Stock Market Consolidation Week

Stock-Markets / Stock Markets 2015 Nov 29, 2015 - 06:24 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend - Bull Market

Intermediate trend - SPX has resumed its uptrend in order to complete the last phase of the bull market.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discuss longer market trends.

A WEEK OF CONSOLIDATION

Market Overview

For the past five days, SPX has had daily closes within a nine-point range. Perhaps it is because of the Thanksgiving holiday, or perhaps it is because it is being sold at a resistance level. Whatever the reason, it will not stay there for long and will soon need to decide on the next direction. Daily and weekly indicators show a bias to the upside, so the next move may rise to challenge the previous short-term high of 2116. In order to do that, it will have to overcome the 2097 resistance which stopped its last attempt at moving higher. There are multiple resistance lines above 2116, all the way to 2170.

The upward bias also comes from some leading/confirming indexes which have slowly been creeping up in spite of their relative weakness to the SPX, and the Nasdaq 100 remains near its all-time high. These are not signs of a market that is ready to start a significant correction. One way to understand what the market is in the process of doing is through its structure. More than likely, October's 1968 low was Primary wave IV and we are now in Primary wave V. Its completion should also mark the end of the bull market which started in 2009. Should the move alter its profile in the near-future, we will have to reassess the market's position.

Intermediate Indicators Survey

Both the weekly MACD and SRSI are still in an uptrend.

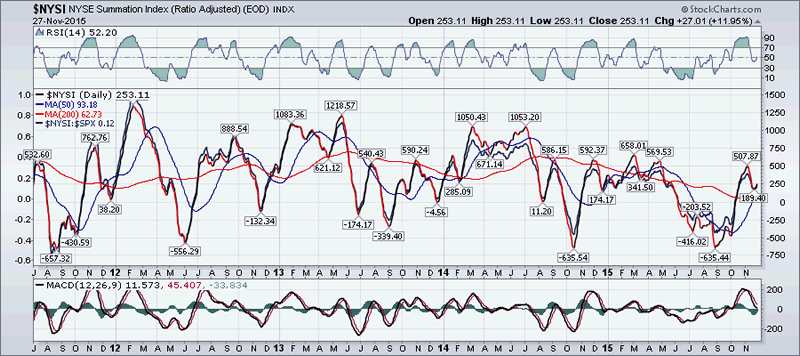

The NYSI (courtesy of StockCharts.com) has turned up from 169 and started an uptrend which would be the 5th one from the low. It looks vulnerable to negative divergence with price if SPX goes past 2116.

The 3X P&F chart does not show any significant distribution at this level, but there is plenty of former distribution above this level which may restrict any future advance in the SPX.

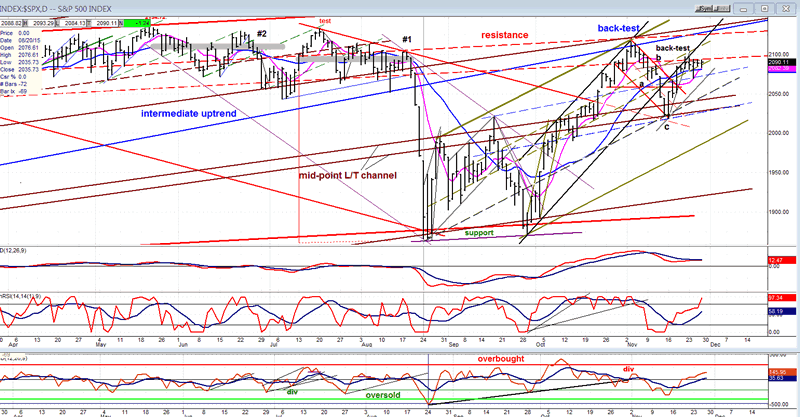

Chart Analysis

After the October correction down to 1868, the SPX had an initial choppy rally to 2020, came back down to re-test the low, and started a short-term uptrend from 1872 which came to an end at 2116 when it back-tested the blue intermediate lower channel line which was broken during the October correction. (As a reminder, the intermediate channel in question had its start in October 2011 at 1075 and came to an end in May 2015. Breaking out of that channel was a significant milestone in the bull market uptrend and one of the primary reasons to suspect that we are now in the final phase of the bull market which started in 2009). The move from 1872 was contained in the black channel which appears on the chart until it was breached when price dropped quickly to 2020. There the index found good support and started another short-term uptrend which met with resistance at the lower black channel line, effecting another back-test.

