Banking Stocks Still Not a Buy, Heading for New Lows Into August

Companies / Banking Stocks Jul 05, 2008 - 02:30 AM GMTBy: Donald_W_Dony

The unprecedented decline in global financials, since early 2007, has most investors wondering when the bottom will arrive. Many world financial indexes are now sitting on half of their value from 18 months ago. Attractive fundamental valuation levels, provided by many analysts, have proven to be of little consequence since stocks have continued to waterfall 20%-40% below those 'attractive levels' and show no signs of stopping. But as many financial indexes plunge to the same levels as the 2002 bear market lows, the big question remains; when will the banks stop their fall?

The unprecedented decline in global financials, since early 2007, has most investors wondering when the bottom will arrive. Many world financial indexes are now sitting on half of their value from 18 months ago. Attractive fundamental valuation levels, provided by many analysts, have proven to be of little consequence since stocks have continued to waterfall 20%-40% below those 'attractive levels' and show no signs of stopping. But as many financial indexes plunge to the same levels as the 2002 bear market lows, the big question remains; when will the banks stop their fall?

Banks play a double role in the stock market cycle. First, they reflect the underlying strength of an economy and second, this group of companies is a very reliable leading indicator for the equity markets. And with this continual selling-off from the financial sector, any thoughts of an extended capital markets recovery appears distant in the future.

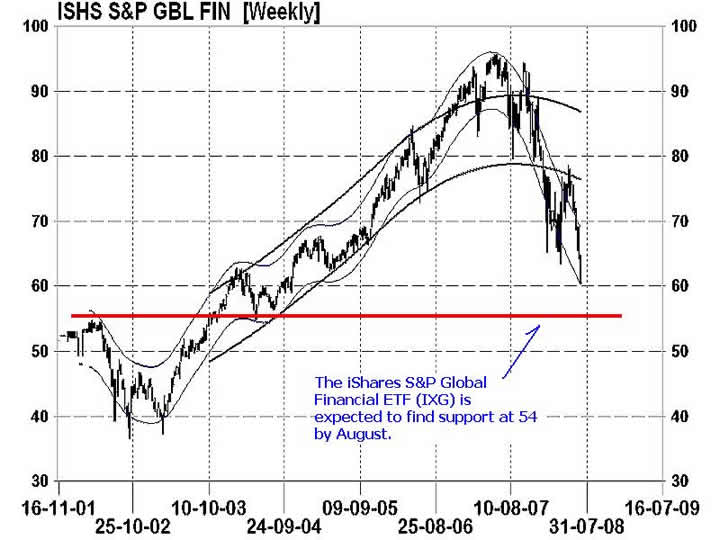

Chart 1 is of the iShares S&P Global Financials and provides a long-term illustration as to the extent of the decline. This collection of senior world banks has been in a free fall for 12 months and continues to break one key support level after another. Technical models, however, are indicating a potential low will develop in August at about the 54 range. This deep price level, not seen since mid-2004, has solid price support and is anticipated to hold the S&P Global Financial Index for the rest of 2008.

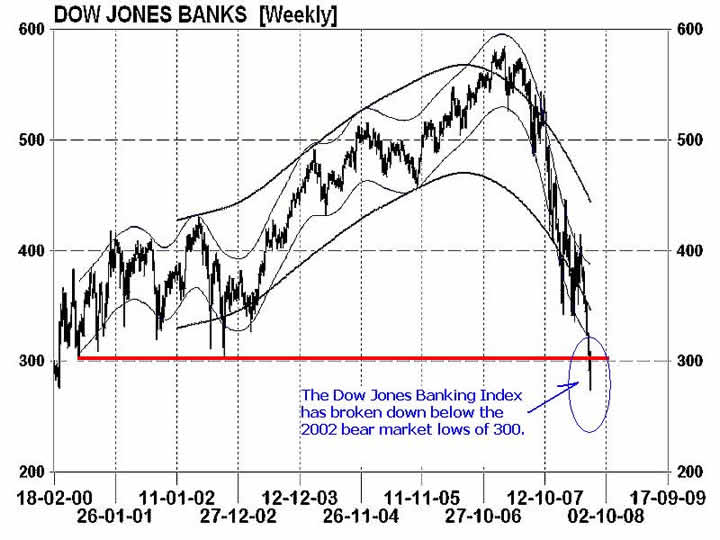

The Dow Jones Banking Index (Chart 2) is displaying a similar picture as many world banks only with a deeper bearish tone. This index has penetrated below the 2002 bear market price levels and is expected to reach the 1998 levels of 230. Technical models are also suggesting that August should offer some stability for this 'falling knife'.

The Canadian Financial Index (Chart 3), though trending to the same bearish direction as the U.S. and global banks, are feeling considerably more buoyant. Overall exposure to the sub- prime fiasco appears considerably less than in U.S. and European banks and, in response, the index has held up far superior to other banking indexes. Canadian financials are still trading in a similar pattern to global financial indexes. As with the Dow Jones Banking Index, Canadian financials have a technical low in August.

Bottom line: Technical models are indicating that Global banks should reach an intermediate bottom in August. This means another 3-4 weeks of downward pressure. Though it is not know if this anticipated trough will represent the beginning of a base or only a resting step before lower numbers emerge. As the current stock market cycle is predicted to end in 2010, banks can foreseeably drift lower before a true base is achieved.

Investment approach: As models for global, U.S. and Canadian banks all point to a low in August, investors would be wise to wait until that time before trying to buy the financials. Canadian banks, which appear to have the lest exposure to the sub prime mortgage crises, are still not developing any signs of a base support level. Prices are expected to drop below the March 2008 levels by August.

More research is available in this month's newsletter. Go to www.technicalspeculator.com and click on member login. The July newsletter focuses on the major market low that is developing this month in capital markets.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2008 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.