The Fed Rate Hike Will Trigger a $9 Trillion Financial Markets Meltdown

Stock-Markets / Financial Markets 2016 Dec 18, 2015 - 05:18 AM GMTBy: Graham_Summers

Yesterday, the Fed has hiked interest rates from 0.25% to 0.5%.

Yesterday, the Fed has hiked interest rates from 0.25% to 0.5%.

It is the first rate hike in 10 years. And it is now clear that the Fed is not only behind the ball in terms of raising rates… but that it has now primed the financial system for another 2008-type meltdown.

By way of background we need to consider the relationship between the US Dollar and the Euro.

The Euro comprises 56% of the basket of currencies against which the US Dollar is valued. As such, the Euro and the Dollar have a unique relationship in which whatever happens to the one will have an outsized impact on the other.

Here’s why the Fed’s decision to raise rates will implode the financial system.

In June 2014 the ECB cut interest rates to negative. Before this, the interest rate differential between the Euro and the US Dollar was just 0.25% (the US Dollar was yielding 0.25% while the deposit rate on the Euro was at exactly zero).

While significant, the interest rate differential was not enough to kick off a complete flight of capital from the Euro to the US Dollar. However, when the ECB launched NIRP, cutting its deposit rate to negative 0.1%, the rate differential (now 0.35%) and punitive qualities of NIRP (it actually cost money to park capital in the Euro) resulted in vast quantities of capital fleeing Euros and moving into the US Dollar.

Soon after, the US Dollar erupted higher, breaking out of a multiyear triangle pattern and soaring over 25% in a matter of nine months.

To put this into perspective, this move was larger in scope than the “flight to safety” that occurred in 2008 when everyone thought the world was ending.

The reason this is problematic?

There are over $9 trillion in borrowed US Dollars sloshing around the financial system. And much of it is parked in assets that are denominated in emerging market currencies (the very currencies that have imploded as the US Dollar rallied).

This is the US Dollar carry trade… and it is larger in scope that the economies of Germany and Japan… combined.

In short, when the ECB cut rates to negative, the US Dollar carry trade began to blow up. The situation only worsened when the ECB cut rates even further into negative territory in September 2014 and again last week bringing the rate differential between the US Dollar and Euro to 0.55%.

Now, the Fed has raised interest rates to 0.5%. This has made the interest rate differential between the Euro and the US Dollar 0.75%. This will trigger a complete implosion of the $9 trillion US Dollar carry trade.

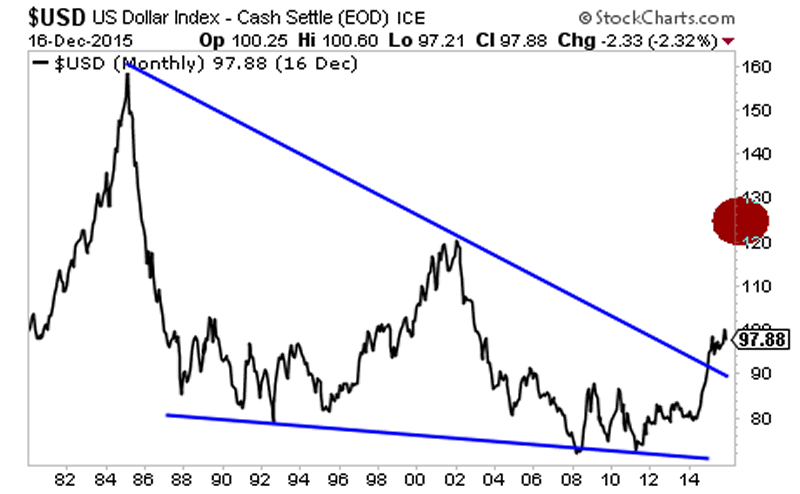

This is a long-term, multi-decade chart of the US Dollar.

As you can see it has just broken out of the largest falling wedge pattern in monetary history. The chart predicts that during the next leg up, the US Dollar will rally to 120 or even 130.

At that point, the $9 trillion US Dollar carry trade will implode triggering a 2008-type event. Our timeline for this is within the next 12 months.

Smart investors are preparing now.

Private Wealth Advisory subscribers are already profiting from the markets, having just closed THREE more winners yesterday, bringing us to a FORTY THREE trade winning streak…

Private Wealth Advisory subscribers are already profiting from the markets, having just closed THREE more winners yesterday, bringing us to a FORTY THREE trade winning streak…

What is Private Wealth Advisory?

Private Wealth Advisory is a WEEKLY investment newsletter that can help you profit from the markets. Every week you get pages of high quality editorial presenting market conditions and outlining the best trades to make to profit from them.

It is the only newsletter to have closed 72 consecutive winning trades in a 12 month period (ZERO losers during that time). And we just began another winning streak last year, already racking up 43 straight winners.

And we’ve only closed ONE loser in the last FOURTEEN MONTHS.

You can try Private Wealth Advisory for 30 days (1 month) for just $0.98 cents.

However, this offer will be expiring tomorrow at midnight. I cannot maintain a track record of over a YEAR of straight winners with thousands and thousands of investors following these recommendations.

To take out a $0.98 30-day trial subscription to Private Wealth Advisory… and lock in one of the few remaining slots….

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2015 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.