A Peek Behind the Fed Policy Curtain

Interest-Rates / US Federal Reserve Bank Dec 08, 2015 - 12:28 PM GMTBy: Gary_Tanashian

This article was originally and simply titled ‘Market Management’ as the opening segment from this week’s NFTRH 372. We then covered US and global stock markets and precious metals in detail, along with brief but ongoing negativity about commodities (but also what to look for regarding signs of change), a currency update and extensive market sentiment and indicator updates.

This article was originally and simply titled ‘Market Management’ as the opening segment from this week’s NFTRH 372. We then covered US and global stock markets and precious metals in detail, along with brief but ongoing negativity about commodities (but also what to look for regarding signs of change), a currency update and extensive market sentiment and indicator updates.

As noted recently, my trading had become problematic because I do not have the time, inclination or even the raw talent to day trade, which is what this market has seemed to demand lately. There is no better illustration of the reason why trading has been difficult than what happened on Tuesday through Friday as markets popped up to challenge the recovery highs, tanked hard, seemingly launching the bear view and then ramped again toward the highs on Friday (on a policy maker’s jawbone, what else?).

Yet nothing is resolved. Mario Draghi could not allow even two consecutive days of post-ECB market tankage before he gulped down a microphone on Friday to regale the world about the limitless commitment the ECB has toward accomplishing its goals of asset market appreciation, rising costs and an outright USA style elimination of the ethic toward saving.

Assuming policy makers are cut from the same cloth (outside of Raghuram Rajan, I do make that assumption) this gives the lie to something Janet Yellen said on Thursday when with a straight face she told the world that monetary policy makers watch the economy, not the stock market. Ha ha ha, that’s a good one.

Management-wise, we are left with ole’ Steady Eddy (i.e., me) remaining balanced and patient in order to see through this volatile phase in which the bear case remains favored, but the bull case is not kaput. That is the market we have and that is the market we need to manage in service to the day when said market fails or breaks to the upside.

Backing out Draghi from the equation, it was notable that the US market launched on a fairly decent November jobs report and the now-firm perception that the Fed is going to raise the rate by whopping .25% (sarcasm alert) on December 16. If it were to follow the late 90’s and mid 2000’s models, the market would generally follow increasing rate hikes upward until the inevitable flame out and crash. That would be due to still-firm economic signals (like the November Payrolls report) as the ‘back end’ of the economy services itself with Leisure and Hospitality, Healthcare and Construction. We however, can also continue to be interested in the front end, the Canary AKA the Semi sector.

I would add general manufacturing in there as well, but the US economy has in the past shown great stamina in riding its vast consumer economy. Wall Street media could warm over a promotion (ref. late 90’s) about how, due to the strong dollar, we do not need manufacturing and indeed can simply outsource all of our manufacturing needs. The Semi’s, if the Semi equipment sector is the ‘Canary’s Canary’ and if it is truly entering a deceleration as opposed to a blip, are a different story.

The consumer (US and global) is walking around, driving around, riding the bus or train and blissing out on iTunes or one of myriad apps to be aided and/or distracted by. He is ever more dependent upon Semiconductors in his daily life. Have I mentioned we are on the back end of the economy, driven by the consumer? If Semi decelerates, it will say something about the consumer (or at least inventory build ups on the way to the consumer) and the consumer puts the CON in the ‘consumer economy’.

That last line is just something that popped up from an old manufacturing guy, a bias of mine on display. I have never been a big believer in the new age concept that we can simply print money, have it remain strong globally, employ the rest of the world to do the dirty work and go on dumb and happy. But again, that is a bias.

