The Fed’s Academic-Based Theories Are Creating a BRUTAL Economic Reality

Interest-Rates / US Federal Reserve Bank Jan 02, 2016 - 06:20 PM GMTBy: Graham_Summers

One of the most frustrating aspects of today’s financial system is the fact that the Fed is being lead by lifelong academics with no real world banking or business experience.

One of the most frustrating aspects of today’s financial system is the fact that the Fed is being lead by lifelong academics with no real world banking or business experience.

Consider the cases of Ben Bernanke and Janet Yellen.

Neither of these individuals has ever created a job based on generating sales of any kind. Neither of them has ever had to make payroll. Neither of them has ever run a business. What are economic realities for business owners (e.g. operating costs, capital and profits) are just abstract concepts for Bernanke and Yellen.

Moreover, there is a particular problem with academic economists. That problem is that a major percentage of their “research” is total bunk made up in order to make tenure.

This is not our opinion… it is fact based on research published by the Fed itself.

According to a paper published by researchers from THE FEDERAL RESERVE BOARD, it was not possible to replicate even HALF of the results found in economics papers EVEN WITH THE ASSISTANCE OF THE INDIVIDUALS WHO WROTE THE PAPER.

Let’s repeat that: even with the help of those who claimed to have found the results, the results were not replicable.

There is a word for a result that is not replicable. It’s imaginary.

This might go a long ways towards explaining how individuals like Ben Bernanke and Janet Yellen can continue to say with a straight face that they have a grip on the economy, when the results show that they are either completely lost or being dishonest.

Consider the Fed’s unemployment target for raising rates.

Back in 2012, the Fed claimed it would start to raise rates when unemployment fell to 6.5%. We hit that target in April 2014. The Fed didn’t raise rates for another 20 months.

One wonders, just what was the legitimacy of the Fed’s “target” for raising rates. How on earth can you make a target, then move the target for nearly two more years and claim the target was even remotely accurate?

More importantly, if the Fed’s economic models suggested raising rates when unemployment was 6.5% and the Fed didn’t raise rates until unemployment was at 5% (a full 20 months later)… just how accurate are these models?

We might be nitpicking here, but if the models in question are being used to steer the US economy, there is an awful lot at stake here.

Let’s take a look at what happens when the Fed’s theories connect with the real world.

The Fed claims it cut rates to ZERO to boost the economy. The theory here is that if capital becomes cheaper, corporates and consumers will spend more, creating more jobs.

Unfortunately this is not how the real world works. For consumers, excessive debt is deflationary in nature in that at some point you are so in debt that making your debt load more serviceable accomplishes next to nothing in terms of solvency/ spending power.

Moreover, ZIRP is deflationary in nature for savers and those who rely on interest income because it makes them concerned about future returns on their capital. As a result of this, they tend to hoard their cash, not spend it.

The only individuals who benefit from ZIRP are the very wealthy and corporates, because both can use their assets to leverage up. And this is precisely what has happened.

We are currently on track for our FOURTH straight RECORD year for corporate bond issuance.

Why is this bad?

Because A) it means corporations are going massively in debt and B) they are doing this NOT to expand operations (economic growth doesn’t warrant this) but to issue buybacks and dividends.

With rates at zero, executives are leveraging up to generate shareholder returns. This works great in the short-term, but there is hell to pay down the road. And unfortunately we’re there.

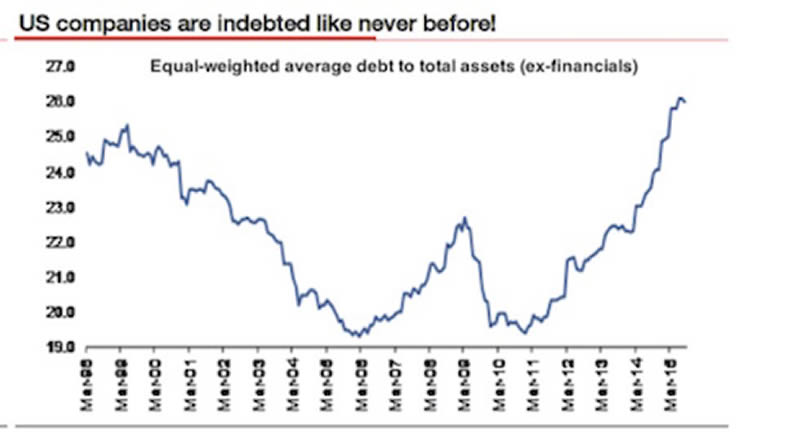

Today US corporates are more leveraged than at any other point in history, including the Tech Bubble.

H/T Societe General

This is what happens when the Fed’s academic-based nonsense collides with economic realities: perversions of capital that lead to massive bubbles and eventually even more massive crises.

The Fed fueled the Tech Bubble, which lead to the Tech Crash.

It then fueled the Housing Bubble, which lead to the Housing Crash and 2008.

And now it’s created an ever bigger bubble that that.

Which means.,.

We are heading for a crisis that will be exponentially worse than 2008. The global Central Banks have literally bet the financial system that their theories will work. They haven’t. All they’ve done is set the stage for an even worse crisis in which entire countries will go bankrupt.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisoryis a WEEKLY investment newsletter with an incredible track record.

To whit, we just closed out two new double digit winners yesterday, bringing us to 40 straight winning trades over the last 12 months.

That correct, during the last year, we’ve not closed a SINGLE LOSER.

And if you go back further, 46 of our last 47 trades have made money.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS.

During that time, you’ll receive over 50 pages of content… along with investment ideas that will help make you money… ideas you won’t hear about anywhere else.

If you have not seen significant returns from Private Wealth Advisory during those 30 day, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2015 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.