SPX Probing at the 200-day Moving Average

Stock-Markets / Stock Markets 2015 Nov 17, 2015 - 02:58 PM GMT SPX ramped above the Broadening Top lower trendline in the final hour of yesterday’s session. The SPX Premarket is up about 5 points as I write, but still beneath its ultimate resistances, the daily mid-Cycle resistance at 2061.97 and the 200-day Moving Average at 2064.38.

SPX ramped above the Broadening Top lower trendline in the final hour of yesterday’s session. The SPX Premarket is up about 5 points as I write, but still beneath its ultimate resistances, the daily mid-Cycle resistance at 2061.97 and the 200-day Moving Average at 2064.38.

Today and tomorrow are both Pivot days. Tomorrow is the stronger one. I had originally surmised that tomorrow would be a low with a ramp into options expiration. The timing of this retracement changes things, with potentially devastating consequences. A decline through options expiration would certainly magnify the volatility during such an event.

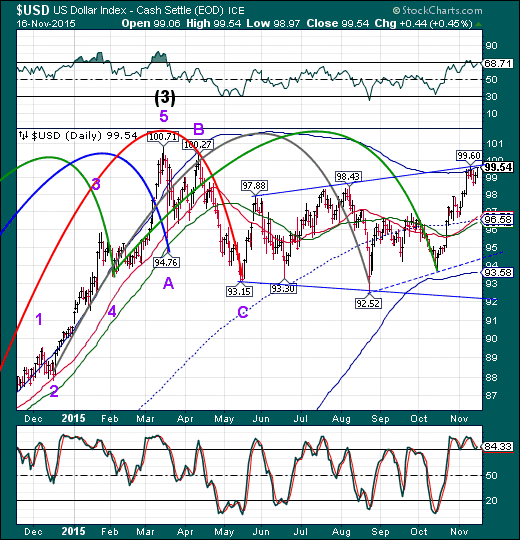

Part of the reason for the move higher in stocks is the USD pushed to 99.77 this morning. This final probe was needed to complete the a-b-c pattern before allowing USD to decline back to its Cycle Bottom or lower by the end of the month. This may be a panic phase that implies some event happening on our soil or against our citizens overseas. ZeroHedge reports, “The kneejerk shock from this weekend's Paris terrorism, which briefly pushed S&P futures below 2000, is now a distant memory, and has been replaced with another breathless, violent rally for the second day in a row, which has seen global stocks surge after yesterday's lackluster performance before the S&P500 soared in afternoon trading, and this morning US equity futures launched another push higher the moment Europe opened for trading, just like a day earlier, begging the question just which central bank is pushing this scramble to buy ES futures.”

VIX is beneath its 50-day Moving Average at 18.97, but above mid-Cycle support at 16.36. The retracement appears complete, or nearly so. It remains on a sell signal for SPX.

The NYSE Hi-Lo Index remains on a sell signal.

TNX is also in a retracement that may be nearing completion. When it is complete, it may precede the turn in stocks.

All the best,

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.