The net result of all this activity since the 1868 low is that another broad (green) channel has been created in which prices are currently moving. Since the correction to 2020 retraced 2/3rds of the channel width, we probably should not expect the current rally to continue all the way to the top of that channel which is currently around 2180. As (if) the rally from 2020 is extended, it will continue to find resistance at the black channel line as well as the blue one and the other trend lines which appear on the chart, all of which are valid internal resistance lines. The consolidation of the past five days has created a congestion on the 1X P&F chart which gives the index the potential to extend to about 2110, and perhaps as high as 2115.

Looking at the indicators, during the short consolidation the index has remained above its 8 and 21 MAs, and the SRSI and A/D oscillators remain positive and in an uptrend. All this points to higher prices ahead -- as long as the 2085 level is not violated. It was tested on Friday, but held and SPX closed at 2090.

There are strong indications that we are in the last phase of the bull market and, as long as prices continue to trade within the green channel, the trend will continue to be up. But be prepared for a period of extended weakness to take place once the index comes out of it. There is no current prediction about time or price for the end of this phase and, in any case, this information would be restricted to subscribers.

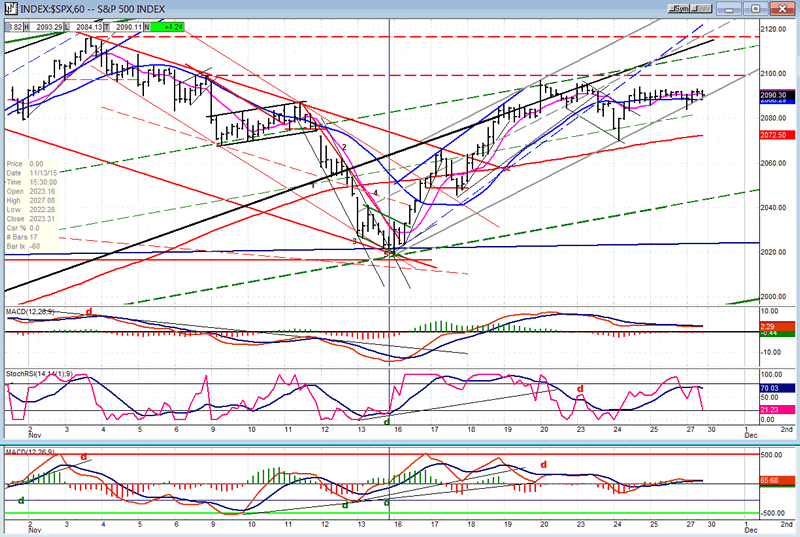

Hourly SPX chart.

The hourly chart is essentially neutral with very little trading range over the past few days. The index has been in a consolidation pattern ever since it ended its rally at 2097 and came out of its minor channel. A small correction to 2071 was quickly bought with prices re-bounding toward the previous short-term high. The black line that you see on the chart is the extension of the lower channel line of the trend from 1872. The rally from 2020 tried to get back inside the channel, but failed and was pushed back. It is likely to continue to provide resistance to prices unless a very strong uptrend manifests itself.

I have created a theoretical grey channel which could delineate the next uptrend if SPX decided to move up and out of its congestion pattern. The various trend lines above are where price could find initial resistance. The strength of the move (if an uptrend is created) would be gauged by whether the index could get past all these resistance points and reach the top line of the grey channel.

The indicators are not as bullish looking as those of the daily chart. With the MACD and A/D oscillators flat, the SRSI is in a downtrend, but all this would quickly change to the positive if prices started to move up. As they stand, however, the move out of this pattern could be in either direction and we will have to wait until Monday to see which it will be.

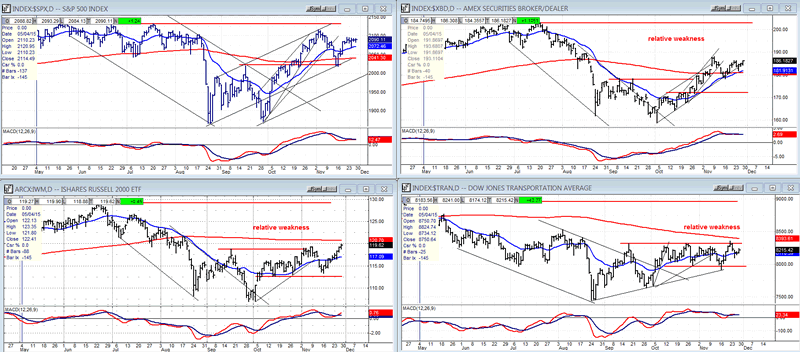

XBD (American Securities Broker/Dealer) and other leaders

The only index in which noticeable change occurred was in the IWM which appears to be breaking out of its consolidation pattern. The overall trend continues to be relative weakness to the SPX, but the near-term has become positive and it may be an indication that SPX is ready to extend its rally from 1872. The other two indices remain neutral with the SPX over the near-term, but relatively weaker over the longer term.

