Where Is the Chinese Stock Market Headed?

Stock-Markets / Chinese Stock Market Jan 08, 2016 - 05:39 AM GMTBy: Austin_Galt

The Chinese stock market, the SSEC, has tanked out of the block in 2016 and has investment professionals across the globe running around like headless chickens. So, let's take a deep breath and check out the charts. We'll take it from the top beginning with the yearly chart.

The Chinese stock market, the SSEC, has tanked out of the block in 2016 and has investment professionals across the globe running around like headless chickens. So, let's take a deep breath and check out the charts. We'll take it from the top beginning with the yearly chart.

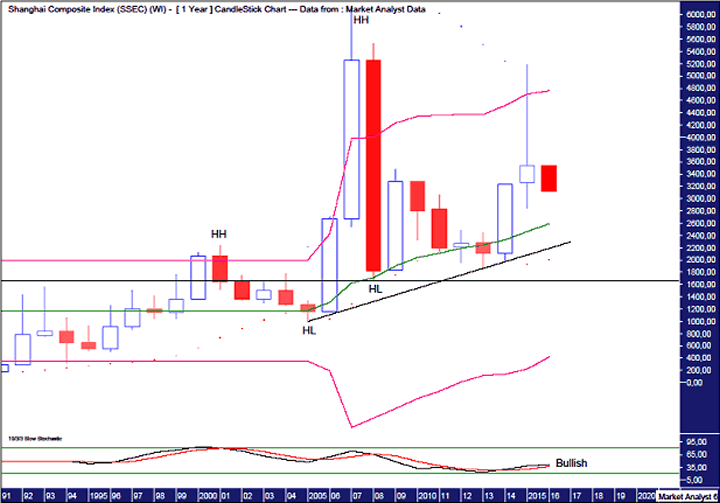

SSEC Yearly Chart

We can see a massive bull trend in play with a pattern of higher highs and higher lows.

The 2015 candle shows a bullish candle with a big wick on the upside and that should be at least consolidated. The low for the year was 2850 and price holding above that level keeps the picture very bullish. Breaking that level will likely mean a bigger correction is at hand.

The Bollinger Bands show last year's high at resistance from the upper band and it is certainly possible that price is now headed to the middle band. The middle band stands around 2590 and price breaking below the 2015 low will likely mean price is headed to the middle band at the minimum.

The PSAR indicator is a tight setting and shows price busted resistance last year so a bullish bias is now in force with the dots below price.

I have drawn an uptrend line which is currently around the 2200 mark but I doubt price will trade that low even if price does in fact break to new yearly lows.

The Stochastic indicator is bullish and looks in reasonable shape.

So, the yearly chart is actually quite bullish but a lot depends on the 2015 low holding.

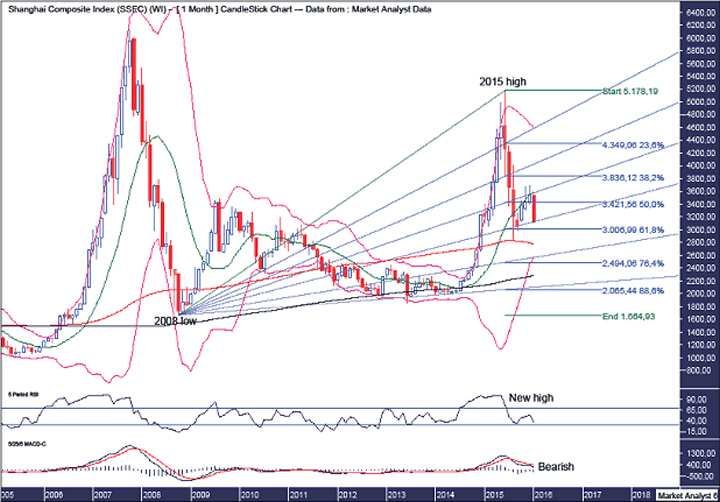

SSEC Monthly Chart

I have added Fibonacci retracement levels of the move up from 2008 low to 2015 high and the low last year clipped the 61.8% level which is a common setup for low. Previously, I was looking for a low down at the 76.4% level at 2494 but as it stands now I am giving the benefit of the doubt to the 2015 low being the final pullback low. Price now looks headed down to test this low and if it doesn't hold then the76.4% level comes back into contention.

