - The last close recovered to just back above $30, at $30.6. The panic in the oil market is evident on break below $35 which pushed the oil price out of its channel that had contained the oil price since the September 2015 low. The current severe downtrend extends ALL the way to ZERO. However, that's not going to happen, as whilst the oil price could continue hugging the downtrend line to perhaps as low as $25, ultimately a break above the down sloping line will propel the oil price into a new trading range of approx $50 to $30, trending in the direction of of $50 and we are probably less than a month away from this upwards breakout.

SUPPORT AND RESISTANCE - The oil price does not have any support, so before an upwards break takes place the oil price needs to form a bottom which would take about a month to form be it at $29, $25 or $20. Overhead resistance lies at $35, then $48 to $51 and then $60-$64. So a break of $35 would propel the oil price towards resistance at $48-$51, before a likely retest of $35.

MACD - Whilst the oil price has been sinking like a stone, the MACD indicator is showing positive divergence which is supportive of expectations for a trend higher. Overall the MACD is supportive of rising prices ahead, even if it is within a tight trading range.

SEASONAL ANALYSIS - The seasonal analysis proved remarkable accurate in my last analysis of Mid Sept i.e. for a the oil price to reverse before year end and target a test of the $37.75 low. The seasonal pattern is for Crude oil price to bottom during February and then March higher into September before turning lower into December. Current price action would tie into a Feb bottom, however a rally all the way into September would be suspect.

US DOLLAR / OIL - It is often taken as granted that commodities tend to have an inverse relationship to the US Dollar by virtue of the fact that internationally commodities are priced in dollars i.e. a strong dollar cuts the price of a commodities in foreign currencies therefore this should, most of the time be reflected in the price charts of major commodities such as crude oil. In additional to dollar pricing, the crude oil price has literally collapsed that in times of economic uncertainty (falling oil demand) prompts both flight to safety, namely the worlds reserve currency and acts as a stimulus for the US Economy and thus the US Dollar as a consequence of falling energy costs.

The crude oil price has clearly continued to exhibit a strong inverse relationship to the US Dollar. My USD forecast for 2015 proved accurate for most of the year, forecasting that the dollar would be capped at around USD 99. Though the last 2 months showed significant deviation as the USD rallied into the end of the year rather than declining to 94.

14 Dec 2014 - U.S. Dollar Collapse? USD Index Trend Forecast 2015

Whilst my USD forecast for 2016 remains pending. However, the US Dollar is clearly in a bull market, which at worse would resolve to a trading range of USD 100 to USD 90, but more probably is looking to breakout higher which would continue to act as a drag on oil prices for some time. So crude oil is unlikely to find any boost from the dollar.

Formulating a Forecast

The key points that stand out for 2016 are -

1. Fundamental downward pressures on the oil price of a weak china, and record production look set to remain for the duration of 2016,

2. The world's oil industry is being slowly ground into dust thus supply destruction will slowly support oil prices as the year progresses.

3. Saudi and Iran proxy wars support higher oil prices whilst failure to cut production acts to drag prices lower.

4. Technically the oil price is weak and shows no signs of breaking significantly higher.

5. A bottom is likely imminent.

6. There is a high risk of a black swan of a major oil producer imploding Syria style during 2016.

The overall picture being painted is one of THREE trading ranges that act to step the crude oil price higher during 2016. For instance the current bottoming range, the second retesting range, and the third breakout range.

Crude Oil Price 2016 Forecast Conclusion

My forecast conclusion is for the crude oil price to trade within three distinct trading ranges for 2016 of $20 to $40, $35 to $50 and $62 to $40. Furthermore the trend pattern imposed onto the trading ranges implies that a bottom is likely by early February 2016 at around $25, followed by a trend higher into Mid year towards $50, a correction into September, followed by a trend towards $62 before succumbing to a correction during December to target an end year price of approx $48 as illustrated by the following forecast graph.

The bottom line is that the current the oil price collapse is a wake up call to all major oil producers that crude oil as an energy source is running out of time. So whilst there may be future oil price spikes, however the long-term trend, given the likes of climate change is for the oil age to go the way of previous ages such as the Stone Age and Bronze age and so it will be for the oil age. Which means nations such as Saudi Arabia, regardless of price understand they need to get as much of their oil out of the ground as possible and sold off before they run out of customers!

