Bank of Canada Announces Negative Interest Rates; Loonie Sinks to 2004 Low

Interest-Rates / Canadian $ Dec 09, 2015 - 10:25 AM GMTBy: Mike_Shedlock

The Canadian dollar, affectionately known as the loonie because of a loon on the one dollar coin, has crashed vs. the US dollar.

The Canadian dollar, affectionately known as the loonie because of a loon on the one dollar coin, has crashed vs. the US dollar.

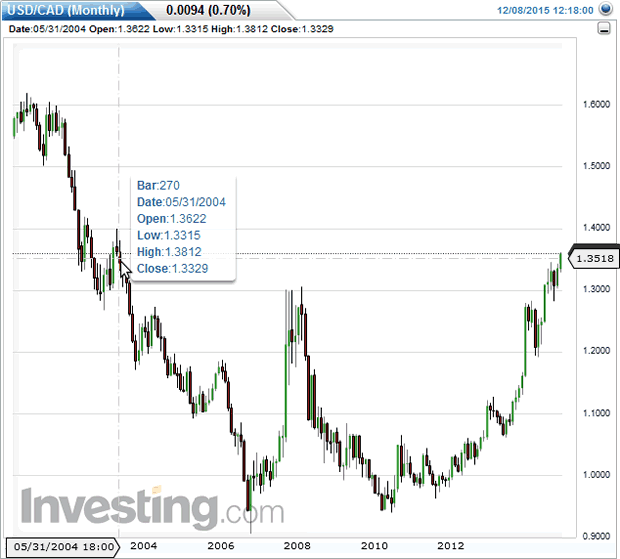

US Dollar vs. Canadian Dollar Monthly

The USD vs. the Loonie is back to a high last seen in May of 2004.

Tools Needed

Isn't a sinking currency supposed to help exports and the economy in general? Well, not in this corner, but that is what central bankers believe.

Canada ought to be flying high if the general central bank currency thesis was correct. Instead, the Bank of Canada announced it has Tools Beyond Zero Rate if needed.

Policy makers still have firepower to spur growth in the face of another crisis, even with borrowing costs near zero, Bank of Canada Governor Stephen Poloz said.

While the central bank doesn't expect it will need to resort to unconventional policies, a number of tools are still available, Poloz said, including charging banks for deposits, forward guidance and asset purchases. Fiscal stimulus could be even more effective than monetary policy in extreme circumstances, he said.

"I certainly hope we won't ever have to use these tools," Poloz said, according to the text of a speech he's giving Tuesday in Toronto. "However, in an uncertain world, a central bank has to be prepared for all eventualities."

Poloz said the bank's estimate for its real lower bound is negative 0.5 percent, an update from a previous estimate of 0.25 percent, published in a 2009 unconventional monetary policy framework. Poloz also said the central bank is now 'confident' Canada's financial markets could function in a negative rate environment, where banks would be charged for deposits, rather than being paid interest as is conventional.

"In short, should the need arise, we'll be ready. The effectiveness of each tool will depend on the situation, making it more a matter of choosing the right one at the right time," said Poloz.

Right Tool at the Right Time

I have a very simple question for Poloz: If you know the right tool for the right time, why is Canada in or flirting with recession?

If the Fed knew how to use tools, why was there a global financial collapse?

If the ECB knew how to use tools, why can't the eurozone hit inflation targets?

It may be a matter of "matter of choosing the right one at the right time" but don't expect central banks to come close.

In practice, central banks pull tools out of their collective asses, making them up as they go along, hoping to cure the messes their policies created. The results speak for themselves: a series of asset bubbles of increasing amplitude over time.

There is one and only one tool that will work. It's called the free market.

Expecting a bunch of economic illiterates who do not understand the irreplaceable role of the free market is like expecting an idiot to divine the theory of relativity.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2015 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.