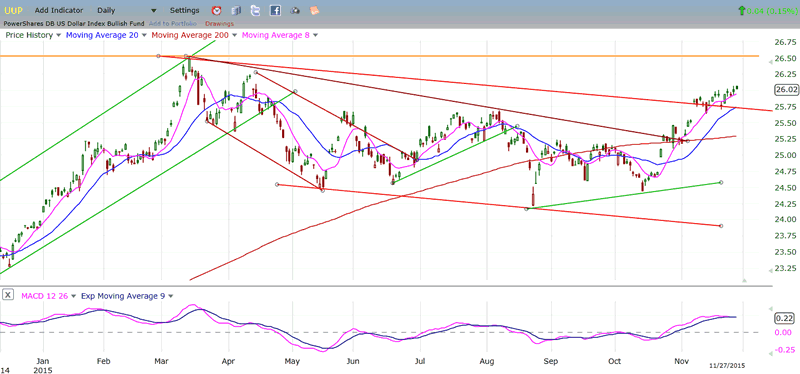

UUP (dollar ETF)

UUP is extending its move upward, but it's a slow process and it still has a ways to go before reaching the area of its former top. There are much higher counts, but the time required to reach them is not known!

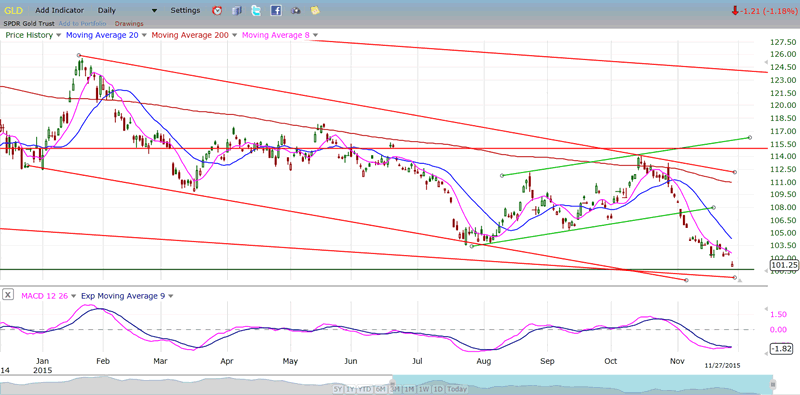

GLD (Gold trust)

GLD is now rapidly approaching its 100 target in a typical manner: a climactic end to the down-phase from 114 which could quickly reverse itself when the projection has been reached. Going a little beyond would not be unusual, especially since this looks like the fifth wave from 114 which is not quite complete. Since this index does not usually spend much time creating a base, a price reversal could come quickly after it reaches its projection.

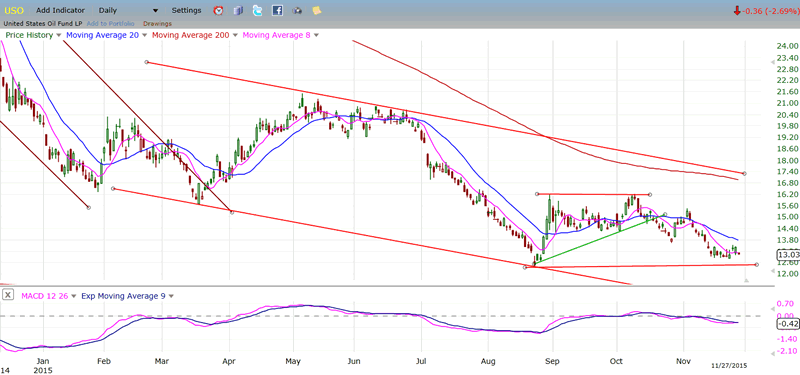

USO (United States Oil Fund)

USO shows no immediate desire to generate a new uptrend. More likely than not, it will continue downward to a new low after it has finished its consolidation.

Summary

SPX is in a short, sideways trend from which it could emerge in either direction. The daily indicators give it a bullish bias, but the hourly suggest that there could be a little more consolidation/correction. In any case, the 2085 level is the critical support level to watch. Breaking it could lead to a re-test of the 2070 level.

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.