Why Are Gold Stocks So Cheap? – Down Under

Commodities / Gold & Silver Stocks Jul 02, 2008 - 02:30 AM GMTBy: Neil_Charnock

The Mid and small sized Australian resource stocks have been sold down to unrealistic levels – scary to even some sophisticated investors who have contacted me lately. As mentioned by one – “becoming irrational cheap, as if they go bankrupt”. This article examines the gold sector Down Under, with emphasis on the producers and emerging producers, and exposes an area of value possibly greater than any market currently on offer.

The Mid and small sized Australian resource stocks have been sold down to unrealistic levels – scary to even some sophisticated investors who have contacted me lately. As mentioned by one – “becoming irrational cheap, as if they go bankrupt”. This article examines the gold sector Down Under, with emphasis on the producers and emerging producers, and exposes an area of value possibly greater than any market currently on offer.

Clearly the savage correction in the Chinese Shanghai Index has made investors question the ongoing resource boom – a fall from a high of 6124 on October 16 last year to 2651 on July 2 this year (yesterday as I write) is no small deal. Incidentally I can see an interesting short term RSI price divergence in that chart (not shown) which may indicate a bottom is not far below this level – there is also a possible neckline support not far below. Time will tell. I digress - growth figures and development in China are both robust to say the least.

Clearly credit conditions are much tighter due to significant losses throughout the global financial industry – qualification for loans is much tougher now. Therefore obtaining a loan for development purposes is much more difficult now that risk is again priced into the financial systems operational basis.

Therefore I currently consider companies with healthy balance sheets (or at minimum cash flow from production and completed mining infrastructure in place) to represent safer investment opportunity. Only the robust and more outstanding development projects will attract the capital they require in these conditions – marginal projects will be shelved.

I can understand the correction and pullback in resource stocks and to lesser degree the gold miners. I understand that share prices oscillate between overbought and oversold extremes. What does not compute here is the current valuation of healthy gold producing companies as compared to gold and silver prices which are both in bull markets. The dislocation between large and smaller producers is also an anomaly.

Margin lending debacles and unwinding of leveraged stock positions are part of the cause, along with selling for the sake of selling based on lousy sentiment but that does not mean it makes sense and that prices will not rebound to more realistic levels once sentiment changes.

Is Bankruptcy possible?

Back to my sophisticated investor friends comment - this asks the question – are they going bankrupt? Large resource companies have fared much better showing the underlying strength of resource demand. So why are the ASX emerging gold companies and mid sized producers so cheap?

Firstly let us examine the question of bankruptcy – is this possible? Large scale low grade mines will show some distress in their balance sheets at the next reporting period because diesel is a significant cost in moving all that dirt and rock. Companies that shift their ore over long distances will also register higher costs. Therefore bulk low grade operations that operate in the higher quartile cost range will be under pressure. Any of these companies with high debt levels and or hedge books under water would be under great duress.

Other areas of increasing cost pressures have slowed including interests rates and wages growth. The Australian dollar has consolidated and may be forming a large rising wedge pattern – in any case commodities are still strong thanks to robust demand and constrained growth of supply. This is a global phenomena caused by rising living standards across Asia .

Most large deposits mined in bulk tend to be lower cost however and hedging has been reduced significantly during the last two – three years by large and small operators alike. This has been a global factor as well thanks to rising gold prices and Australia has been a party to this trend with most of our miners reducing or eliminating hedge books in recent times.

The attractive opportunities have a signature

There is of course another category to look at here that will not be “going to the wall” (bankruptcy) any time soon either. Underground gold miners that mill their high grade ore in close proximity to their mines, are mining at highly viable price levels. They shift lower quantities of ore so their costs are not greatly influenced by rising oil costs.

One CFO (Chief Financial Officer of a high grade underground gold operation) I spoke to recently confirmed that their diesel cost represented only 4% of their mining costs at the inflated fuel price levels confirming this point. I provide links to analysis on two gold stocks at the bottom of this article which fit this description and there are many more. I am talking about listed companies with significant infrastructure assets and resource inventories.

