US Downward Economic Spiral in Employment Market

Economics / US Economy Jul 02, 2008 - 02:53 PM GMTBy: Mike_Shedlock

The New York Times is reporting Deepening Cycle of Job Loss Seen Lasting Into '09 .

Plummeting home prices have in recent months eliminated jobs for hundreds of thousands of people, from bankers and real estate agents to construction workers and furniture manufacturers.

The New York Times is reporting Deepening Cycle of Job Loss Seen Lasting Into '09 .

Plummeting home prices have in recent months eliminated jobs for hundreds of thousands of people, from bankers and real estate agents to construction workers and furniture manufacturers.

“The labor market is clearly deteriorating, and it's highly likely to keep deteriorating,” said Andrew Tilton, an economist at Goldman Sachs. “It's clear that the housing downturn and credit crunch are still very much under way. Clearly, there are more jobs to be lost in housing, finance and construction — hundreds of thousands of more jobs to be lost collectively.”

Recent indications lend credence to the view that the job market is in the grip of a sustained downturn. Three weeks in a row, new unemployment claims have exceeded 380,000, a level generally associated with recession. Construction spending fell in May. The University of Michigan Consumer Sentiment Survey, which tracks attitudes about business and personal finance, has dropped to a depth last seen in 1980.

With job losses growing and working hours shrinking, many paychecks are eroding, prompting millions of families to cut their spending. Soaring prices for food and gasoline are overwhelming modest wage gains for most workers, leaving households with even less money to spend. All of which deprives struggling businesses of sales, prompting them to shed more workers, sending the cycle down another turn.

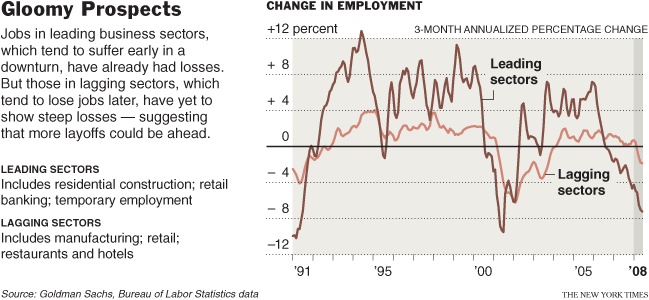

Downward Spiral In Jobs

This is how downward spirals start, ant it was entirely predictable. Commercial real estate follows residential with a lag. Now that retail stores and restaurants are cutting back, it is finally dawning on mainstream media that the Shopping Center Economic Model Is History .

I have been asking for well over a year "Where is the driver for jobs once Walmart (WMT), Target (TGT), Pizza Hut (YUM), and Starbucks (SBUX) stop aggressively expanding?" The answer, which I knew, was "Nowhere".

ADP Small Business Report

The only bright spot in the economy has been small businesses. Now, even the ADP Small Business Report shows the last bastion of overall strength on the verge of contraction.

ADP Employment Forecast By Size Of Firm

The above chart tells the story of weakening small business employment. Service providing small businesses are still doing OK, but in aggregate, small business employment is barely expanding. Medium and large businesses are nothing short of a disaster.

Add it all up and things look bleak. ADP forecasts another 79,000 jobs will be lost in June.

Job Growth Timeline

The above chart shows how small businesses have been leading the economic expansion since 2002. Small business employment will soon be contracting in my estimation.

By the way there have been a number of what one might call "huge misses" of ADP job totals vs. the BLS reports that come out the first Friday of every month (Thursday this month because of the holiday).

Note however, that ADP is based on actual job data, while the unemployment numbers from the BLS are distorted by the infamous Birth/Death Adjustment series. I recently talked about the BLS Black Box and Birth/Death Adjustments in May Jobs: Unemployment Skyrockets to 5.5% .

It is hard to say who is missing and who isn't, and it is likely both are. No models are perfect. ADP does seem to be in catch-up mode at the moment, which is a bit hard to swallow given the nearly insane upward bias in in the Birth/Death Adjustment series. The important point now is that both the ADP and BLS models are showing a contraction in jobs. One thing is sure: The small business series is going to be interesting to watch going forward.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.