Bursting Bubbles Mean Inflation to Give Way to Deflation

Economics / Deflation Jul 08, 2008 - 01:19 AM GMTBy: John_Mauldin

There is a reason I call this column Outside the Box. I try to get material that forces us to think outside our normal comfort zones and challenges our common assumptions. And this week's letter does just that. I have made the comment more than once that is it unusual for two major bubbles to burst and for the conversation and our experience to be rising inflation and not a serious problem with deflation.

There is a reason I call this column Outside the Box. I try to get material that forces us to think outside our normal comfort zones and challenges our common assumptions. And this week's letter does just that. I have made the comment more than once that is it unusual for two major bubbles to burst and for the conversation and our experience to be rising inflation and not a serious problem with deflation.

Van Hoisington and Dr. Lacy Hunt give us a seminar on why it will be deflation that will ultimately be the problem and not the current inflation we are dealing with today. This week's letter requires you to think, but it will be worth the effort. Remember our lesson from Economics 101. If you raise the supply of something, in normal markets the price goes down. And if you increase the price, suppliers will respond by producing more.

Now, if you put all of the various inputs together, Hoisington and Hunt show that theory suggests we will soon be dealing with deflation. It's counter-intuitive to what we see in the stores today, which is why the Bank for International Settlements used the stagflation word in a recent report. The transition that is coming will not be comfortable.

Hoisington Investment Management Company ( www.hoisingtonmgt.com ) is a registered investment advisor specializing in fixed income portfolios for large institutional clients. Located in Austin, Texas, the firm has over $4-billion under management, composed of corporate and public funds, foundations, endowments, Taft-Hartley funds, and insurance companies. And now let's jump right in to the essay.

John Mauldin, Editor

Outside the Box

Quarterly Review and Outlook - Second Quarter 2008

by Van Hoisington and Dr. Lacy Hunt

Inflation

Widespread is the notion that inflation is back for good. Many assume that the relative price stability of the past two decades has been irrevocably shattered by "peak oil" and the surging demand by developing economies. Improvement of living standards in those developing countries has caused, and will continue to cause, increasing demand for calories, and final demand for food will outstrip supply. Additionally, the cost of basic materials is lifting production costs, and the cycle of higher food and fuel costs means that the prices of all imported goods to the United States will continue to rise. The fixed income investment conclusion is that inflation is endemic, and since the market does not currently reflect such dire inflation prospects, long dated Treasury securities should be sold. We would be among the first to move to the short dated part of the curve if the economic statistics supported the above view. Our conclusion is that deflation, not inflation, is, and will continue to be, the essential problem for the U.S. economy and that the optimum fixed income portfolio should consist of treasuries with the longest possible maturities.

Reality

Twelve months ago the annual increase in the CPI was 2.6%. Today it is at 4.1% and rising. The Reuters/Jefferies CRB Index fell 7.3% for the year ending last June. Today the 12 month change is 36% higher. Nevertheless, the 30 year bond yield fell to 4.5% on June 30 of this year, well down from 5.1% one year ago. This provided a remarkable 15% return for investors. How is it possible that bonds, which have the ultimate sensitivity to inflation, would decline in yield and rise in price in such an inflationary environment? The short answer is that in the broadest terms, insufficiency of demand has, and will continue, to overwhelm inflationary forces, creating deflation in many categories.

In the second quarter, current dollar gross domestic product totaled an estimated $14.3 trillion, about $572 billion greater than a year ago. Of this gain, $359 billion can be attributed to price increases and $213 to higher real output. There are times, however, when GDP is not the final arbiter of the economy's performance, and this is one. The seemingly large gain in GDP pales in comparison to the loss in wealth, which GDP does not capture. Over the past fiscal year, holdings in the stock market, as measured by the Wilshire 5000 Stock Index, lost more than $2.1 trillion. Simultaneously, the 15.3% contraction in the Case Shiller Home Price Index suggests the wealth loss in value of household residences was a staggering $3.1 trillion. Without including the negative wealth impact for declining prices of automobiles and other durables the total wealth loss was approximately $5.2 trillion. Obviously, the sum of dollars being erased from our economic system has overwhelmed the amount of dollars being increased by inflation by a factor of more than 14 to one. Thus, once again, the bond market had it right--deflation is in ascendancy. Treasury bond yields fell, and they will continue to trend lower, creating an even more profitable environment over the next four quarters for long-term Treasury bond holders.

