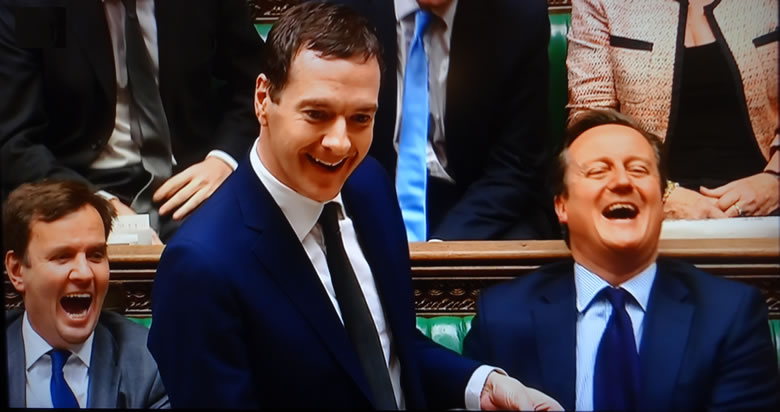

George Osborne's War on Buy to Let Sector Trending Towards Doomsday

Housing-Market / Buy to Let Nov 26, 2015 - 07:11 AM GMTBy: Nadeem_Walayat

The clocks counting down to doomsday for Britain's buy to let sector as the latest announcement in a long list of measures such as the scrapping of mortgage interest tax relief are all aimed at whittling away the profits of buy to let landlords, and now a stamp duty tax hike is set to come in force from April 2016. That of an EXTRA 3% stamp duty tax charged on all additional owned properties i.e. all second homes that will hit buy to let sector investors when buying properties, a tax hike to raise an estimated £1 billion extra per year.

The clocks counting down to doomsday for Britain's buy to let sector as the latest announcement in a long list of measures such as the scrapping of mortgage interest tax relief are all aimed at whittling away the profits of buy to let landlords, and now a stamp duty tax hike is set to come in force from April 2016. That of an EXTRA 3% stamp duty tax charged on all additional owned properties i.e. all second homes that will hit buy to let sector investors when buying properties, a tax hike to raise an estimated £1 billion extra per year.

The following table illustrates the effect of the increase in stamp duty from April 2016 which will especially hit the bottom end of the housing market where for instance tax on a £150k property will jump from just £500 to £3,800, an increase of £3,300! Which is precisely where George Osborne wants to target the most pain so as to increase the supply available for first time buyers that buy to let landlords have been soaking up for many years.

| Value | Existing / Single Property Owner | Buy to Let from April 2016 | Extra Tax |

| £40k-£125k | 0% | 3% | £2550 |

| Upto 250k | 2% | 5% | £6300 |

| Upto 925k | 5% | 8% | £26550 |

| Upto £1.5mil | 10% | 13% | £51300 |

| Over £1.5mill | 12% | 15% |

George Osborne's War on Buy to Let:

"In the end Spending Reviews like this come down to choices about what your priorities are. And I am clear: in this Spending Review, we choose to build. Above all, we choose to build the homes that people can buy. For there is a growing crisis of home ownership in our country. 15 years ago, around 60% of people under 35 owned their own home, next year it’s set to be just half of that.

We made a start on tackling this in the last Parliament, and with schemes like our Help to Buy the number of first time buyers rose by nearly 60%. But we haven’t done nearly enough yet. So it’s time to do much more.

Today, we set out our bold plan to back families who aspire to buy their own home. First, I am doubling the housing budget. Yes, doubling it to over £2 billion per year. We will deliver, with government help, 400,000 affordable new homes by the end of the decade. And affordable means not just affordable to rent, but affordable to buy. That’s the biggest house building programme by any government since the 1970s. Almost half of them will be our Starter Homes, sold at 20% off market value to young first time buyers. 135,000 will be our brand new Help to Buy: Shared Ownership which we announce today. We’ll remove many of the restrictions on shared ownership – who can buy them, who can build them and who they can be sold on to.

The second part of our housing plan delivers on our manifesto commitment to extend the Right to Buy to housing association tenants. I can tell the House this starts with a new pilot. From midnight tonight, tenants of 5 housing associations will be able to start the process of buying their own home.

The third element of the plan involves accelerating housing supply. We are announcing further reforms to our planning system so it delivers more homes more quickly. We’re releasing public land suitable for 160,000 homes and re-designating unused commercial land for Starter Homes. We’ll extend loans for small builders, regenerate more run-down estates and invest over £300 million in delivering at Ebbsfleet the first garden city in nearly a century.

Fourth, the government will help address the housing crisis in our capital city with a new scheme – London Help to Buy. Londoners with a 5% deposit will be able to get an interest-free loan worth up to 40% of the value of a newly-built home. My Honourable Friend for Richmond Park has been campaigning on affordable home ownership in London. Today we back him all the way.

And the fifth part of our housing plan addresses the fact that more and more homes are being bought as buy-to-lets or second homes. Many of them are cash purchases that aren’t affected by the restrictions I introduced in the Budget on mortgage interest relief; and many of them are bought by those who aren’t resident in this country. Frankly, people buying a home to let should not be squeezing out families who can’t afford a home to buy.

