Retired Investors: Apply a Value Investing Strategy and Earn More Income and Higher Returns

Companies / Investing 2015 Nov 09, 2015 - 07:23 PM GMT Value investing produces safe, powerful long-term results, but it is often misunderstood. This is why most of the greatest investors that have ever lived have employed some form of value investing as an integral part of their overall stock investing strategy. However, the term, concept or strategy called value investing does not necessarily universally apply. Like many financial terms and concepts, there are many nuances that pertain to the general concept of investing for value in common stocks.

Value investing produces safe, powerful long-term results, but it is often misunderstood. This is why most of the greatest investors that have ever lived have employed some form of value investing as an integral part of their overall stock investing strategy. However, the term, concept or strategy called value investing does not necessarily universally apply. Like many financial terms and concepts, there are many nuances that pertain to the general concept of investing for value in common stocks.

On the other hand, there is some common ground that theoretically applies to all value investing approaches. At the core, value investors are looking for investment opportunities in companies that they believe the market is currently undervaluing. Additionally, most value investing strategies are attempting to exploit disconnects that occasionally occur between a company’s stock price and its true underlying fundamental value.

This article will present value investing strategies that apply primarily to investing in dividend growth stocks. Although all value investing implies investing in a business below its true worth, the calculation of fair value can differ significantly between various types of common stocks. For example, a fast-growing true growth stock will command a different level of fair valuation than a slower growing dividend paying company. Although the underlying principle of value applies to both, the calculation of fair value will be materially different.

Successful Value Investing Requires a Long-Term View

An important attribute shared by most value investing approaches is the rational perspective of taking a long-term view. This is critically important, because it is all too common that undervalued common stock investments do not tend to perform well over the short run. This is simply because, as a general rule, you will not find undervalued investment opportunities in popular stocks (companies). Common sense dictates that stocks only tend to become undervalued when they are simultaneously unpopular, at least temporarily. It is generally this unpopularity that creates the short-term discrepancy between fundamental value and stock price.

However, the greatest success derived from value investing happens when the company’s stock price is dropping even when the fundamentals of the company continue to remain strong. Therefore, the key to implementing a profitable value investing transaction is to learn to focus on and trust the fundamentals supporting the business. In the same context, this further means adopting the conviction to not trust, and even the willingness to ignore poor short-term price action. Accomplished value investors understand that stock prices can lie, at least over the short run. But more importantly, accomplished value investors also understand that in the long run, fundamentals matter most.

Consequently, successful value investing requires a level of patience that unfortunately many short-term oriented investors do not possess. However, the rewards from investing in a truly undervalued stock can produce powerful long-term returns for the rational value investor who is capable of engaging in intelligent patience. But even better yet, those powerful long-term returns are generated at reduced levels of risk relative to other common stock investing strategies.

On the other hand, value investing does not eliminate all the risk or risks associated with common stock investing. But, if engaged in properly, value investing does significantly mitigate or reduce the risks to a more than acceptable level. Importantly, this last point also applies to investing in the same individual stock at different levels of valuation. In other words, if you overpay for even the best company, you thereby add a level of risk that is not innate to the fundamental strength of the business itself. In contrast, by investing in the same company when it is undervalued will reduce the risk of owning it, and simultaneously add a turbo-charger of sorts to your future long-term results.

The turbo-charger I am alluding to refers to the tendency of stock prices that have disconnected from fundamental value to inevitably move back to alignment with intrinsic value in the long run. In other words, when a stock is overvalued, it will inevitably move back into alignment with its fundamental value. Unfortunately, the precise timing of that movement is unpredictable, and can take longer than many people expect. This principle can cause investors in overvalued stocks to lose capital long-term, even when the company remains fundamentally strong.

In contrast, when a stock is undervalued, it will also inevitably move back into alignment with its true worth in the long run. Again, the precise timing is unpredictable and can even take longer than many investors are willing to tolerate. Regardless, the value investor not only receives financial rewards from the fundamental strength and/or growth produced by the company’s business results, they also receive accelerated rewards from future P/E ratio expansion.

Value Investors Care Deeply about Capital Appreciation and Total Return

There is a great misconception and even criticism that alleges that value investors do not care about capital appreciation or total return. Although it is true that accomplished value investors will ignore short-term price volatility (losses), this does not mean that they don’t care about making a profit. On the other hand, it does mean that they do not worry very much about short-term price volatility, but only when they have determined through research that it is unjustified.

