Silver Price Stuck in a Grim Downtrend

Commodities / Gold and Silver 2015 Dec 21, 2015 - 06:59 AM GMTBy: Clive_Maund

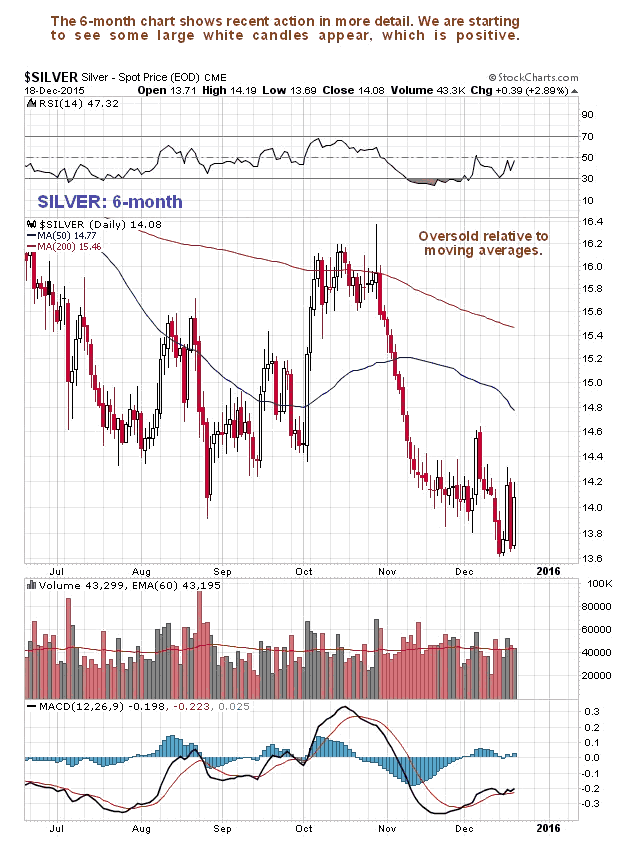

Silver has been somewhat weaker than gold in the recent past and dropped to clear new lows last Monday, as we can see on its 6-month chart below, but this should not come as a surprise as its recent COT structure has been nowhere near as positive as gold's, and at the end of a bearmarket or beginning of a bullmarket, gold outperforms silver.

Silver has been somewhat weaker than gold in the recent past and dropped to clear new lows last Monday, as we can see on its 6-month chart below, but this should not come as a surprise as its recent COT structure has been nowhere near as positive as gold's, and at the end of a bearmarket or beginning of a bullmarket, gold outperforms silver.

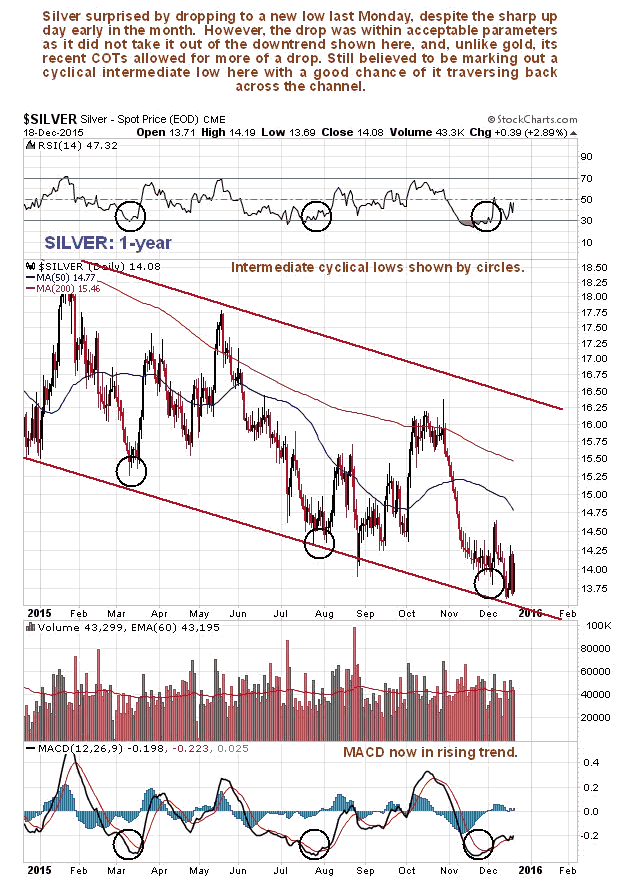

Although silver made clear new lows last week, it did not change the overall picture from the last update, which is of silver marking out a probable intermediate base pattern that should lead to a tradable rally, as we can see on its 1-year chart below. On this chart we can see that it is near to the bottom of the downtrend channel shown within which there is plenty of room for a tradable rally, even if it doesn't succeed in breaking out of this channel. Silver's latest COTs are certainly supportive of such a rally now, and these are bolstered by gold's strongly bullish COTs.