A Basic Macroeconomic Model

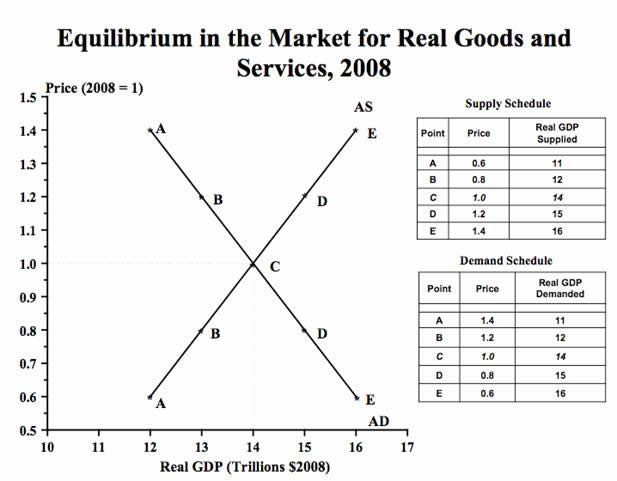

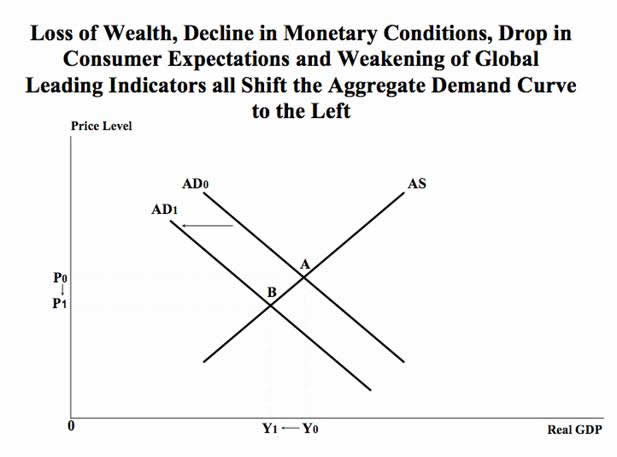

A superior approach to evaluating the inflation/deflationary mix is to define inflation in terms of the aggregate supply (AS) and aggregate demand (AD) curves (Exhibit 1). This economy-wide model permits a structured framework to evaluate whether inflation or deflation is more likely. The model allows for the economy's price level and real GDP to be determined jointly. With the price level on the vertical axis and the real GDP on the horizontal axis, the AD curve slopes downward and the AS curve slopes upward. As such, AD and AS are both a function of price.

The AD curve is composed of plans to buy, which are dominated by consumers, and they buy less at higher prices. The premise of the AS curve is that sellers offer more at higher prices. Five major factors may shift the entire AD curve. They include: monetary conditions, fiscal policy, wealth, consumer expectations and global considerations. The aggregate supply curve may shift by three major factors: labor costs, raw material costs and rent. Presently, forces are shifting the aggregate demand curve downward while costs are holding the aggregate supply curve basically stable. This means that we are moving into a period of weak or insufficient demand, creating disinflation, if not outright deflation.

(In this very brief thumbnail sketch of the AD/AS model, we have cut at lot of corners. For those who want to know more about this thoroughly vetted and highly objective model, a more formal presentation is found in an Appendix of this letter which can be retrieved from our website at www.hoisingtonmgt.com , or by request.)

Factors Operating on the Aggregate Demand (AD) Curve

Four of the above mentioned factors - a massive wealth loss, a severe contraction of monetary conditions as measured by both money and velocity, deteriorating global demand and an enormous decline in consumer expectations - all point to a downward shift in aggregate demand, meaning lower inflation. However, we start this analysis with fiscal policy, which at first glance might appear to be supporting an outward shift in the AD curve, or an increase in planned final demand.

Fiscal Policy

Fiscal policy would seem to be undisputedly supportive for the economy with the Treasury's $110 billion in rebate checks and a Federal budget deficit that is approaching a record $500 billion. But that is not the case. The Treasury does not have $500 billion in its checking account to cover the deficit, nor even the lesser amount for the rebates. The Treasury has to raise the funds by selling debt securities to the private sector. Credit availability may be thought of as a pie. When the Federal sector, which is the economy's premier borrower, takes more of that pie, fewer dollars are left for the private sector. Thus, deficit financing crowds out funds that would have gone to private uses. With the exception of the Federal funds rate, in the first half of this year virtually all money and bond yields rose, a clear sign that the deficit usurped funds for the private sector. This has had the impact of slowing, rather than stimulating economic growth.

