More Wild Swings Ahead For Stock and Gold Markets?

Stock-Markets / Stock Markets 2015 Dec 06, 2015 - 11:27 AM GMTBy: Richard_Cox

Last week saw the SPX drop more than I thought it would (Dec 3 has been on my radar for a couple of weeks, the 7 week low) on the Drahgi speech that strengthened the Euro vs. the Dollar causing gold to spike. The short euro/$ pair was too heavily tilted in that direction causing a reverse of positions.

Last week saw the SPX drop more than I thought it would (Dec 3 has been on my radar for a couple of weeks, the 7 week low) on the Drahgi speech that strengthened the Euro vs. the Dollar causing gold to spike. The short euro/$ pair was too heavily tilted in that direction causing a reverse of positions.

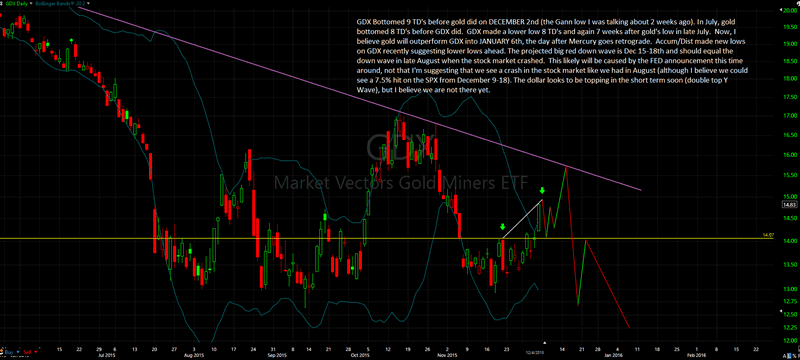

The stock market's "come back" on Friday did not surprise me, however, gold's strong spike caught me off guard. The recent action in GDX has been corrective, but in E-wave terms it is turning out to be a 'rare' running correction. I have been looking for a gold low on December 2nd, but this kind of move off a bottom is rare.

Cycle-wise, we are due for a pull back into Tuesday for both gold and GDX (GDX is running 9.5 TD's on the 8 TD cycle, and gold hits 8-1 TD's on Tuesday and 8+1 on Thursday possible lows for gold). A running correction pulls back to the area of the previous top and that is 14.06/.07 on GDX. GDX showed weak buying on Thursday and was obviously catapulted up by gold's strong performance Friday.

The week ahead is fraught with peril as we see Mars (in Libra) opposing Uranus (in Aries) on Dec 10. Mars = Aggression, Hate, War, Explosions. Uranus = Agitation, Surprises, Radical, Shocks, Internet, Disruptions. Aries is Mars' home planet. I see gold bottoming on Dec 10 and rising into Dec 16. Last time I saw gold do this was right before the market crashed in August. GDX should bottom Tuesday and go up strongly into Dec 15 (especially Friday the 11th, Monday into Tuesday Dec 15). War is peace. I see gold up from next week into the following. GDX has a target of $15.70 on Dec 15 after tagging support @ 14.06/.07 Tuesday.

The moon is in Scorpio Wednesday and turns to Sagittarius on Thursday and Friday on the new moon = A spike low, wild, exaggerated reactions both up and down (the sun is also in Sagittarius adding to the swing intensity among other aspects). An SPX top (2119? Dec 9 wave [c]) on the Sun Trine Uranus Dec 8-9 (Recognition that all is well after a sudden Tuesday drop?) should afterward see a sudden drop into early Friday only to reverse to near even. There are Bradley turns due Dec 7 and Dec 11. Dec 6th, Mars sq. Pluto = Investigations due to recent terrorist activities, people demand answers, the stock market tops on wave [a] near 2107 Dec 7, GDX reverses, gold down. Dec 7 and 11 SL turns. Dec 7 CC turn. The stock market and gold both go down into Tuesday wave [b].

Dec 11 Venus trine Neptune & new moon = sudden plunge in stock market perceived to be a buying opportunity, (could it be overdone because of another terrorist attack the night of Dec 10? Or what else could cause it?) Mars is still in Libra, war is peace.

The best I can say for Dec 14-18 is that more selling should occur Dec 14, then up again into Dec 15 (4 TD top) only to reverse hard into Dec 18th. Downside minimum SPX 1988 (.50 fib), medium 1960 (.618 fib), maximum hard down 'b' wave like we just had taking out under the .618 retracement at 1960. My best guess is SPX 1960. GDX plummets with the stock market Dec 15-18.

Going into the New Year: GDX makes new low January 6 near Mercury retrograde, gold's bottom already in for this move. Gold is still in a bear market. After Dec 18 low, a massive year-end SPX rally takes us up to near new highs (2134 DEC 31?). More SPX selling is due in January into early February, time for gold and GDX to shine.

Obviously, the FED will be raising rates Dec 16 (otherwise why would the stock market tank???). A lot of people don't think they will: The Boy Who Cried Wolf.

S&P500 Hourly Chart

GDX Daily Chart

The above forecast is subject to change as the markets change. I use e-wave, cycles and astrology along with technical indicators to guess what the markets might do. I trade the markets not the forecast.

Recap: Be careful with the stock market's attempt to make a new recovery high next week. Regardless of cause, the market is "flat out" going to plunge below the Nov 16 low this month. As I have warned three weeks ago up until today, unfortunately, more terrorist activity could be in the fray. The dates December 10-11 and through the weekend next week look perilous. Mars in Libra opposite Uranus in Aries is foreboding. I hope I am wrong. I like gold over GDX until early January. I believe gold and GDX will be better buys in early January. I believe we see a massive year-end rally in the stock market, with more choppy selling from January into early February.

Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The subscription website is www.blustarmarkettimer.info

BluStar Market Timer offers auto-trading for those who don't have the time or inclination to trade their own accounts.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com Copyright 2015. All Rights Reserved

Copyright 2015, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.