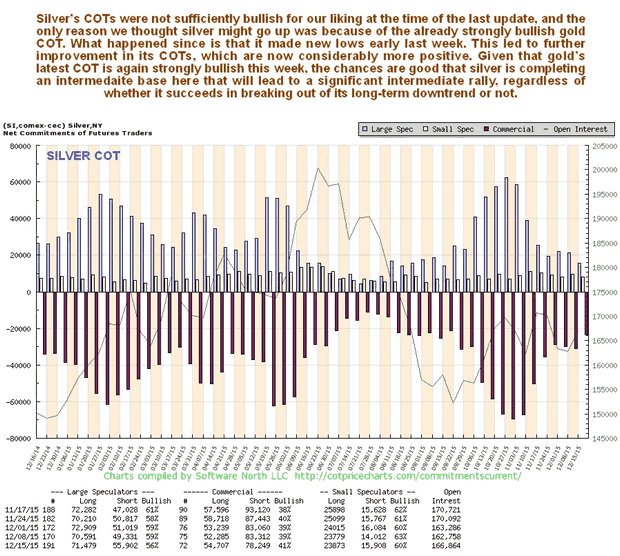

You may recall that silver's COTs were a cause of some concern at the time of the last update, as the Commercials had not reduced their short positions to a sufficient degree, and this helps to explain the new low last week. However, they improved further last week, and while there is still room for improvement they have certainly improved enough to permit a rally, especially when you take into consideration gold's now strongly bullish COT.

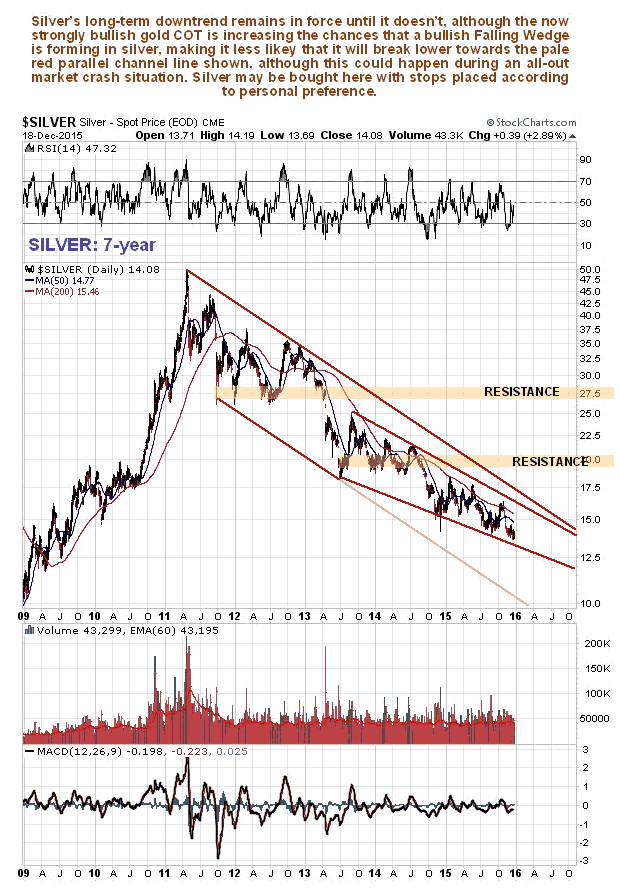

While the long-term 7-year chart for silver still looks rather grim, with the price still stuck in a downtrend which must be assumed to continue until it doesn't, there is evidence of convergence of the downtrend which could be the precursor to a breakout. While it could break lower towards the pale red parallel channel return line shown, the chances of both gold and silver going counter-cyclical and rallying when the market crashes are considered to be good, especially as the sector is so beaten down, in contrast to what happened in 2008.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2015 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.