Historical experience has shown that deficits have a beneficial effect in the longer-term only under certain situations. Net gains can occur if the deficit is due to a reduction in the marginal tax rates, or if the expenditures are for projects such as power plants, roads and bridges that finance themselves in time and create large spending multipliers. Presidents Kennedy and Reagan cut marginal tax rates and this produced significant paybacks, but these positives took time because of pressures from financing the deficit over the short-run. Evidence indicates that transitory tax rebates produce no lasting benefit. Thus, another round of rebates, in view of the massive deficit already existing, would not be any more successful than the current round, or the previous one in 2001. The government merely usurps resources, which would have flowed into more productive private sector uses.

Monetary Conditions

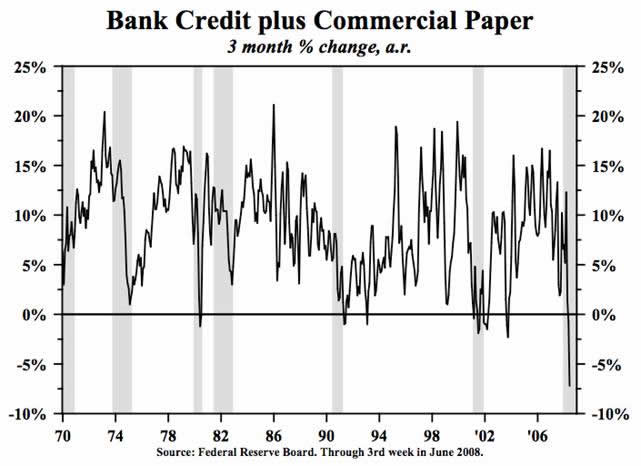

The growth of M2 and changes in its velocity indicate monetary conditions are shifting the aggregate demand curve inward. M2 growth decelerated from 9.8% to 6% from the first to second quarter. Even more importantly, velocity continued to contract sharply, falling at an estimated 1.9 % annual rate. From its peak, velocity has declined from 1.932 to 1.866, an exceedingly sharp drop in just eight quarters. Other truly extraordinary symptoms of monetary contraction are also evident. In the past three months, commercial bank credit (loans and investments) plus commercial paper contracted at a 7.2% annual rate. A record decline for the nearly four decade history of this series (Chart 1). The latest survey of senior lending officers by the Fed indicates that bank lending standards are, in general, higher than ever, and that credit availability is harshly constrained. The economy cannot grow without credit expanding. Over the past four decades the credit elasticity of GDP (responsiveness of GDP to changes in debt) has been .86. If credit expansion fails, then GDP will definitely contract, shifting the AD curve downward to the left.

Wealth

From its peak in July 2006, home prices, as measured by the Case Shiller Index, have now fallen 17.8%. Stock prices have decreased 15% from their peak in 2007. The combined wealth loss from these two sectors is more than $5.2 trillion, an effect that, like the monetary contraction, shifts the AD leftward, lowering the price level.

Consumer Expectations

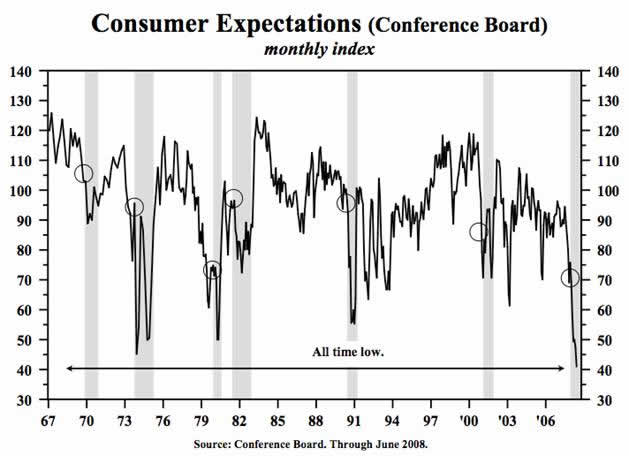

The deterioration in consumer expectations is another significant event. According to the University of Michigan, consumer expectations slumped to a 28 year low in June, while the Conference Board's measure fell to the lowest reading in the more than four decade history of the series (Chart 2). Since the aggregate demand curve is 70% supported by consumer spending plans, it implies that final demand will continue to weaken, causing the AD curve to shift downward and to the left, intensifying disinflationary forces.

