Silver: May the 100 Year Force Be With You

Commodities / Gold and Silver 2015 Dec 21, 2015 - 06:03 PM GMTBy: DeviantInvestor

What force? Some of the “forces” in our world that are supportive of higher silver prices are:

What force? Some of the “forces” in our world that are supportive of higher silver prices are:

- Debt Increases: Global debt exceeds $200 Trillion and rising rapidly.

- Warfare: Syria, Turkey, Russia, Ukraine, South China Sea, Chicago and others. It is a long list.

- Welfare: Bank bailouts, military contractors, Medicaid, food stamps, dozens of “programs” and so much more.

- Central bank “money printing:” Bank of Japan, European Central Bank, the Federal Reserve, Bank of England and others are doing what they do best – devaluing their currencies. The bubbles created in the bond, stock, and currency markets must be fed and supported.

There is little doubt that the world is drowning in debt. The choices seem to be:

- Add even more debt. Some Nobel Prize winners like this option. The default action by nearly every politician and government is to create far more debt every day, until the system breaks.

- Inflate the currency so the debt becomes insignificant – think Weimar Germany and Zimbabwe. Hyperinflation has never been good for the middle and poor classes. The financial and political elite take care of themselves.

- Raise taxes and reduce debt. NOT A CHANCE! Have you ever met a politician that wanted to spend less money?

- Default! Unthinkable! Sorry bond markets, insurance companies, hedge funds, pension funds, savers, we were lying when we promised to repay you ……. Unthinkable! (Until there are no remaining choices …)

If defaulting on the national debt and raising taxes can’t or won’t happen, governments are left with more of the same – add more debt, pretend it will be repaid, increase consumer prices, and hope the financial system does not crash. This will lead to ugly consequences such as much higher inflation, a deflationary crash, and/or a hyperinflationary depression.

What does United States history indicate? Examine the following graphs that cover 100 years on a log scale.

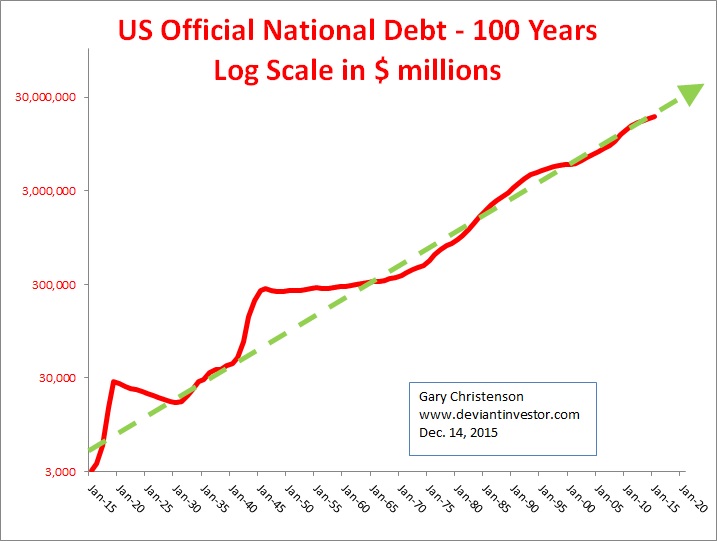

National debt has increased from a few $ billion to about $19 Trillion. The 100 year history is clear. Expect debt to increase.

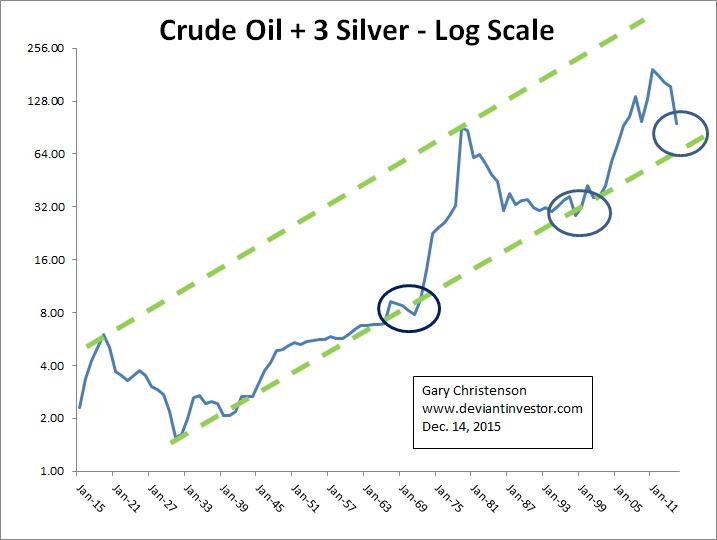

Over 100 years crude oil prices have averaged about three times the price of silver. For approximately equal weights graph the price of crude oil plus 3 times the silver price. The trend toward higher commodity prices over 100 years is clear. However silver prices have been crushed over the past four years and crude oil has similarly fallen during the past 1.5 years. The 100 year chart makes the recent nasty short-term price collapse look tiny and unimportant. Expect higher long-term prices for silver and crude oil as politicians spend and central banks “print” and both silver and crude oil prices eventually return to their long-term uptrend. If not, the system has crashed and the unpleasantness is beyond belief.

