The Coming Economic Collapse Will Crash Stocks

Stock-Markets / Financial Crash Dec 14, 2015 - 05:01 AM GMTBy: Graham_Summers

In 2008, the world experienced the worst economic collapse in 80+ years. This collapse triggered a stock market crash that erased $30 trillion in wealth.

In 2008, the world experienced the worst economic collapse in 80+ years. This collapse triggered a stock market crash that erased $30 trillion in wealth.

Since that time, collectively Central Banks have cut interest rates over 600 times and have printed over $15 trillion in new money… money that has failed to generate sustained economic growth… money that has set the stage for another stock market crash.

Consider the measures of GDP growth in the US for instance.

The mainstream media likes to present the “official” GDP numbers as though they are gospel… but the reality is that the number you hear in the press is not even close to accurate.

One of the simplest means of hiding the real economic collapse is to use a bogus measure for inflation. If GDP growth is 10%, and inflation is 10%, then real GDP growth is 0%.

But what if GDP growth is 10%, real inflation is 10%, but you claim inflation is just 6%?

Boom! You can promote GDP growth of 4% to support your claim that printing trillions of dollars has boosted the economy.

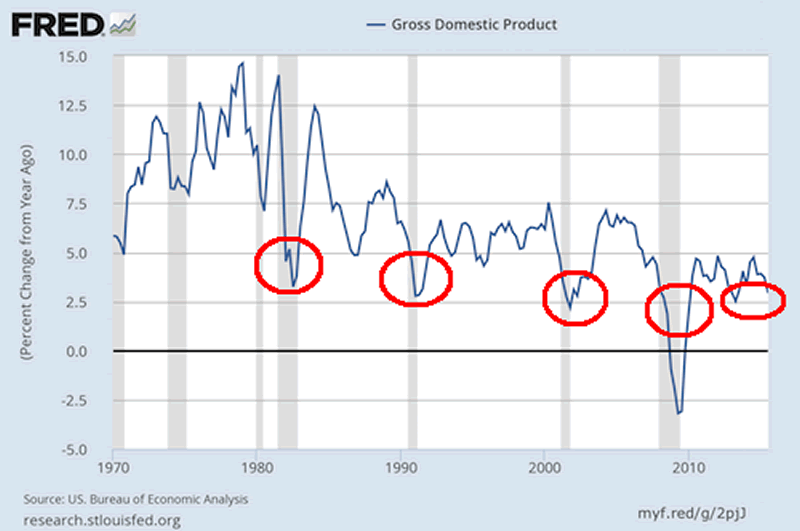

To remove this accounting gimmick, you can use Nominal GDP and look at the rate of growth from a year ago. Doing this presents a VERY different view of the economy: one of economic collapse, not growth. I’ve circled periods in which the current level of “growth” occurred in the past.

As you can see, the “recovery” of the last six years has largely involved a “growth” rate that was closely associated with recessions over the last 30 years. At best the US economy has been flatlining. At worst we’ve had bouts of economic collapse comparable to a recession.

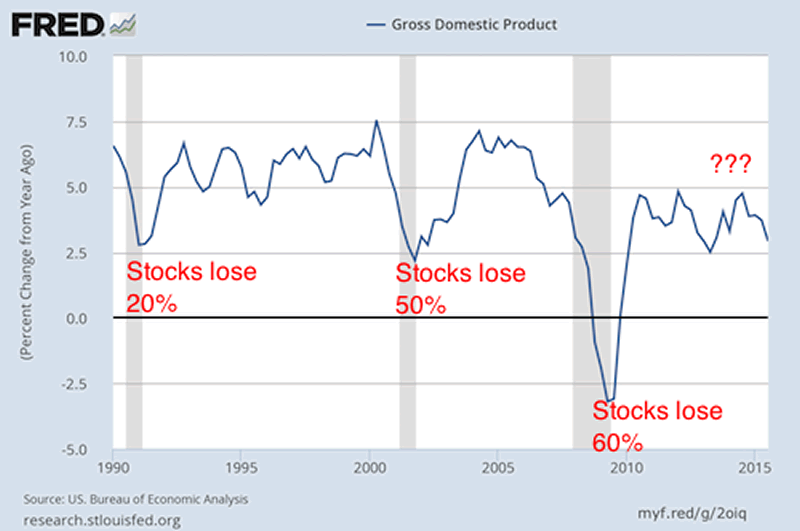

Also, note that the previous periods in which we’ve experienced this rate of economic collapse have been associated with stock market crashes.

The media can try to hide reality all it wants. But an economic collapse is here. It will trigger another stock market crash just as it did in the early ’90s, the Tech Bubble, and the Housing Bubble. And this time Central Banks won’t be able to stop it: they’ve used up all of their ammo in the last six years trying to create recovery.

Smart investors are preparing now.

Private Wealth Advisory subscribers are already profiting from the markets, having just closed THREE more winners yesterday, bringing us to a FORTY THREE trade winning streak…

What is Private Wealth Advisory?

Private Wealth Advisory is a WEEKLY investment newsletter that can help you profit from the markets. Every week you get pages of high quality editorial presenting market conditions and outlining the best trades to make to profit from them.

It is the only newsletter to have closed 72 consecutive winning trades in a 12 month period (ZERO losers during that time). And we just began another winning streak last year, already racking up 43 straight winners.

And we’ve only closed ONE loser in the last FOURTEEN MONTHS.

You can try Private Wealth Advisory for 30 days (1 month) for just $0.98 cents.

However, this offer will be expiring tomorrow at midnight. I cannot maintain a track record of over a YEAR of straight winners with thousands and thousands of investors following these recommendations.

To take out a $0.98 30-day trial subscription to Private Wealth Advisory… and lock in one of the few remaining slots….

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2015 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.