Global Considerations

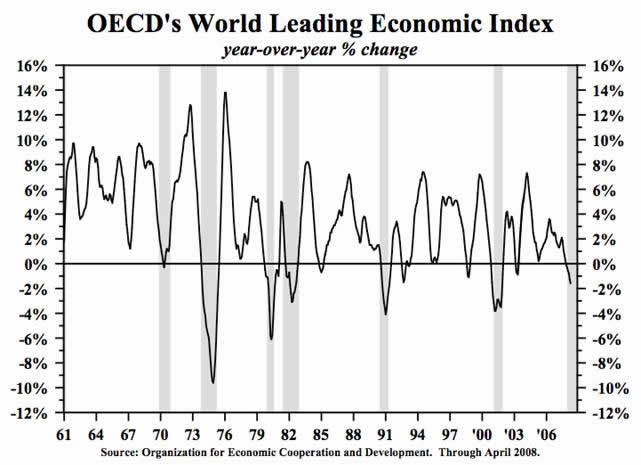

Numerous signs indicate that economic growth is decelerating worldwide, and that the trend is likely to continue. The OECD's World Leading Economic Index has declined 1.6% in the past 12 months (Chart 3). While there have been some false signals in this indicator, and it is not as reliable at the U.S. LEI (or ratio of the U.S. coincident to lagging indicators), the World Index has never fallen this sharply without a recession occurring. Thus, foreign factors are also a negative for buying plans.

Factors Currently Operating on the Aggregate Supply (AS) Curve

Cost push inflation reflects an inward or leftward shift in the AS, which is depicted in Exhibit 1, while an outward (rightward) shift would constitute cost push deflation. At present, the higher raw material costs, which would tend to shift the supply inward, are being neutralized by a moderation in compensation costs and rents. Thus, the aggregate supply appears to be relatively stable.

Compensation

In the past four quarters, unit labor costs in the nonfarm business sector have increased a very modest 0.7%, down from a peak of 4.3% registered in the four quarters ending in spring of 2007. Since wage costs comprise about 70% of the cost of production for the U.S. economy, this serves as a powerful disinflationary force.

Raw Material Costs

If energy and other commodities were the only major cost, the AS curve would shift inward and cause cost push inflation. But, raw material costs only constitute about 10% of U.S. production costs.

Rents

Rents account for about 10% of the cost of U.S. production, or approximately the same weight as raw materials. Rents for retail space are falling, and there are nascent signs that office and warehouse rents have begun to ease. All other costs also account for about 10% of the cost of U.S production, so any increases in this residual category would be neutralized by rents.

AD and AS Together

The divergent factors currently operating on economy-wide aggregate demand and supply are captured by Exhibit 2. The aggregate supply curve is stable, meaning that the risk of cost push deflation is equal to the risk of cost push inflation. Thus, the dominant force is the inward shift in the aggregate demand curve, which is also shown in Exhibit 2. Due to consumer expectations, wealth, monetary, global, and fiscal factors, the AD/AS model suggests that the direction of the aggregate prices and real GDP should both be downward. As such, the risk is greater for demand pull deflation than demand pull inflation.

Conclusion

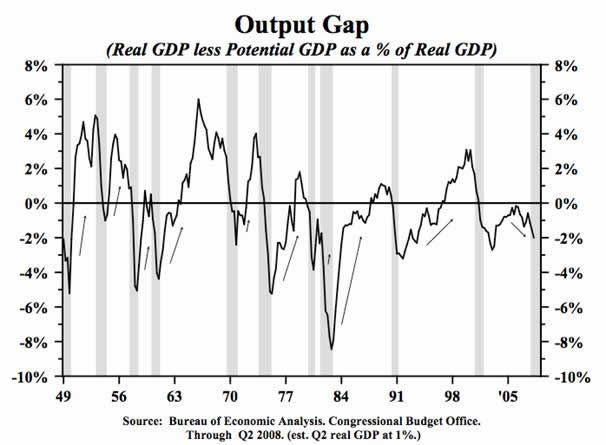

Aggregate supply and demand analysis can be confirmed by three different indicators - the unemployment rate, the manufacturing capacity utilization rate, and the output gap. Presently, all indicate that the U.S. economy faces insufficient aggregate demand, and consequently disinflationary pressures.

The unemployment rate has risen to 5.5%, the highest level since October 2004, while the manufacturing capacity use rate has fallen to 77.5%, the lowest since November 2004. Since 1949, manufacturing capacity utilization has averaged 81.1%. As such, there is an additional 3.6 % of excess capacity. The output gap, which is real GDP less potential GDP as a percent of real GDP, was an estimated -2% in the second quarter, the largest amount of economy wide excess capacity in five years (Chart 4).

These measures also confirm our prognosis for aggregate prices. The higher unemployment rate points to downward pressure on wages and benefits. This is clearly happening since wage gains have fallen to 3.4%, down 0.9% from their cyclical peak. The low rate of manufacturing plant use indicates that firms do not have pricing power. As such they are unable to pass through higher fuel and raw material costs, thus squeezing their profit margins. The negative output gap confirms the excess supply in the labor and production markets and also points to lower inflation. In such a disinflationary environment, long term Treasury bond yields should continue to work lower.

Your feeling the stagflation pain analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.