Is Japan's Wicked Economic Winter Almost Over?

Economics / Japan Economy Nov 09, 2015 - 07:34 PM GMTBy: EWI

Economic blossoms may bloom again in the Land of the Rising Sun

Economic blossoms may bloom again in the Land of the Rising Sun

The winter season is a common metaphor for a bleak period in someone's life: Borrowing a line from Shakespeare, John Steinbeck titled his final novel "The Winter of Our Discontent."

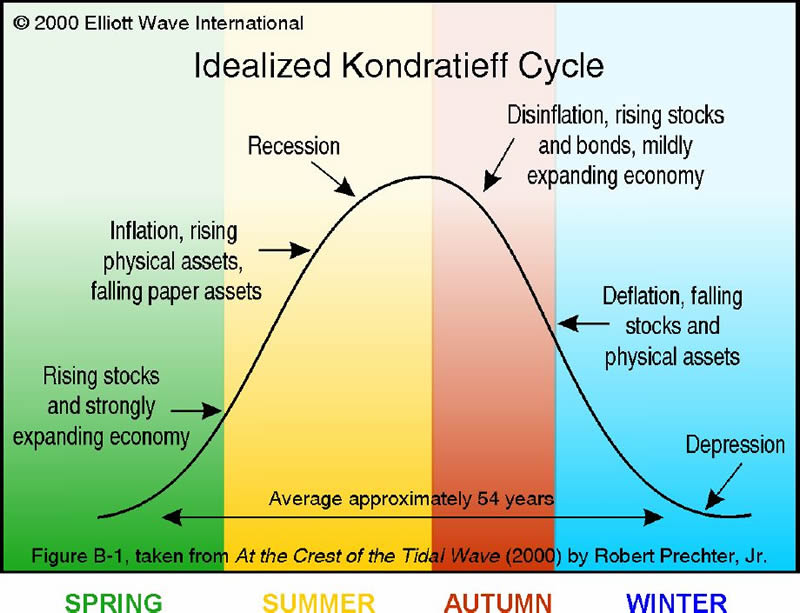

Nikolai Kondratieff used "winter" to describe the worst part of an economic cycle. Indeed, the famous Russian economist used all four seasons as metaphors for the four natural phases of expansion and contraction that an economy goes through in 50 or 60 years.

Take a look at this chart:

Japan's economy has gone through a very long winter. The nation has experienced deflation for most of the past 25 years.

Here's a September 25 Financial Times headline:

Japan falls back into deflation for first time since 2013

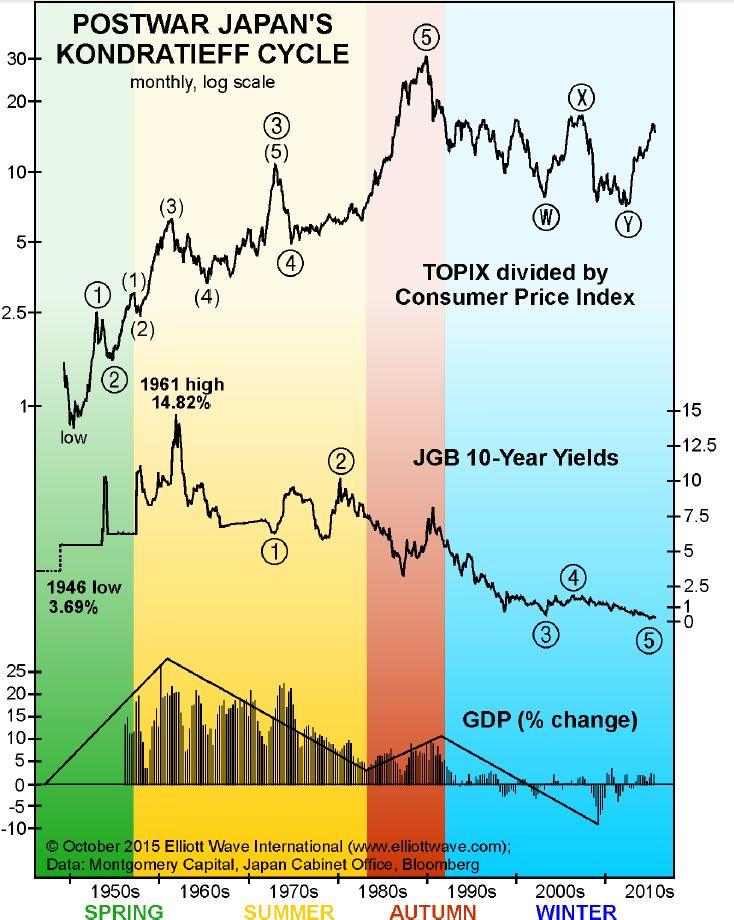

But a change of seasons may be closer than many observers realize. Review this chart and commentary excerpted from a Special Report by Mark Galasiewski in the October issue of Elliott Wave International's monthly Global Market Perspective:

Let's see how that [Kondratieff] template has applied to Japan since the low in Japanese interest rates in 1946.

This chart shows three markers of the Japanese economy. At the top is the inflation-adjusted TOPIX. In the middle is the chart of 10-year JGB yields, showing the 1946 low at 3.69% and the 1961 high near 15%, followed by the long five-wave decline through to the present. At the bottom is the year-over-year percentage change in Japan's GDP.

... Japan's Spring lasted from the end of the Pacific War to the late 1950s. ... Japan's Summer extended from the late 1950s to the early 1980s. Japan's so-called bubble economy of the late 1980s and early 1990s was its Autumn. ... Finally, Japan's Winter lasted more than 20 years.

We conclude from the data that Japan is in the process of ending a Kondratieff Winter and is beginning a Kondratieff Spring ... .

Is this sleeping giant ready to offer opportunities for investors?

You can learn now in a new free report from Elliott Wave International, 3 Reasons to Get Excited About Japanese Stocks.

You'll get Galasiewski's Special Section on Japan, as presented to Elliott Wave International subscribers in Global Market Perspective.

Access your free report now >>

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.