Why Your Bank Deposits May Be at Risk

Personal_Finance / War on Cash Dec 09, 2015 - 10:53 AM GMTBy: EWI

Another financial crisis will bring widespread bank failures

Another financial crisis will bring widespread bank failures

Elliott Wave International's July issue of The Elliott Wave Theorist reminds us why bank depositors need to prepare for the worst before a nation's financial system is gripped by crisis:

You can't wait until a monetary system collapses to protect your wealth. Just ask the Greeks. One day they were free to access all their savings at banks, and the next day the banks' doors were closed. Depositors' only relief was a dispensation allowing depositors to withdraw up to 60 euros a day.

You may be tempted to think that such a situation is unlikely to occur in Europe's advanced economies like France, Great Britain and Germany.But another severe economic downturn could bring historic bank failures.

Why? Because the banking system never fully recovered from the 2007-2009 financial crisis.

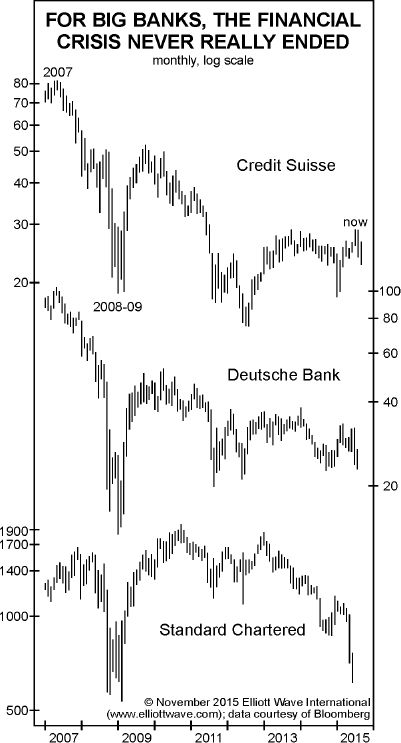

Here's a chart of three of Europe's largest banks:

You can see that the stock prices of all three banks continue to languish.

Here are some recent news items about major European banks:

- Standard Chartered Bank plans to cut 15,000 jobs and "reported a pretax loss of $139 million in the third quarter." -- (New York Times, Nov. 3)

- "Royal Bank of Scotland Group Plc, Britain's biggest government-owned lender, said profit fell by more than half in the third-quarter." -- (Bloomberg, Oct. 30)

- "Deutsche Bank to shed 35,000 jobs, exit 10 countries" -- (CNBC, Oct. 29)

- "Pre-tax earnings at Credit Suisse's private banking and wealth management unit plunged 31%." -- (The Guardian, Oct. 21)

In the U.S., Reuters reports that the falling value of loans to junk-rated companies could be a negative factor in fourth-quarter earnings for banks.

Bankers must also grapple with the high cost of onerous regulations and huge fines imposed by the government.

In 2014 alone, U.S. and European banks paid nearly $65 billion in penalties and fines, about 40% greater than 2013, according to the Wall Street Journal. Billions in bank fines have continued into 2015.

Every bank depositor should read Elliott Wave International's (EWI) FREE new special report: "The Secret New Government Tax -- UNVEILED."

EWI's U.S. and European Financial Forecast editors have teamed up to show you how the government is strong-arming big banks and squeezing out depositors' hard-earned money -- under the guise of keeping it safe. See what the government is up to and take an important step toward making your money safer.

Follow this link to get your free report now >>

This article was syndicated by Elliott Wave International and was originally published under the headline Why Your Bank Deposits May Be at Risk. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.