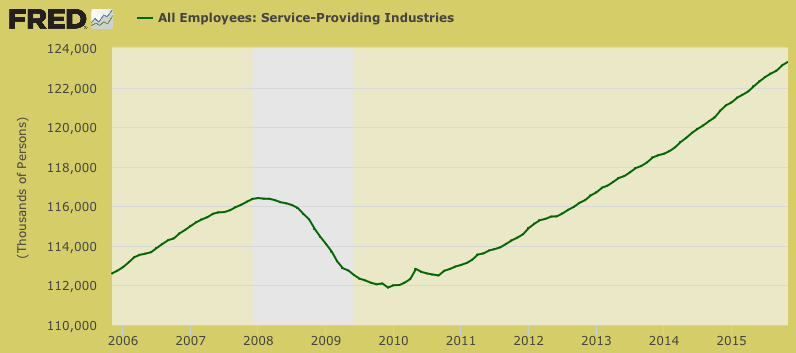

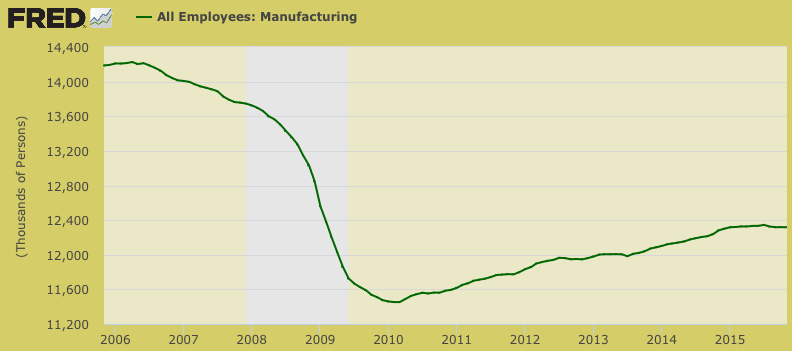

Let’s move on to some particulars in the Payrolls report, this time without the aid of my beloved Floatingpath graphics. Nick is preparing to launch as a premium service and the freebies and the mailing are inactive for now. Here are a few items from the St. Louis Fed. Services and Manufacturing employment…

Current trends continue as the strong dollar buys services and pressures manufacturing.

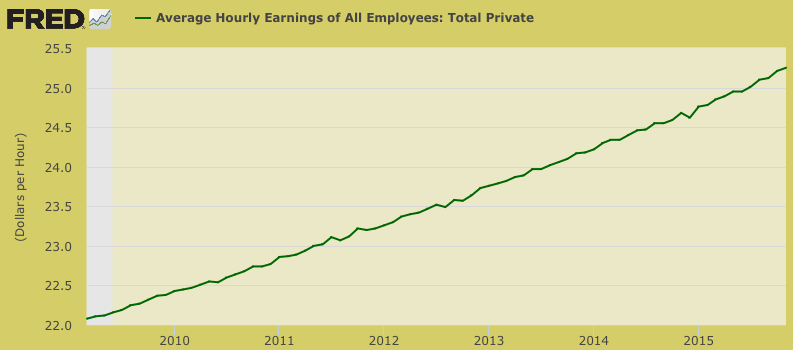

You can bet the Fed is watching hourly earnings as it balances its stock market inflation operation against what might happen if people make too much money by actually working (as opposed to the market’s ‘wealth effect’) and prospering within the economy. Compensation for all workers is grinding upward and that is where conventional economists (like those at the Fed) are going to get spooked about inflation getting out of hand.

The S&P 500 can go up from 666 (the mark of the devil :-( ) to 2134 since 2009, but to have workers’ pay go up from 22 to 25 bucks an hour over the same period? Evidently, that will not do as inflation might get out of hand (sarcasm alert #2).

The Fed is not for the people. I don’t think I am enlightening anyone with that comment. The Fed is for corporations and in particular, financial corporations.

In my opinion, the great post-2008 economic cycle, touted so conventionally by so many as being normal, has gone something like this… asset market meltdown due to over-leveraged financial institutions > bailout at public expense through QE inflation (now showing up in services throughout the economy) and 7-year ZIRP > asset speculators richly rewarded > savers punished > employment much improved but wages not keeping up with costs of important services > Fed, fearing its repressed inflation will be forceful, begins to tighten long after first abusers have locked away bailout gains… or something like that.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.