Accomplished value investors understand that long-term investment results are functionally related to the success of the business behind the stock. Therefore, they focus more on fundamentals such as earnings, cash flows and dividends (if the company pays one). As long as fundamentals are strong, they are confident that this strength will eventually be reflected in higher future stock values. Frankly, I have never seen a situation where that confidence was not justified in the long run, as long as fundamentals remain intact.

In summary, value investors care deeply about capital appreciation and total return. However, they are willing to wait patiently for it to happen as long as the fundamentals of the company they purchase remain solid, and better yet - continue to grow. But perhaps more to the point, value investors are not expecting poor long-term returns when they invest in an undervalued stock, quite the contrary. Value investors expect outsized long-term returns resulting from purchasing a stock at a bargain valuation. But best of all, they will get them as long as they are patient enough.

Northrop Grumman Corporation (NOC) a Classic Example of Patience Rewarded

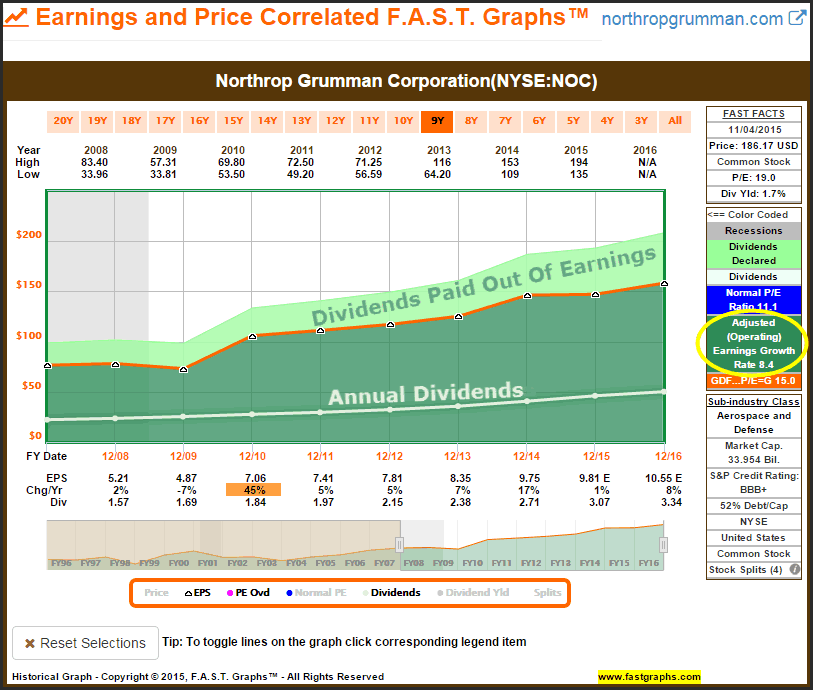

The following F.A.S.T. Graphs™ looks at Northrop Grumman based on the important fundamentals earnings and dividends only since 2008. Just as it was for most publicly traded US corporations, Northrop Grumman produced a down earnings year in 2009 (The Great Recession). However, it’s important to point out a few critical factors. First, the company was not losing money , in fact, remained highly profitable. Second, they remained profitable enough for management to have the confidence to raise their dividend by 8% in 2009.

Additionally, a weak 2009 lead to an incredibly strong 2010 where earnings growth recovered 45% off of 2009’s low. From there, forward earnings growth for the next few years ranged from 5% to 7%. However, the Budget Control Act of 2011 included slashing our country’s defense budget. As I will illustrate in the next graphic, this generated a high level of pessimism about publicly traded companies in the defense industry’s future.

