Stock Market Supports Are Being Broken

Stock-Markets / Stock Markets 2015 Nov 24, 2015 - 05:54 PM GMT SPX has clearly broken through its Short-term support at 2078.86 and is headed for the 200-day Moving Average at 2065.06.

SPX has clearly broken through its Short-term support at 2078.86 and is headed for the 200-day Moving Average at 2065.06.

ZeroHedge reports that the the third monthly decline as wages crash the most in 4 years. Consumer Confidence is now at 14-month lows, as well. In the meantime, the Pentagon shrugs over the Russian warplane shoot-down.

Not a good mix for investor confidence…

VIX is on a clear buy signal, having surpassed its mid-Cycle resistance at 16.43. The next hurdle is the 50-day Moving Average at 18.08.

The Hi-Lo Index is at -11, but must cross beneath the mid-Cycle support at -44.46 to confirm the sell signal.

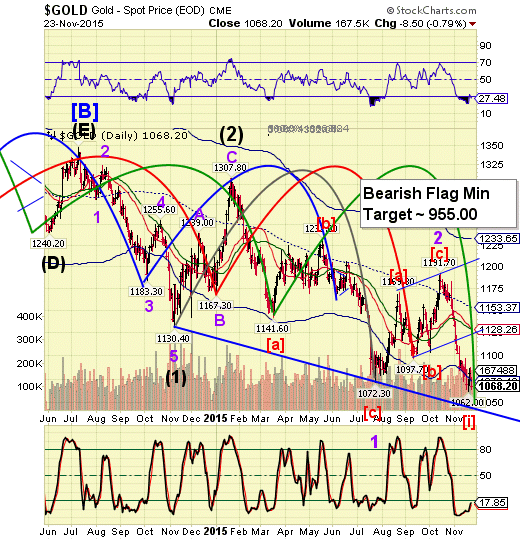

Gold has crossed above tis Cycle Bottom support, giving it a buy signal, as well. It has been as high as 1180.50, but has settled down to 1175 at the present.

The minimum retracement appears to be the Flag trendline and the 50-day Moving Average at 1128.26. However, it may go as high as mid-Cycle resistance at 1153.37, should the world become even more disruptive.

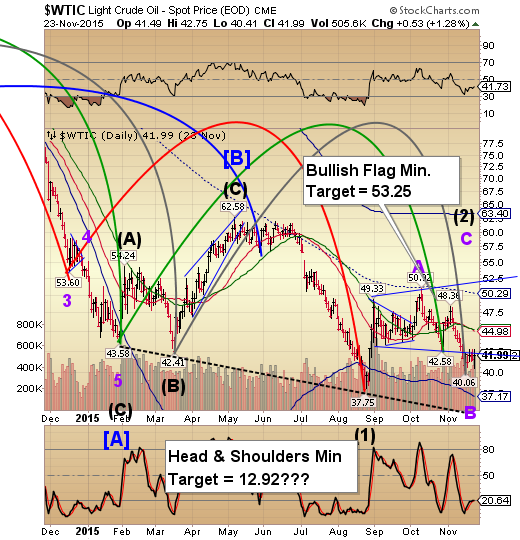

Crude shot up as high as 43.45 at the open, also putting it on a buy signal. It is currently at 42.70. If the chart pattern is correct, crude may go to the upper trendline of the Flag near 52.50 or possibly higher. By doing so, it will have cleaned a lot of weak hands who are short WTIC.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.