The U.S. Housing Market Needs to Watch Out For China!

Housing-Market / US Housing Dec 08, 2015 - 03:42 PM GMTBy: Harry_Dent

The New York Times ran an article on Sunday talking about how the Chinese invasion of U.S. real estate is only expanding.

The New York Times ran an article on Sunday talking about how the Chinese invasion of U.S. real estate is only expanding.

They aren’t just buying condos in Manhattan or McMansions in Silicon Valley – they’re buying properties in new developments in places like Plano, TX, just north of Dallas.

In the market for homes over $1 million, the Chinese make up one out of every 14 buyers – which is huge. In the top tier markets in San Francisco, Orange County or Manhattan, they can be 50% or more!

In the past year they paid $831,800 on average for an American home for a total of $28.6 billion. That’s more than double their level just two years prior!

The next biggest buyers, Canadians, only spent $380,300 on average. The average U.S. buyer: just about $250,000.

As you can imagine, a lot of Americans in these cities the Chinese are buying into aren’t much too happy. With that kind of buying power, they’re jacking up costs across the board. But it gets worse.

69% of their purchases are entirely in cash. Local buyers can’t do that! They have to apply for a mortgage. So they’re pissed off because so many Chinese can close a deal in a weekend.

But we need to consider why the Chinese are trying to get the hell of out dodge in the first place.

Many know like I do that China’s economy is a time bomb, so they’re trying to get their money out – especially before, worst case scenario, the government starts taking it.

Others just want to get their kids into American high schools or colleges to give them a world-class education. And some are just escaping the growing smog!

There’s also the fact that since 2009, U.S. real estate has only become more attractive as Chinese property got more expensive. So this trend of the Chinese buying over here has just accelerated since.

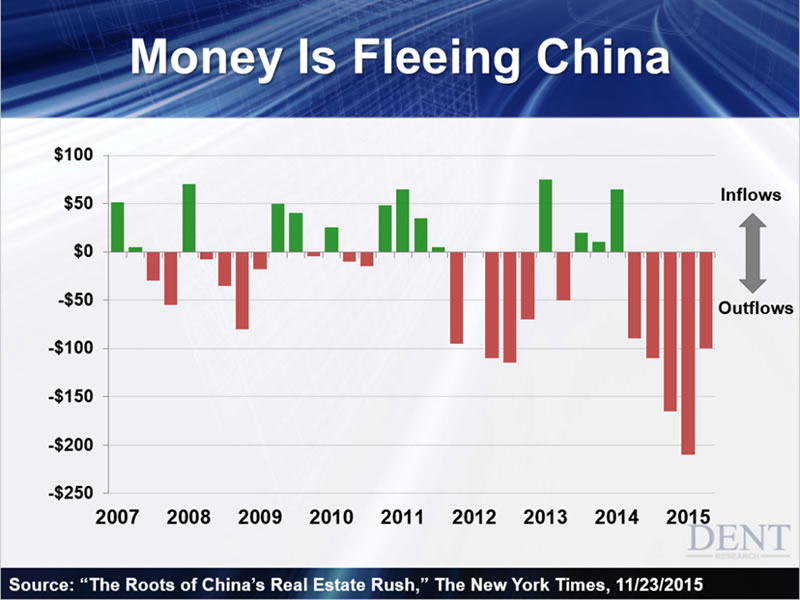

And it shows in the exodus of money coming out of China in the chart below.

You can see it started to heat up between 2012 and 2013, and going into 2015 it’s just been berserk! (Though we have data only up through Q2.)

The New York Times articles argues that the Chinese government has been making it easier for affluent Chinese and corporations to move money overseas. And the U.S. government helps by offering EB-5 Visas or green cards for foreigners who invest $500K to $1 billion in projects that employ at least 10 people. In fact, 86% were granted to Chinese last year!

But it finally seems like the Chinese buying might be slowing down.

That’s the point of another article in The Wall Street Journal by Laura Kusisto and Alyssa Abkowitz, which is more in line with what I’ve been hearing.

They’re saying in recent months the Chinese government has been making it harder to get money out of China.

The government is cracking down on the $50,000 per year limit they enforce on transferring money overseas. Up until now, people have been pooling money through friends, relatives, and employees to get around that limit.

And then there’s the fact that China’s stock market crashed. That’s made the Chinese more cautious about any and all investments. Real estate agents have noticed a marked decline since.

So the question is – will this stall be more temporary or more permanent?

First, I think the government is going to crack down even more seriously about the money flowing out of their country.

Outflows recently totaled $580 billion in 12 months. How can you continue to let your most affluent take their wealth out of the country under the guise of their kids’ education?

But more importantly, I think another shock is coming to China’s stock bubble burst. And that will create more uncertainty among the affluent. They can’t be feeling too secure about their financial assets, and some are already getting less comfortable with speculation.

My forecast: Look for another stock crash in China starting by late January. And then an acceleration of the real estate crash in China that has already begun.

This happened with the Japanese in the early 1990s…

When such a crash and implosion of wealth happens where it really matters – real estate – it will cause global speculation to come to a halt, and fast.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2015 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.