Stock Market Internal Bleeding, Cheap Tech, And Falling Angels

Stock-Markets / Stock Markets 2015 Nov 30, 2015 - 05:56 AM GMTBy: John_Rubino

Think of "market internals" as the blood pressure and insulin levels of the financial world. They operate below the surface, frequently unnoticed, but over time they have a big say in the health of the patient.

Think of "market internals" as the blood pressure and insulin levels of the financial world. They operate below the surface, frequently unnoticed, but over time they have a big say in the health of the patient.

And right now they're pointing to a heart attack.

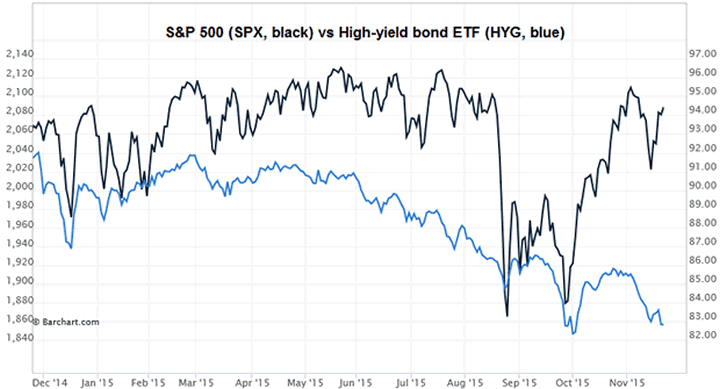

Let's start with junk bonds. These are loans to financially and/or operationally-weak companies that because of their weakness have to pay up to borrow. Such bonds have a risk/return profile that's more akin to equities than to, say Treasury bonds, and they trade accordingly, rising and falling on the likelihood of default rather than their relative yield.

Recession means higher default rates for weak borrowers, so when the economy is slowing down or otherwise hitting a rough patch, the junk bond market is often where it registers first. Lately, junk has been tanking relative to stocks (chart created by Hussman Funds ):

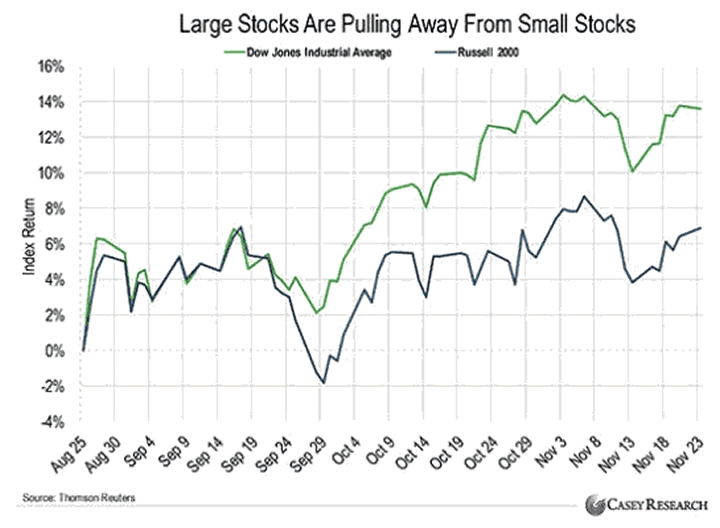

Another widely-followed internal is the relationship between large-cap (i.e., relatively safe) stocks and riskier small caps. When large caps outperform small caps, it's frequently a sign that the broader economy is weakening. Since September, that's been happening too:

In general, when market leadership gets extremely narrow - that is, when only a few things are going up and everything else is either flat or falling - trouble ensues. During the late 1990s tech stock mania, for instance, the global economy ended up being supported by the US, whose economy was supported mostly by the NASDAQ, which was supported by just a handful of high-flying tech stocks. When those stocks finally cracked, they took the whole world down with them.

Now something similar is happening, thanks in large part to this cycle's dominant tech firms, especially Apple. From CNBC:

To summarize, Apple will remain a great company but won't continue to make more on each new dollar of sales. And this will cause investors to start treating it like a non-deity, revaluing its stock accordingly.

Meanwhile there's a good chance that Apple will soon fall victim to a combination of falling tech prices and rising quality. Low-end consumer electronics are now adequate for most people, leaving the average consumer far less anxious to buy the best. Today there are 70-inch flat-screen TVs with a great picture to be had for $1,000 or less. Low-end smart phones, meanwhile, can now do most of what the best iPhone could do just a few years ago. A friend recently bought an $80 Windows-based phone that he describes as "okay.pretty good screen and it texts just fine." He pays about $25 less per month than with his old, much more expensive phone, and is happy with the trade-off. Barring a new must-have iPhone killer app, this trade-off is only going to become more compelling going forward.

So what happens to a market that's balanced precariously atop the shares of a handful of "must own" companies when those companies lose their halos? Historically, the previously-strong sectors join the rest in a broad sell-off.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.