SPX May be Turniing at the 50% Retracement Level

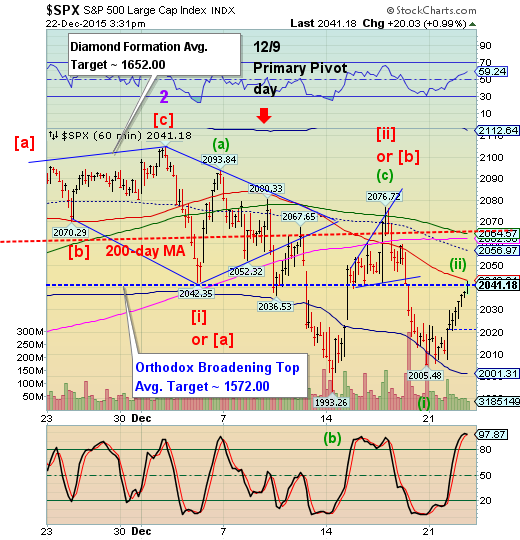

Stock-Markets / Stock Markets 2015 Dec 23, 2015 - 06:22 AM GMT I am remiss in not bringing up the Orthodox Broadening Top trendline as a potential target for this retracement. It appears that SPX may have just turned at 2042.74 while the exact location of the trendline is at 2041.61. The 50% retracement point is 2041.57. While I did mention the 50% level this morning, I had not recently calculated the position of the trendline. Now that I have located it properly in the chart, you can see how many times (at least 5) it has provided support in the past month. Today it finally appears to act as resistance.

I am remiss in not bringing up the Orthodox Broadening Top trendline as a potential target for this retracement. It appears that SPX may have just turned at 2042.74 while the exact location of the trendline is at 2041.61. The 50% retracement point is 2041.57. While I did mention the 50% level this morning, I had not recently calculated the position of the trendline. Now that I have located it properly in the chart, you can see how many times (at least 5) it has provided support in the past month. Today it finally appears to act as resistance.

The final hour of the trading day approaches and with it comes the institutional traders. One of those institutions, BofAML warns that the “Fragility” indicator is the highest since 2008.

Goldman Sachs warns that all six of its Global Risk Indices are worsening. Neither of these Dealer-banks will be buying for their own accounts this afternoon. Is Citadel trying to spoof the market higher?

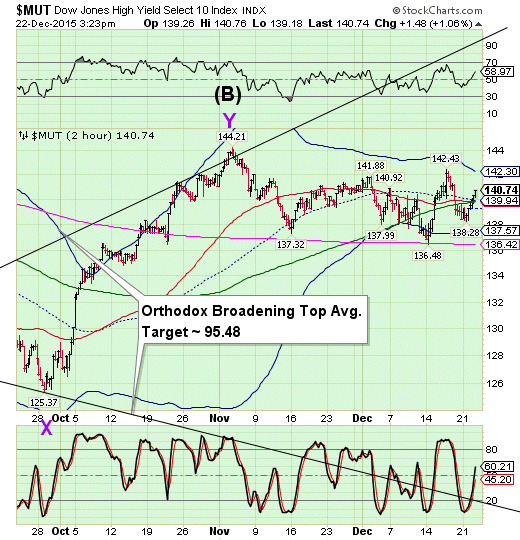

MUT is attempting to claw back its losses since last Thursday. With many junk bond funds throwing up the gates to those who wish to exit, we are seeing this spread across the hedge fund and mutual fund community.

ZeroHedge reports, “In the aftermath of the stunning liquidation and gating of first Third Avenue's junk bond mutual fund, and shortly thereafter several other fixed income hedge funds, investors have been following with great interest capital (out)flows from the fixed income space. However, while the junk bond space is certainly ripe for fireworks, even more dramatic events are taking place in the far more familiar equity space, where with redemption submission deadlines looming or having just passed, LPs and all other hedge fund investors have decided that after seven years of underperforming the market, it is time to get out, and do so with a bang.”

I wonder where these funds get their liquidity to rally like this.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.