Will Lower Crude Oil Prices Cause the Fed to Delay Tightening?

Commodities / Crude Oil Dec 15, 2015 - 11:54 AM GMTBy: Bob_Kirtley

The FOMC has been moving towards the beginning of a new tightening cycle for a considerable amount of time. Throughout this year Fed statements and the accompanying press conferences have been preparing the markets for the first rate hike. Since the October FOMC various Fed speakers have signalled to the market that the first hike would come at the December meeting, which is this week.

The FOMC has been moving towards the beginning of a new tightening cycle for a considerable amount of time. Throughout this year Fed statements and the accompanying press conferences have been preparing the markets for the first rate hike. Since the October FOMC various Fed speakers have signalled to the market that the first hike would come at the December meeting, which is this week.

Prior to 2015 employment had been the key focus for the Fed. Consistent jobs growth had allowed the tapering of QE3 and appeared to be paving the way for higher rates this year. However, inflationary pressures fell, causing the Fed to delay the first rate hike until now. They key reason for the decline in inflationary pressures has been the massive selloff in oil, which broke to new lows last week.

We believe the most likely outcome of this week's Fed meeting is a rate hike accompanied by an overall hawkish tone. However, the risk of a delay has significantly increased with the break in oil prices. The purpose of this article is to discuss how and why those risks have risen, and how to trade now that the risk reward dynamics have changed.

The Negative Effects of Lower Oil Prices

When oil prices first began to fall there was speculation that this decline would be positive for the US economy. Lower oil prices would mean smaller operating costs for firms and more discretionary income for households. This would lead to higher profits and increased spending, which would drive economic growth.

However, this argument was without respect for the US oil industry, and in particular the new high costs shale projects. Lower oil prices reduce profit margins for already operating oil producers while also making new shale oil projects too expensive to action. This means fewer jobs in the US, either by way of layoffs or lack of necessity with shale ventures being axed. This brings us to the multiplier effect, which is crucial when considering the impact of lower oil on the economy. We discussed this in depth in a market update sent to our subscribers last year:

“…if an energy worker losses a job, they may not buy the new house they were looking at, which would have involved a mortgage and credit. This means that the impact of a job loss is a lot more than just the salary as they employee may forego future spending with borrowed funds. Therefore, the multiplier impact has the potential to have an overall negative effect on the economy even in net oil importing countries, such as the US."

This means that although more people may feel the benefit of lower oil prices, the overall effect has the potential to be heavily detrimental to the US economy. This means that there is a sizeably increased risk that the Fed may delay the tightening cycle.

Can The Fed Delay Tightening?

The Fed has signalled a hike is coming this week and markets have largely priced this in. This makes it highly likely that Yellen will announce the first rate hike on Wednesday. However, this does not rule out that the Fed can still delay the tightening cycle as this is a process that will likely cover a number of years.

The tightening cycle can be delayed this week, even with a rate hike, by the language used and dot projections released. These will show the Fed’s plan for the future of monetary policy after the first hike, and thus will signal how the tightening cycle is likely to play out. If the dot projections are flatter than expected, this means that there will be less hikes next year and that rates will rise at a slower pace. This is a delay in the tightening cycle.

Last week’s break to the downside in oil reopens the risks to the economy that were prevalent during the initial decline. In response to this the Fed may believe it is prudent to delay the tightening cycle in the manner discussed above. This would calm market fears, shown by the fall in bonds, that both lower oil prices and a less accommodative monetary policy may harm economic health.

In the past Yellen has described lower oil prices as being transitory, and not the reason for a delay in rate hikes. However, the lack of inflationary pressures has been a key reason for the Fed not hiking sooner. The most significant hamper of these pressures has been lower oil, which has both directly lowered headline inflation and has had a negative impact via the flow on effects of fewer jobs. Therefore the break in oil may cause a delay without being explicitly stated as the reason.

Trading Gold’s New Risk Reward Dynamics

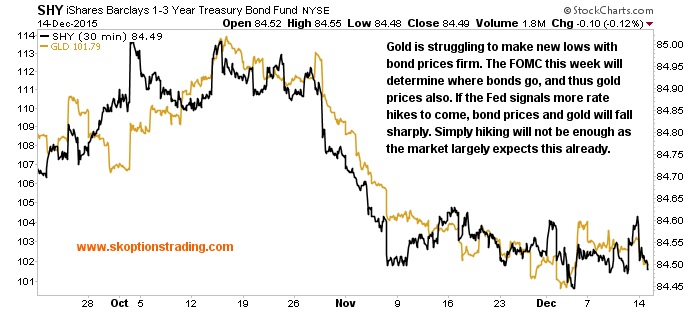

The yellow metal is struggling to make new lows with bond prices remaining firm. The Fed meeting this week will determine where bonds go from here, and will therefore move gold prices also. We expect the Fed to hike, but this is already largely priced in so its announcement is unlikely to move bond prices. Therefore the tone of the meeting and dot projections will be key, which the break in oil has increased the risk around.

If the Fed signals that more rate hikes will come and come often next year bond prices and gold will fall sharply. However, if the tone and dots are more dovish as a result of last week’s break in oil, then gold and bond prices are less likely to decline heavily.

We believe that the most likely outcome of this week’s Fed meeting will be a rate hike accompanied by hawkish tones for the future, but we respect that the risk of increased dovishness has risen. The long term direction of the Fed remains hawkish with rates still likely to rise going forward. This will still have a bearish effect on gold prices, so we remain bearish over the long term.

Given our bearish bias, we will look to use the break in oil to gain entry to gold shorts at a better level, with the view to fade gold above $1120 via various options strategies. Prior to the break, we intended to simply add to our gold shorts on any strength in the metal. These trades would then perform as a hawkish Fed drove gold to new lows.

However, now that the risk of a more dovish Fed has increased, the risk of gold rallying after this week’s meeting has risen. Therefore it is a better trade to keep powder try until after the Fed meeting. This allows for gold to rally on the back of a dovish Fed, and thus a better entry point for any new shorts.

We may also look to tactically reduce exposure to gold ahead of the Fed meeting. Gold has the potential to break lower towards the next major support of $1030 on speculation that the Fed will be hawkish. However, this does not change there is an elevated risk of the Fed being dovish. In this case we would look to tactically reduce our exposure by banking the profits currently showing on a number of our gold shorts.

Our analysis of this week’s Fed meeting and the exact details of any trades we make will be issued immediately to our subscribers. Therefore if you want to know what gold trades we will be making in response to this week’s FOMC meeting, then please subscribe below.

Sam Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

Disclaimer: www.gold-prices.biz makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents our views and replicates trades that we are making but nothing more than that. Always consult your registered adviser to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this letter. Options contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. Past performance is neither a guide nor guarantee of future success.

Sam Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.