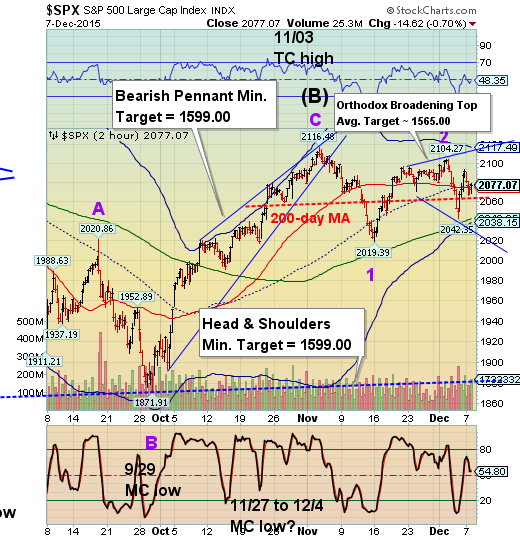

SPX challenging the 200-day Moving Average

Stock-Markets / Stock Markets 2015 Dec 08, 2015 - 02:31 PM GMT The SPX Premarket is down approximately 1% and appears to be resting just above the 200-day Moving Average at 2064.60.

The SPX Premarket is down approximately 1% and appears to be resting just above the 200-day Moving Average at 2064.60.

The catalyst may be China. ZeroHedge reports, “Over the weekend, in its latest quarterly presentation, the Bank of International Settlements made what may have been a very premature assessment that China is now contained. To wit:

In October, equity markets staged a remarkable recovery, recording their strongest one-month gain in recent years. Market nerves were partly calmed by receding fears over tail risk in China. The improvement was broad-based. European and American stocks recouped nearly all losses experienced in the third quarter, while China’s stocks also made up some lost ground

Judging by events in the past 24 hours, the reality is turning out to be anything but as China's "tail risk" appears to set to make a dramatic return and drag all emerging markets lower once again.”

This morning the Shanghai Index is at 3470.07, which is still above its 50-day Moving Average, but clearly on a sell signal.

The Nikkei is at 19492.60, just 30 points above its 200-day Moving Average and a sell signal at 19462.15.

The EuroStoxx 50 Index declined 1.5% to 3309.87 this morning, having been repelled at the 200-day Moving Average last week and having lost all near-term support. It went on a sell signal last Thursday.

TNX is still challenging its 2-hour mid-Cycle support at 22.13, but it doesn’t appear that it will take long to break it. A breakdown beneath the 50-day Moving Average at 21.58 would add extra confirmation to the decline.

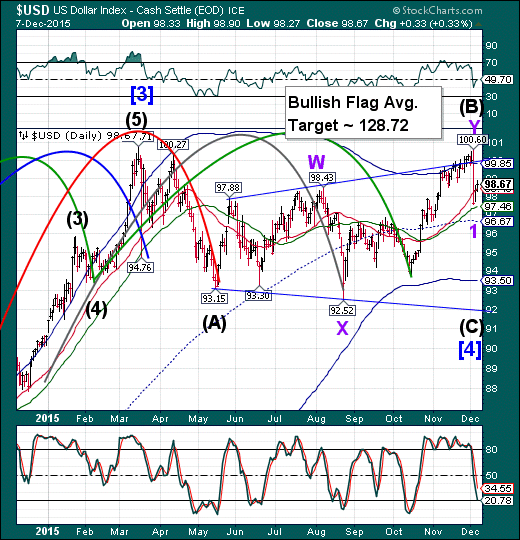

USD is hovering at 98.56, but may signal the resumption of the decline beneath the 50-day Moving Average at 97.46.

The big story in commodities is that crude is crashing. This morning’s futures tumbled to 36.80, a new low with no end in sight.

ZeroHedge reports, “How many times were we told that an OPEC decision was "priced in" - well it wasn't. WTI is now down 15% from pre-OPEC and has crashed through the $37 level for the first time since Feb 2009... time to catch a falling knife (again), or fold on all those 'recovery' bets?”

Martin Armstrong’s blog, ArmstrongEconomics, has an explanation why this is.

Have a good morning!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.