Stock Market Reversal Day

Stock-Markets / Stock Markets 2015 Dec 22, 2015 - 06:19 PM GMT Good Morning!

Good Morning!

SPX appears to have completed an impulse from its Thursday morning high. The correction, which is nearly complete, appears to be a flat one, indicating a further decline ahead. Today is a Pivot day, suggesting a reversal may be about to take place.

ZeroHedge reports, “It has been a seesaw session with U.S. stock index futures following their dramatic buying burst in the last half hour of market trading yesterday by first rising, then falling, then rising again alongside European equities both driven almost tick for tick with even the smallest move in the carry trade of choice, the USDJPY, even as Asian shares trade near intraday highs after China’s leaders signaled they will take further steps to support growth, including widening the fiscal deficit and stimulating the housing market, to put a floor under the economy’s slowdown according to statements released at the end of the government’s Central

Economic Work Conference by the official Xinhua News Agency on Monday.”

On this side of the pond, however, “smart money” has never been more bearish. This may either be an invitation for another short squeeze or an all-out panic decline.

VIX appears to be lining up with the panic decline. It has made an impulse from Thursday’s low and the correction appears to be complete, or nearly so.

The Hi-Lo Index closed on a sell signal yesterday at -117.00.

SKEW has come down considerably from its Thursday high at 146.53 to 125.10 at yesterday’s close. Despite the decline, it remains on an uptrend and may shoot higher at a break in supports in the SPX.

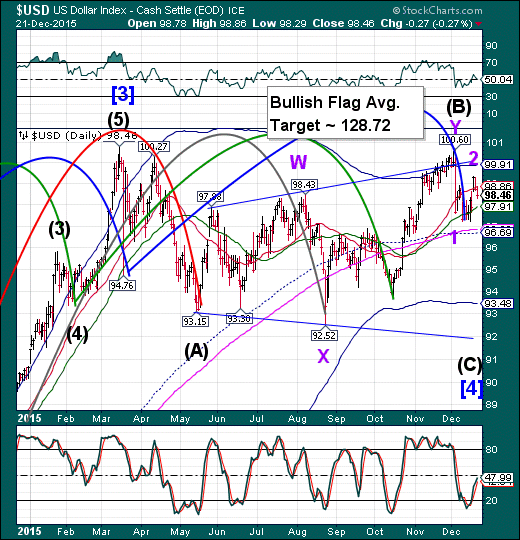

USD appears to be in a persistent decline. USD futures have made a low of 98.12 this morning an show no letup. This suggests, as I have maintained, that dollar weakness may be the trigger for the next sell-off in equities.

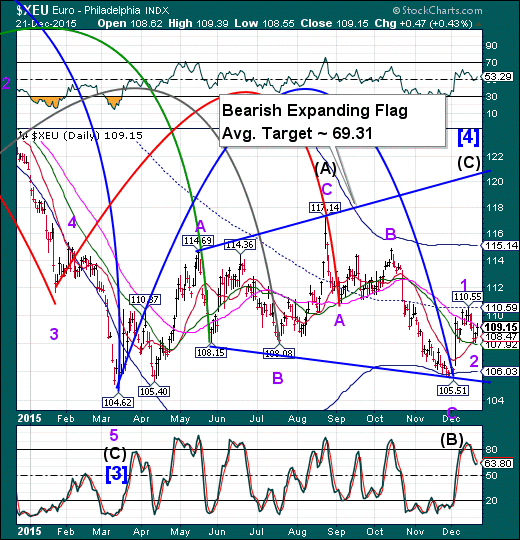

SPX denominated by the Euro is also in decline after failing to better its 19.88 high in March. A decline in SPX coupled with a decline in USD will compound the decline in Euro.

The outcome is that, as bad as it gets in Europe, SPX may not be the safe haven it once was.

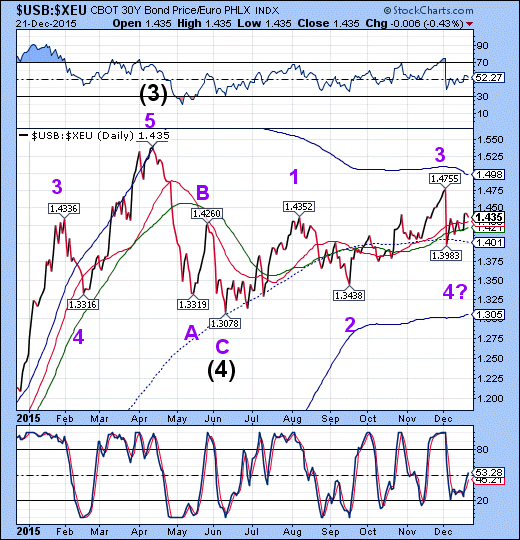

On the other hand, USB denominated by the Euro has been on a steady rise since June. This appears to be the most likely recipient of European cash fleeing the continent.

The Euro appears to be a mirror image of the USD. The demand for liquidity in Euros as their markets decline may force the Euro higher as well as have a salutary effect on USB.

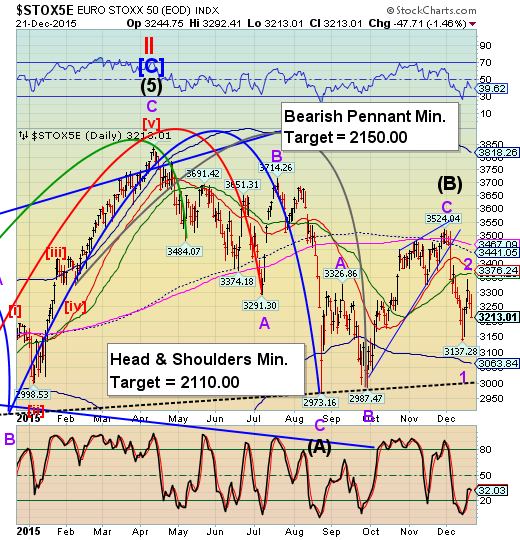

The decline in equities appears to be global as all indexes but the Shanghai Index have reversed down.

How long the Chinese government can support their equities market is to be determined.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.