So I am introducing new rates of Stamp Duty that will be 3 per cent higher on the purchase of additional properties like buy-to-lets and second homes. It will be introduced from April next year and we’ll consult on the details so that corporate property development isn’t affected. This extra stamp duty raises almost a billion pounds by 2021 – and we’ll reinvest some of that money in local communities in London and places like Cornwall which are being priced out of home ownership. The funds we raise will help building the new homes. So this Spending Review delivers: A doubling of the housing budget. 400,000 new homes; with extra support for London. Estates regenerated. Right to Buy rolled-out. Paid for by a tax on buy-to-lets and second homes. Delivered by a government committed to helping working people who want to buy their own home. For we are the builders."

The clear strategy is for buy to let investors seeking to expand their portfolios to act before the April 2016 tax hike, therefore this could result in a temporary surge in house prices over the next few months, especially at the lower end of the market which will be set against those buy to let landlords who have had enough and decide to sell their portfolios into temporary strength before the next negative measure is announced. Of course there is one way for landlords to avoid the tax hike as was the case for avoiding the end of mortgage interest relief which is to INCORPORATE.

This trend should not come as much surprise for readers of my UK housing market articles that even before the May 2015 general election warned of the forthcoming dire consequences for buy to let sector investors, conditions that are only going to steadily get worse with each passing year as the political parties would increasingly seek to woo the 6 million strong army of private renters in the run up to the 2020 general election as illustrated below:

14 Apr 2015 - Conservatives Bribe Labour Voters by Extending Right to Buy to Housing Association Tenants

Private Rental Sector Crisis

To date approx 40% of the right to buy council homes have ended up in the hands of private landlords who then rent out these properties to those on benefits or low incomes. So whilst Council house tenants and soon to join them Housing Association tenants are in receipt of 70% discounts (bribes) of upto £102,000! Those in private rental accommodation get NOTHING! In fact the rents in the private sector tend to be substantially higher than for social housing and the properties also on average tend to be in far poorer state of repair.

Therefore at the end of the day the winners will be private landlords as the supply of buy to let sector properties increases. Meanwhile those waiting on the ever expanding housing lists are going to face even less choice as now even housing association properties will soon start to evaporate so that all that will be left will be some 6 million private landlord rental properties.

The big question mark is what bribes will the politicians come up with to appease the 6 million private rental households? Will a future government announce the right to buy your private rental property, especially as it would be a relatively easy votes winning calculation for a left of centre party to make. Something for today's would-be landlords to ponder the consequences of as they mass property empires that they could be forced to liquidate.

And more recently - 26 Oct 2015 - Buy-to-Let Property Boom Over Despite UK House Prices Grinding Higher

Britain's 2 million strong army of buy-to-let private landlords with well over 5 million properties in their portfolios face a perfect storm of new regulations, tax hikes and benefits cuts that looks set to turn their and their tenants finances upside down, converting profits into losses, this despite UK house prices expected to continue to grind ever higher and thus increasing portfolio valuations.

Impact on the UK Housing Market

All of the measures are clearly aimed at increasing supply of housing by forcing landlords to sell through erosion of profits, especially at the lower end of the market which should at least result in house prices significantly under performing in the worst hit areas, though more probably see outright falls in house prices in pockets of cities right across the UK that in reality have already been underway for some months. So clearly the Conservative governments measures are aimed at INCREASING the supply of housing for potential Tory voters, especially at the bottom end of the market that will attract first time buyers interest.

Another measure that will appeal to prospective Tory voters is the extension of the Right to Buy scheme to 1.3 million Housing Association tenants from April 2016. Which if following the example of council housing then within this parliament 50% of social housing could be sold off thus further increasing supply at the lower end of the market.

Therefore the Conservative government appears to be already laying the property market groundwork for the 2020 General Election, one of far higher supply of first time buyer properties, all without increasing the construction of new builds significantly as effectively many hundreds of thousands of today's renters become property owners.

The current assault on the Buy to let Sector just confirms that ultimately the trend is towards a buy to let doomsday, that of the right to buy scheme being extended to private sector tenants.

Ensure you are subscribed to my always free newsletter for ongoing in-depth analysis and concluding detailed trend forecasts that include the following planned newsletters -

- London House Prices Bubble

- US House Prices

- US Dollar Trend Forecast

- Stock Market 2016

- Islam 3.0

Also subscribe to our Youtube channel for notification of video releases and for our new series on the 'The Illusion of Democracy and Freedom', that seeks to answer questions such as 'Did God Create the Universe?' and how to 'Attain Freedom' as well as a stream of mega long term 'Future Trend Forecasts'.

Also subscribe to our Youtube channel for notification of video releases and for our new series on the 'The Illusion of Democracy and Freedom', that seeks to answer questions such as 'Did God Create the Universe?' and how to 'Attain Freedom' as well as a stream of mega long term 'Future Trend Forecasts'.

By Nadeem Walayat

Copyright © 2005-2015 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.