Bernanke's Indecision on Interest Rates Opens the Door for Resource Juniors

Commodities / Gold & Silver Stocks Jul 09, 2008 - 01:31 AM GMTBy: John_Lee

On June 25, Bernanke left key short term rates unchanged at 2%, citing "considerable stress" in financial markets and tight credit conditions. The Fed also cautioned about the upward pressures on prices caused by rising oil and other commodity prices. On the same day, Mr. Warren Buffett fingered "exploding" inflation as the biggest risk to the economy. Buffett said on CNBC "It's huge right now, whether it's steel or oil. We see it everywhere."

On June 25, Bernanke left key short term rates unchanged at 2%, citing "considerable stress" in financial markets and tight credit conditions. The Fed also cautioned about the upward pressures on prices caused by rising oil and other commodity prices. On the same day, Mr. Warren Buffett fingered "exploding" inflation as the biggest risk to the economy. Buffett said on CNBC "It's huge right now, whether it's steel or oil. We see it everywhere."

The markets spoke convincingly on Buffett's side as oil has zoomed up and set new highs while the Dow has been in a freefall. Clearly the Fed has not done enough to calm inflationary fears. As more data emerges on the plight of the financial sector, we see that there may be more bank bailouts coming in the near future. As we saw in the case of Bear Stearns, the banks own so much equity in one another that the collapse of one bank could lead to a chain-reaction collapse. Because of this, there's every reason to expect that bailouts will be extended to the troubled financials stocks that can't cover their losses. Meanwhile, the costs would be paid by anyone holding dollar-denominated assets.

Gold has been buoyed by oil's rise and is now sitting around $920/oz after Tuesday's step back. More interestingly, gold stocks measured by the XAU index have defied the general equity downtrend and held fairly steady.

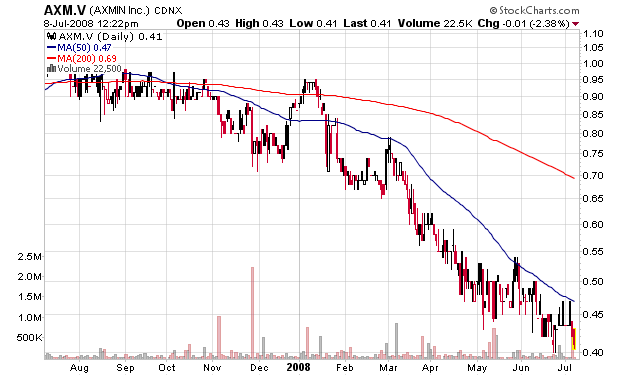

On the junior gold stocks, one company that caught my eye on the volume gainer board is Axmin Inc. (AXM), a gold explorer in West Africa.

Axmin was a favourite of several fund managers in 2003. The stock went from 30 cents to $1.7 by the end of 2003. Since then, it's been treading water and reached a 3 year low of 40 cents on heavy volume in late June. The company was 40% owned and locked up by a private group, which makes it a tight shareholder structure.

At roughly a $100 million market cap for 4 million oz of gold of decent grade, AXM is a good speculation. Note that they recently closed a private placement at 40 cents, therefore a good entry point is the low 40 cent range with profit taking at 200 DMA of 70 cents within the next 4 months. For disclosure purposes, I'm not affiliated with Axmin in any way.

Right now, I'm in Singapore speaking at Terrapinn's Commodity Investment World 2008 Conference.? Rising prices, US inflation, and the banking sector are hot topics, and I did interviews with people from both Dow Jones and Bloomberg, who quoted me in an article this morning: http://www.businessday.com.au/crude-in-upward-spiral-as-iran-plays-hardball-20080707-34it.html?page=1

Click here to find out more about the conference and the speaker lineup: http://www.terrapinn.com/2008/commodity/

I'm also excited to announce that we've done a complete renovation at my home site, Goldmau.com , giving the site and updated look and added a news headlines feed with only the most relevant economic news. In addition, headlines are accompanied by exclusive commentary from myself and other Goldmau analysts as they're published.

John Lee, CFA

johnlee@maucapital.com

John Lee is a portfolio manager at Mau Capital Management. He is a CFA charter holder and has degrees in Economics and Engineering from Rice University. He previously studied under Mr. James Turk, a renowned authority on the gold market, and is specialized in investing in junior gold and resource companies. Mr. Lee's articles are frequently cited at major resource websites and a esteemed speaker at several major resource conferences.

John Lee Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.