Gold has stayed strong in AUD terms with the current price at $AUD962.87 as I write this piece – silver is trading at $AUD18.26. Mining margins are robust at these levels for most mines – where debt levels are low it is hard to imagine these companies going bankrupt.

I am growing more confident that we are seeing the bottom now in many ASX resource and PM stocks and that market sentiment is reaching its own agonising bottom at the same time. I could not say the same for other market sectors even after heavy corrections – earnings will continue to drop as disposable incomes drop and this will bite into discretionary spending.

Credit contraction (global) will continue to bite into financials and various sectors. This will still weigh on the precious metal stocks that need to raise capital forcing a prolonged bottom process over the coming months. Yet, just like in Canada recently, the odd stock in Australia is beginning to rally from over sold levels based on company news and fundamentals – these are the current opportunity.

There is tremendous leverage at this level – I am picking off highly oversold stocks and pulling profits which are taken before I reinvest in the next play. Of course oil stocks have been fun and gas from coal has paid off in strong share runs. Australia has been in tax loss selling to the end of June and has been presenting delicious pickings in this climate at this time.

Offshore investors have the exchange rate to consider and I leave this evaluation up to you. Should the Aussie dollar turn down then it is in the interests of offshore investors to hold off until we see corrections to the down side – this would offer a potential currency gain as an additional bonus.

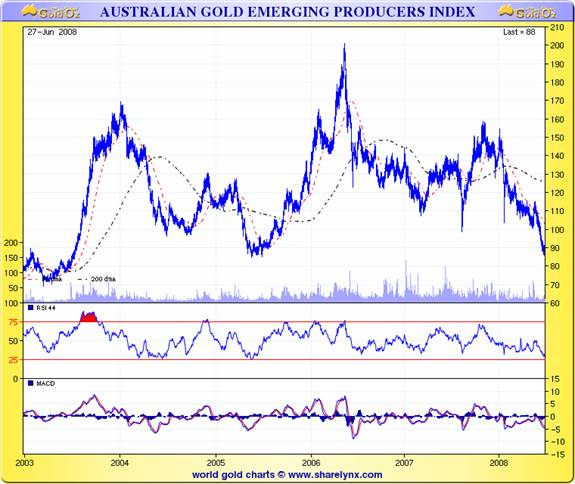

What about the base metal resource sector and related stocks? Again - I personally believe we will now grind along during a multi-week (a few months perhaps) bottom process and I look to the technicals for guidance at this time because the fundamentals are vastly out of whack. I say this because I see companies selling far below real asset levels (replacement cost) and in some cases below cash levels – I have not seen this since 2001. Here is a chart of our emerging gold producers confirming vastly oversold levels – especially when one considers the high gold price.

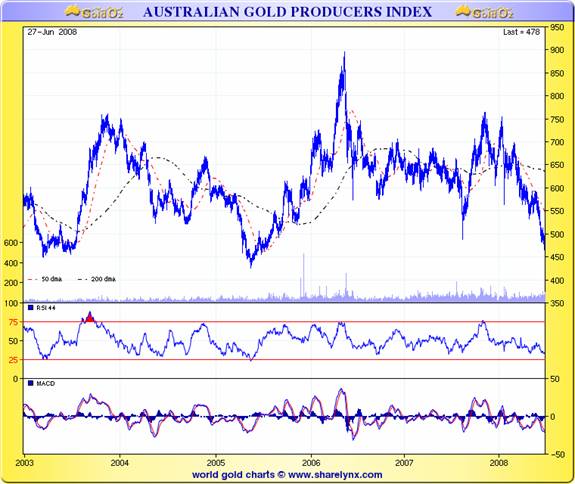

Junior gold explorers have been treated with the same disrespect due to poor investor sentiment. Because the juniors tend to follow last in a trend reversal I shall be concentrating on opportunities on a company specific nature in the emerging producers and producers categories. It is worth a look at the Producers chart below as well to get the picture on price levels and this should be viewed against a strong AUD gold price environment.

