Is The BBC Global 30 Index Signalling a Stock Market Top?

Stock-Markets / Stock Markets 2015 Dec 22, 2015 - 06:27 PM GMTBy: Sol_Palha

"A wise man is he who does not grieve for the thing which he has not, but rejoices for those which he has." ~ Epictetus

"A wise man is he who does not grieve for the thing which he has not, but rejoices for those which he has." ~ Epictetus

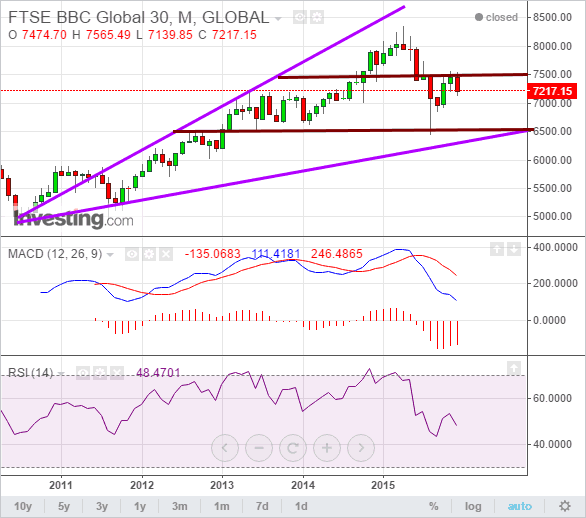

Much the same way many experts felt that the NYSE was issuing a series of death signals, there are just as many who share the same sentiment towards the signals the Global BBC 30 Index is supposedly issuing. This index is thought to provide a more accurate reflection of what is going on in the markets as it is based on the economic data of 30 of the world's largest companies. In today's world where manipulation is the order of the day, over-reliance on such an index might not be the most prudent of actions. It has, however, confirmed that volatility levels have surged to the moon, but of course, we already knew this would occur as this was predicted well in advance by the Market volatility indicator (V-indicator).

Let us examine the situation from a mass psychology perspective before we go into the technical outlook. Overall the world expects things to get worse. Commodities prices are in the toilet, salaries when inflation is factored in have been flat or dropping for decades. In fact, one estimate states that over 75% of Americans are living pay check to pay check; according to this article , the actual figure is 76%. Overall the world is in a pessimistic mood, and it's during such times that opportunity comes knocking.

The global BBC 30 index is not indicating an imminent market breakdown; instead, it is showing us that the world has changed. This index is not going to trend in unison with all the markets, for it is not representative of one single nation.

There are three ways to look at any given situation. The two the masses are trained to follow and adopt are:

- The glass is half empty which signifies that you are negative

- The glass is half full which illustrates that you are an optimist.

Our opinion on this retarded form of psychology is that it's utter rubbish, for neither one is correct. The only question that should ever pop into the mind of a rational being is "Am I thirsty or not" if you are thirsty then you reach out and take a sip. If you are not thirsty, you move on and continue with your daily routine.

In that sense taking a look at the above chart, what is the only question that should come to mind?

Is the trend up? And the answer would be yes, and as the index has been trending upwards for the past five years, every pullback should be seen as a buying opportunity.

The MACD's are still not trading into the extremely oversold ranges, so further consolidation is warranted, and as the economy of some nations is weaker than the others, this index cannot be asked to keep pace with indices such as the Dow and NASDAQ. There is a small chance that it could test 6500 ranges again though the most probable course of action is for it to put in a higher lower. The ideal scenario would call for a drop to the 6800 ranges and then a move to the 8000 ranges. Once it closes above 8375 on a monthly basis, it will provide the setup for a test of the 9000-9100 levels. Much like they were wrong with their proclamations of doom for the NYSE, the doctors of doom are doomed to share the same experience with the Global BBC 30 index.

"A great fortune in the hands of a fool is a great misfortune." ~ Anonymous

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2015 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.