DJ-UBS Forecast: Can it get worse in 2016 for Commodities?

Commodities / Commodities Trading Jan 05, 2016 - 12:34 PM GMTBy: Submissions

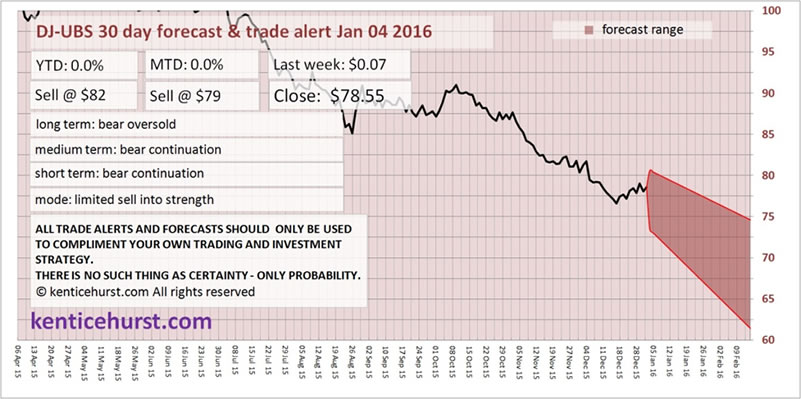

Ken Ticehurst writes: The commodities complex ended 2015 with another poor year, the Dow Jones Commodity Index ended down 25%. Unfortunately as far as we are concerned the downtrend is set to continue for the foreseeable future there appears very little evidence of a capitulation or a bottom forming.

We are currently in a small oversold bounce which we do not expect to last too long as the index itself has spent the last few months in a controlled descent. Rather than an uncontrolled crash the index has moved steadily lower which can sometimes indicate a lower for longer pattern is unfolding.

Now that 2015 is over it is worth noting some of the performances of the markets we forecast; Gold ended the year down some 10% no surprise to us as we remained bearish all year. Ten year yields remained virtually unchanged last yearin spite of the constant Fed chatter and eventual raising of the Fed Funds rate at the end of the year.

The Euro lost more ground against the Dollar falling by over 10% as investors continue to prefer the relative security of the dollar, the DXY dollar index gained over the year by a little over 9%. In spite of the late summer gloom and the bearishness surrounding the S&P 500 it ended the year down by less than 1% in Dollar terms but in many foreign currency terms the safe haven of US denominated yielding assets remained a good bet we suspect that trend will continue for the foreseeable future.

Crude oil fell by some 30% in 2015, thus confirming the deep dark hole that the global economy is in, last year the expectation was for a rebound which having failed to materialise leaves 2016 as a year where the full effects of a prolonged energy and commodity slowdown will be felt.

Commodity producing countries and corporations will now have to deal with the effects of a decade long expansion in production which was spurred by an increase in global demand brought about through an increase in credit and not genuine sustainable demand. Credit brings demand from the future to the present, if it is used to consume rather than invest then at some point the credit will become unmanageable and demand will disappear.

Of all the markets we forecast we are most optimistic in the long run for energy, commodities and precious metals, to us they are beginning to represent value, and we like value. Global population stands at over 7 billion people and many of those would still like things we in the west still take for granted.

We expect the start of 2016 to be the point at which the stresses in the energy and commodity sector start to leak in the wider economy, defaults and contagions in credit markets will signal to the public there is a problem. This general point of recognition will normally signal that just as the media and public realise there is a crisis it will end shortly after and they will all be caught by surprise.

In the mean time we remain bearish commodities in the short term and expect the downtrend to continue with some bumps along the way, would not be surprised to see some extreme valuations in the not too distant future

During the last year we have consistently forecast lower gold prices we have never deviated from this long term position. All our analysis has shown that we spent the last two years in a bear market consolidation and we are now continuing the bear market that began in 2013. Unusually for most analysts you can see our track record right on our front page.

We now create forecasts for a wide range of markets, stocks, commodities, forex, interest rates and energy along with gold using our unique forecasting logic that has kept our followers on the right side of the gold market for so long.

Ken Ticehurst

To view some of the most accurate and unique market forecasts available visit us at: http://www.kenticehurst.com

Copyright © 2015 Ken Ticehurst - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.