I have drawn a Fibonacci Fan from the 2008 low to 2015 high and the low was right around support from the 61.8% angle. Price rallied up to resistance from the 50% angle but is now back down at the 61.8% angle. I favour price nudging back below as it gives the angle a thorough test. If the angle can't hold price then the 76.4% angle becomes the next support.

The Bollinger Bands show price recently trading around the middle band and the current price action looks to my eye as if this move could be a fake out to be followed by an impulsive move back above the middle band. If it is me that is being faked out then price is headed to lower band and new yearly lows.

The moving averages are in bullish formation with the 100ma (red) above the 200ma (black) whiletThe 2015 low was bang on support from the 100ma.

The RSI showed a new high at the 2015 price high which is generally bullish in that final highs often show bearish divergences.

The MACD indicator is bearish although it has generally been trending up since the 2008 low and doesn't look to be in too bad shape.

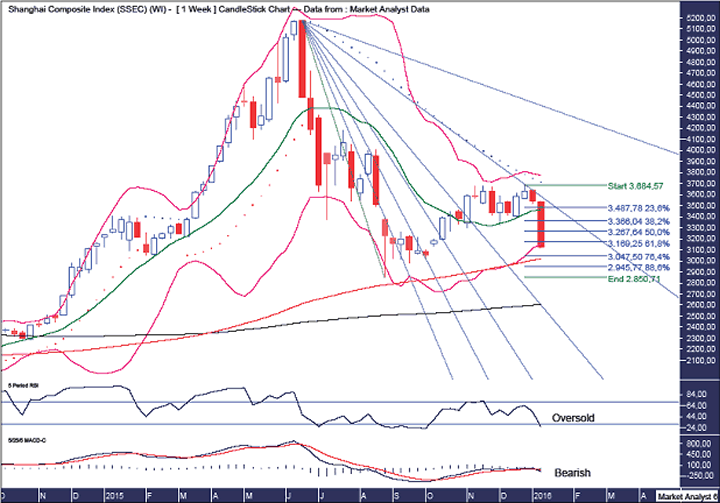

SSEC Weekly Chart

The RSI is currently in oversold territory while the MACD indicator has just made a bearish crossover. No surprise really given the action this week.

The PSAR indicator has a bearish bias with the dots above price. This is my super loose setting and price reversing back up and taking out that resistance would be very bullish in my opinion.

The Bollinger Bands show price is back at the lower band and I favour a bit more downside to be seen as price pushes deeper into this lower band.

The bearish Fibonacci Fan shows the recent high was right around resistance from the 76.4% angle. Price recovering above this angle would look bullish. Let's wait for signs of price turning back up before getting excited about that.

Assuming a new bull trend is now in play, then the first correction often makes a deep retracement and I have added Fibonacci retracement levels of the move up from 2015 low to recent high. Price now looks headed for the 76.4% level which stands at 3047 but I suspect price may trade even lower and the 88.6% level at 2945 also looks in the mix.

The moving averages are in bullish formation with the 100ma (red) above the 200ma (black) and one scenario is price finding support around the 100ma. This looks to be smack bang in between the 76.4% and 88.6% Fibonacci retracement levels. Hmm.

Summing up, I expect price to trade a bit lower from here whereby I'll be looking for a turn back up above the 2015 low. If price breaks below the 2850 level then I'll expect around another 15% to the downside. Whichever scenario plays out, the massive China bull market that has been in force for 25 years remains solid.

By Austin Galt

Austin Galt is The Voodoo Analyst. I have studied charts for over 20 years and am currently a private trader. Several years ago I worked as a licensed advisor with a well known Australian stock broker. While there was an abundance of fundamental analysts, there seemed to be a dearth of technical analysts. My aim here is to provide my view of technical analysis that is both intriguing and misunderstood by many. I like to refer to it as the black magic of stock market analysis.

Email - info@thevoodooanalyst.com

© 2016 Copyright The Voodoo Analyst - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Austin Galt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.