There you have it – thanks to our friends at Sharelynx.com – thanks Nick. The pictures above display my story visually and these charts (plus one on the junior gold stocks) get updated daily in my web site on a free page titled Gold Index Charts and these charts are not available via the ASX – many more are available for reasonable cost at Nicks site.

Now back to the gold and diversified resource equities Down Under. Why will they be any different when equities are out of favour and we have seen nothing but down side so far during these conditions? Let's keep it simple so as not to confuse things.

Big Picture Again – Update: Despite efforts to cool the overheating economy, the officially recorded Chinese GDP growth rate was 11.4% in 2007. This has been revised up even in the face of the US slow down. The China story will not die despite the economic slump in the USA and despite their inflation concerns. The other emerging economies and the resource economies will continue to boom or at minimum do well as a result.

They have been and are gradually becoming more independent from the USA because they have increasing internal demand and increasing trade with each other. The banking industry has world wide reach and can only grow via debt growth in Asia – without major wages growth in the West we are basically tapped out. Can the “disinterest in credit” culture be changed in the East in order to perpetuate global monetary growth? I think so because it fits with human nature to want more.

Masters like Jim Rogers, the investment guru, have taken great interest in China , Jim apparently even moved to Hong Kong to get close to the action and therefore takes a longer term view that this will continue. Money is being added to the system at an alarming rate which offers opportunity.

From late 2007 to up until now we see equities viewed as a high risk asset class along with real estate and get hammered on mass. Capital flows poured into gold and bonds and cash. Real estate continues to look weak however some resource and many precious metal equities are showing signs of hope. The hope is we have reached rock bottom and are carving massive base formations in these companies. Examples of emerging underground gold operators are provided below.

Good trading / investing.

Regards,

Neil Charnock

Links to gold reviews:

http://www.goldoz.com.au/fileadmin/goldoz/editorials/CTO_Editorial.pdf

http://www.goldoz.com.au/fileadmin/goldoz/editorials/Focus_Minerals_Editorial.pdf

GoldOz is currently developing a Member area and building further resources for free usage.

Copyright 20078 Neil Charnock. All Rights Reserved.

REGISTERED ADVISOR – WHO THE ADVICE COMES FROM IN THE GOLDOZ NEWSLETTER: Colin Emery is currently a Branch Manger and Senior Client Adviser of a Stock Broking Company in Queensland Australia. Prior to his work in Share broking he spent nearly 20 years in Senior Management and Trading positions in Treasuries for major International Banks such as Bank Of America, Banque Indosuez, Barclays Bank, Bank Of Tokyo and Deutsche Bank AG. He spent a number of years as a Senior trader in New York , London , Singapore , Tokyo and Hong Kong with these institutions. He also was Global Head of emerging energy, emission and commodity products for the leading Energy and Commodities brokerage firm of Prebon Yamane Ltd – Prebon Energy for four years before moving to Cairns in 2003 to focus on the Stock market and Private consulting work. The private consulting and advisory work currently undertaken is with companies involved in Resources, Energy and Renewable Energy and Forestry.

Neil Charnock is not a registered investment advisor. He is a private investor who, in addition to his essay publication offerings, has now assembled a highly experienced panel to assist in the presentation of various research information services. The opinions and statements made in the above publication are the result of extensive research and are believed to be accurate and from reliable sources. The contents are my current opinion only, further more conditions may cause my opinions to change without notice. The insights herein published are made solely for international and educational purposes. The contents in this publication are not to be construed as solicitation or recommendation to be used for formulation of investment decisions in any type of market whatsoever. WARNING share market investment or speculation is a high risk activity. Investors enter such activity at their own risk and must conduct their own due diligence to research and verify all aspects of any investment decision, if necessary seeking competent professional assistance.

Neil Charnock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.