UK Footsie Bulls Set To Foot The Bill

Stock-Markets / Stock Markets 2015 Nov 21, 2015 - 12:15 PM GMTBy: Austin_Galt

The UK stock index, the Footsie, has been trending down textbook style ever since the all time high set at 7122 in April 2015. This current rally has all the hallmarks of yet another bear market rally with many starting to become bullish.

The UK stock index, the Footsie, has been trending down textbook style ever since the all time high set at 7122 in April 2015. This current rally has all the hallmarks of yet another bear market rally with many starting to become bullish.

Let's see what is in store for these bulls if my analysis of the daily and monthly charts is correct.

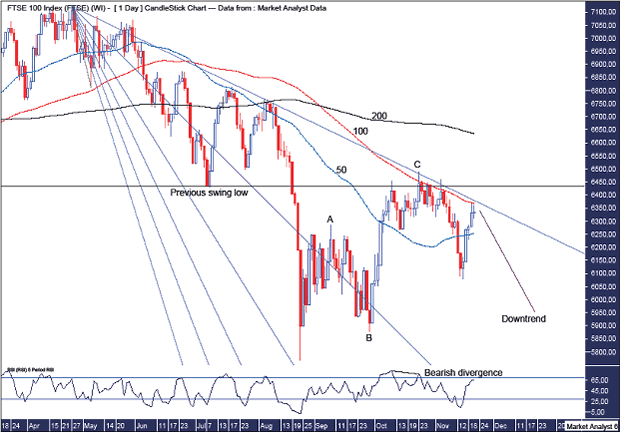

Footsie Daily Chart

We can clearly see the pattern of lower lows and lower highs indicating a bear trend. The rally since the August 2015 low looks to have taken the form of an ABC corrective pattern.

The wave C high was accompanied by a bearish divergence on the RSI which is always nice to see.

I have drawn a horizontal line which denotes a previous swing low. Old lows often provide resistance in the future and once again this looks to be the case with the recent high nudging this level but unable to overcome it authoritatively.

I have drawn a Fibonacci Fan from the all time high to the first low after that high. The wave C high was bang on resistance from the 88.6% angle which also proved too formidable for previous rallies.

I have added moving averages with time periods of 50 (blue), 100 (red) and 200 (black). These are all in bearish formation so it is all systems go for the bears if that is what is desired.

As often happens after moving averages make bearish crossovers is that price soon after rallies to put in the next bear rally high. In this case, the first bearish crossover was the blue line crossing below the red line. Soon after, price rallied back to the blue line where resistance came in.

The next bearish crossover was the blue line crossing below the black line and soon after price rallied back to the black line where resistance came in.

The last bearish crossover was the red line crossing below the black line and soon after price rallied and has been finding resistance at the red line. I am viewing that as the next bear market rally high.

Let's now move on to the bigger picture with the monthly chart.

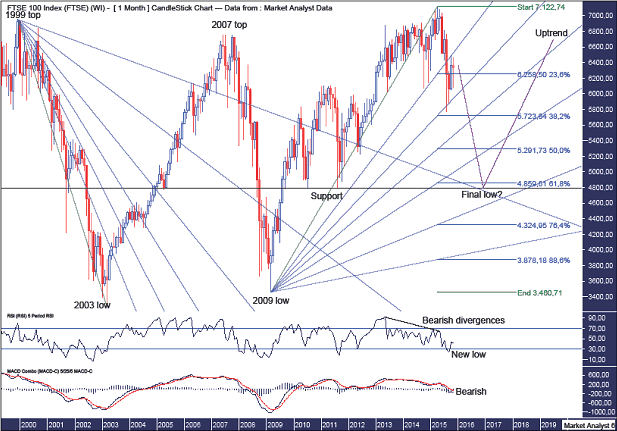

Footsie Monthly Chart

The RSI shows multiple bearish divergences setting up at the final high while the a new low accompanied the August 2015 price low which is a bearish sign in that the final low is generally accompanied by at least one bullish divergence.

The MACD indicator is bearish and I see no reason to bet against it.

We can see the massive triple top comprising the 1999, 2007 and 2015 tops. The 2007 top set up a double top and we saw a big reaction down in response. The 2015 top has set up the triple top however the reaction down of triple tops is generally so nearly as severe as that off double tops. Megabears may want to keep this in mind.

I have drawn a horizontal line which denotes support from previous swing lows at 4790 and this is more or less where I am targeting the current bear market to terminate. After that the uptrend should resume and see price trade to new all time highs in the years ahead.

I have added Fibonacci retracement levels of the move up from 2009 low to all time high and I am targeting price to clip the 61.8% level which stands at 4859. This is convenientky just above the horizontal line.

I have drawn two Fibonacci Fans. The bullish fan shows price finding support at the 38.2% angle in August 2015 before price rallied back and looks to have found resistance at the 23.6% angle. I now expect the downtrend to resumes as price makes its way through the angles which represent support and then resistance.

The bearish fan is drawn from the 1999 top to the 2003 low and I am targeting the final low to be around support from the 88.6% angle which looks set to intersect with the horizontal line in late 2016 so that is some potential timing for the final low.

So, the way I see it, the bears are out of their lairs and it will be the bulls that end up footing the bill over the next year.

By Austin Galt

Austin Galt is The Voodoo Analyst. I have studied charts for over 20 years and am currently a private trader. Several years ago I worked as a licensed advisor with a well known Australian stock broker. While there was an abundance of fundamental analysts, there seemed to be a dearth of technical analysts. My aim here is to provide my view of technical analysis that is both intriguing and misunderstood by many. I like to refer to it as the black magic of stock market analysis.

Email - info@thevoodooanalyst.com

© 2015 Copyright The Voodoo Analyst - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Austin Galt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.