Oil Stocks

Back in September 2015 I warned to give oil stocks a miss for a year or so for the dust to settle as many players with unserviceable debt mountains are going to go bust and given what has subsequently come to pass that message remains in tact. Which means even if the oil price bottoms it's probably best to still wait it out until at least September 2016, as given the forecast conclusion for sustained trading ranges the crude oil price is unlikely to be going anywhere fast that warrants piling into oil stocks at this risky stage.

Stock Market

I'll cover the implications for the stock market in a separate in-depth analysis. But briefly, the 7 year long mature stocks bull market has got off to a disastrous start to 2016, apparently the worst start to a new year EVER! Which on Friday saw the Dow close sharply lower at 15,988, down 391 points and recovering from an earlier 537 point plunge. Whilst the relentless selling of the past 2 weeks has increasingly emboldened the usual suspects, the perma bears who tend to see the start of a bear market in EVERY dip. However for those who actually managed to ride this 7 year long stocks bull market (15 Mar 2009 - Stealth Bull Market Follows Stocks Bear Market Bottom at Dow 6,470 ), which for its first full 3 years at least was a stealth bull market that was met with denial from right across the financial media, never mind the blogosfear, now have to seriously consider whether the relentless weakness could be an early sign that the stocks bull market may be rolling over into a bear market.

13 Sep 2015 - Stock Market Dow Trend Forecast for September to December 2015

My final conclusion is for continuing weakness that will result in a volatile trading range with a probable re-test of the recent low of 15,370 by Mid October that will set the scene for a strong rally into the end of the year that could see the Dow trade above 18,000 before targeting a gain for a seventh year in a row at above 17,823 as illustrated below:

And as the earlier chart illustrates that the Dow did trend close to the forecast into the end of the year. My next in-depth analysis for the stock market will seek to map out a trend for several months and probably for the whole of 2016, so there is little point in giving instant reactions to daily gyrations which are akin to a coin toss response that tends to be the norm where most instant daily market commentary is concerned. Instead, I am going to complete my intensive process of in-depth inter-market analysis to conclude in detailed trend forecasts for several key markets all of which are linked which is the real secret towards arriving at that which is the most probable outcome, rather than wholly focusing on just one market which would mean missing a good 50% of the big picture that influences a market i.e. the impact of the future crude oil price trend on the stock market.

So ensure you are subscribed to my always free newsletter (only requirement is an email address) for the following pieces of analysis

- Interest Rates 2016

- US Dollar Trend Forecast

- Stock Market Trend Forecast 2016

- US House Prices Forecast 2016 and Beyond

- Gold and Silver Price Forecast 2016

However, having traded markets for over 30 years, I can say that today's market neither resembles, 1987, 2000, nor 2007. Which implies to expect something different to that which transpired following each of those market tops. So pending the final conclusions of my ongoing series of in-depth pieces of analysis, my view is that the stocks bull market is currently undergoing it's most severe correction to date which has further to go and may technically turn out to be classed as a bear market but nothing on the scale of the last two bear markets in terms of percentage decline and duration. In fact the next few weeks could prove to be a great buying opportunity.

Meanwhile Robert Prechter has made his research available in a special report that can be accessed for free that includes a free trial offer - How to Survive and Prosper in this Global Financial Crisis.

Also subscribe to our Youtube channel for notification of video releases and for our new series on the 'The Illusion of Democracy and Freedom', that seeks to answer questions such as 'Did God Create the Universe?' and how to 'Attain Freedom' as well as a stream of mega long term 'Future Trend Forecasts'.

Also subscribe to our Youtube channel for notification of video releases and for our new series on the 'The Illusion of Democracy and Freedom', that seeks to answer questions such as 'Did God Create the Universe?' and how to 'Attain Freedom' as well as a stream of mega long term 'Future Trend Forecasts'.

Source and Comments: http://www.marketoracle.co.uk/Article53708.html

By Nadeem Walayat

Copyright © 2005-2016 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.