Deflation and the Devaluation Derby - A Closer Look at All Those New U.S. Jobs

Economics / Deflation Nov 13, 2015 - 04:54 AM GMTBy: EWI

U.S. labor force participation rate is at its lowest level in 38 years

U.S. labor force participation rate is at its lowest level in 38 years

Editor's note: You'll find a text version of the story below the video.

I was in the café of a bookstore recently and overheard a young man tell his friend, "It's hard to get a job these days, even with a degree."

Of course, this was just one comment, and anecdotes are not a substitute for statistics.

But much of the talk about the U.S. job market is that it's far less robust than it use to be, despite a steady improvement in the official jobless rate since the Great Recession high of 10.0% in October 2009. This October, the official unemployment rate was 5%.

In truth, the real jobless rate would be 9.8% if those who have given up looking for work and part-timers who want a full-time job were included.

The labor force participation rate is at its lowest level in 38 years.

This Federal Reserve chart (November 6) shows that only 62.4% of working-age Americans are employed or looking for work:

A record 94,610,000 Americans were not in the workforce in September. But the questionable health of the U.S. labor market doesn't stop here.

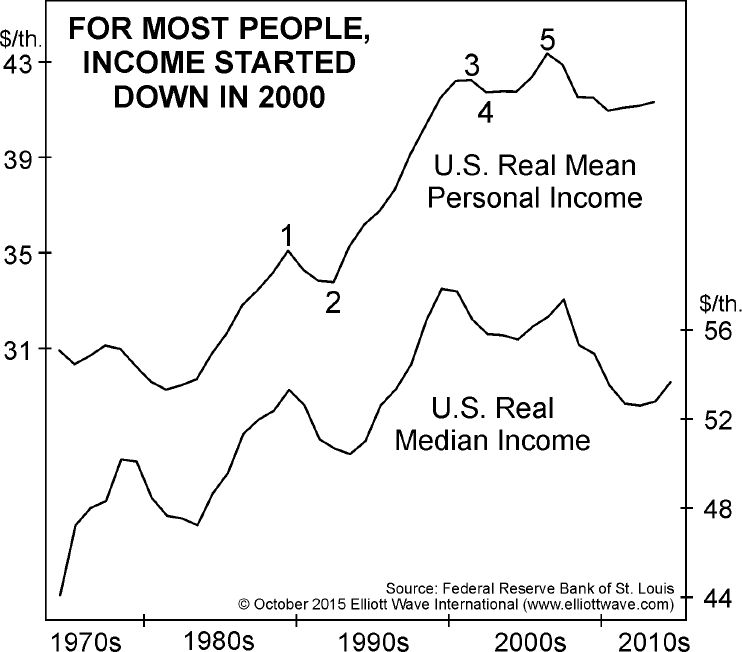

Even those who are working are struggling to make headway. This chart and commentary from our October Elliott Wave Financial Forecast explains:

The mean measure of U.S. personal income peaked in 2006. The median measure shows that half of U.S. citizens are earning less money in real terms than they were in 2000. The five-wave form of the rise in mean income is further Elliott wave evidence that the decline is about to accelerate.

And what about the 2.95 million new jobs that were created in 2014, and the slightly more than 2 million so far in 2015?

The numbers sound impressive until you dig deeper. This is from the Atlantic magazine (September 4):

According to new research, between 2009 and 2014, wage loss across all jobs averaged 4 percent. But for those in the bottom quintile, those losses averaged 5.7 percent. ... The [jobs] where declines in real wages have been the most acute -- are also the jobs that have hired the highest share of new workers during the recovery.

It's true that average hourly earnings increased by nine cents in October. Even so, the point is that many of the new jobs in the U.S. have been at the lower end of the income brackets.

Also consider that in September, the U.S. Consumer Price Index fell 0.2% and that the Producer Price Index declined by 0.5%.

All told, our stance remains that deflation is knocking at the door.

Get the full picture of what we see as a worldwide deflationary trend in our new report, Deflation and the Devaluation Derby.

Here's what you will learn:

- Currency devaluation's role in the developing global crisis

- How the self-reinforcing aspect of deflation is already apparent in commodities trading

- Why the top 1% of earners are in for a rude awakening

- How Europe's biggest economies are screeching to a halt

- The hair-raising future for U.S. stocks

Just recall how swiftly the 2007-2009 financial crisis unfolded. We anticipate that the next global financial crisis could be even more sudden and severe.

Prepare now with our new report, Deflation and the Devaluation Derby. CLICK TO CONTINUE READING >>

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.