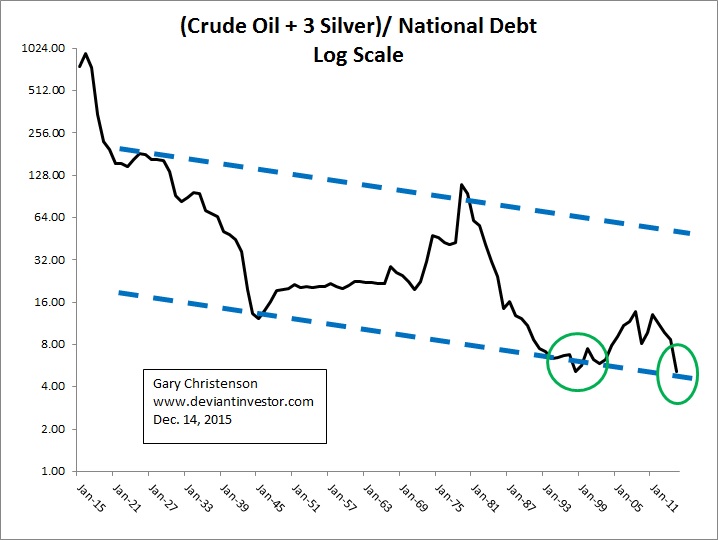

Over 100 years the national debt has increased more rapidly than prices for silver and crude oil – hence the ratio declined. The important point is how low the ratio is currently, and how much higher those crude oil and silver prices will go if governments and central banks choose to inflate away their debt. The upper trend channel suggests ratios 7 to 10 times higher. Silver prices will rise considerably more than the increase in the ratio.

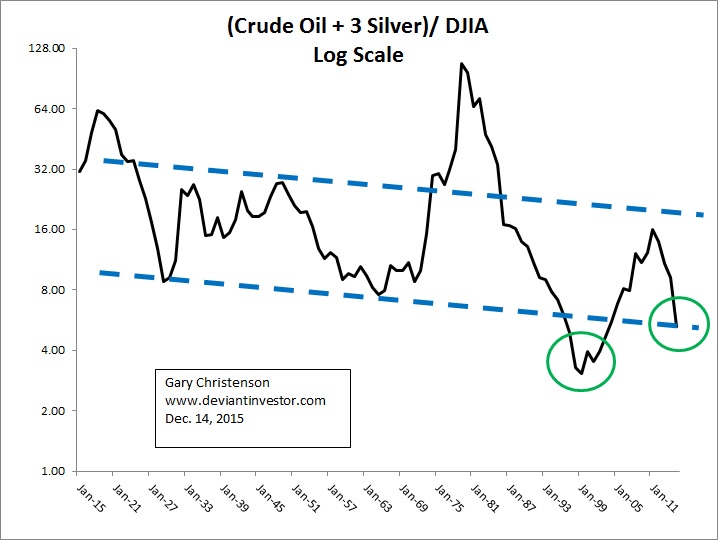

Over 100 years the Dow (DJIA) has risen somewhat faster than silver and crude oil prices. The ratio of silver plus crude prices to the DOW is currently at the low end of the range and has been lower only around the year 2000 when the DOW bubbled up and silver and crude were nearly forgotten. The ratio could easily rise by a factor of 10.

CONCLUSIONS:

Silver and crude oil prices have been crushed while the DOW has been levitated. But national debt increases inexorably – like a runaway freight train on full throttle.

Don’t expect debt to decrease, be repaid, or even to slow its rate of growth. Hence currency in circulation and most prices for what we need will rise. Look again at the exponential graph of debt.

Crude oil and silver prices are historically low compared to national debt, the DOW, the S&P (not shown) and most paper investments. Eventually people will realize that “paper” investments can return to their intrinsic value – much lower. Or relatively speaking, silver and crude oil will be priced much higher in devaluing currencies.

When: My crystal ball is cloudy, but silver demand is strong and prices are too low for miners to make a profit. Eventually silver prices will rise – perhaps soon. Crude oil prices? Who knows all the political manipulations that influence crude oil prices?

Stack silver, stack gold, and remember that 100 year trends are not likely to change. Expect more debt, more currency in circulation, exponential increases in prices, and more spending. War will accelerate the process.

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.