Northrop Grumman Corp Earnings and Dividends Only

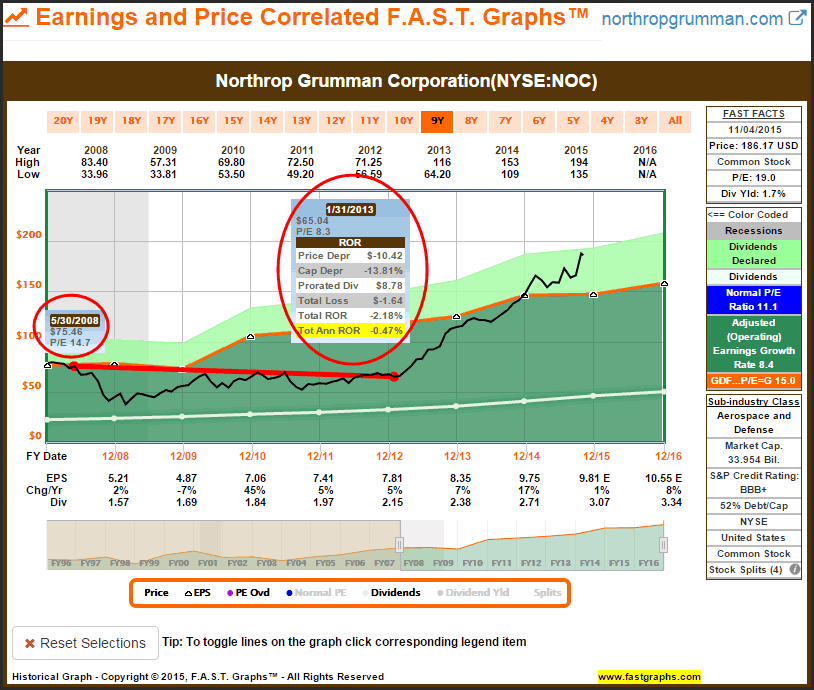

The end result was that the Great Recession followed by fears associated with a cutting of our defense budget lowered Northrop Grumman’s traditional P/E ratio valuation of 13-15 down to a P/E ratio valuation of 9 or less. But here is where the value investor’s required patience comes into play. Not only did Northrop Grumman’s P/E ratio shrink to 9 or below, it stayed there for more than 4 years running. This happened in spite of the fact that the company continued to produce solid earnings and dividend growth over that time.

Consequently, Northrop Grumman’s shareholders suffered with a $10.42 capital loss (-13.81% capital depreciation) for the period May 30, 2008 to January 31, 2013. I chose May 30, 2008 because it was a time when Northrop Grumman was trading at a fair value P/E ratio of approximately 15 (14.7). However, in concert with continuing earnings growth, Northrop Grumman raised their dividend at a compound average growth rate of approximately 9% over that same timeframe. Therefore, long-term shareholders received $8.78 of dividend income per share that softened the blow of weak price action. Nevertheless, a total annualized rate of return of (-.47%) was clearly disappointing up to that point.

Northrop Grumman 4 Years Weak Price Performance

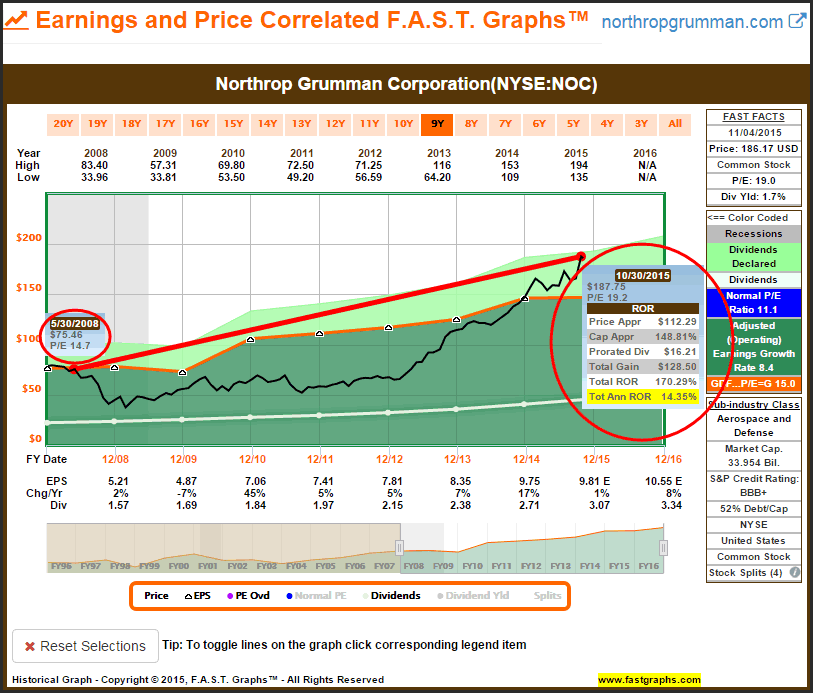

Nevertheless, committed long-term oriented value investors that were focused on fundamentals (earnings and dividends) were eventually rewarded. After long-term Northrop Grumman shareholders suffered through more than 4 years of weak price action, things took a dramatic turn for the better starting in January 2013. From that point to current time, long-term Northrop Grumman shareholders that trusted the company’s continued fundamental strength achieved a total annualized rate of return in excess of 14%. It is interesting to note that long-term Northrop Grumman shareholders also earned total returns that were more than twice the S&P 500 over that same timeframe. Dividend income was also approximately twice that of the S&P 500.

Northrop Grumman Strong Long-Term Total Returns

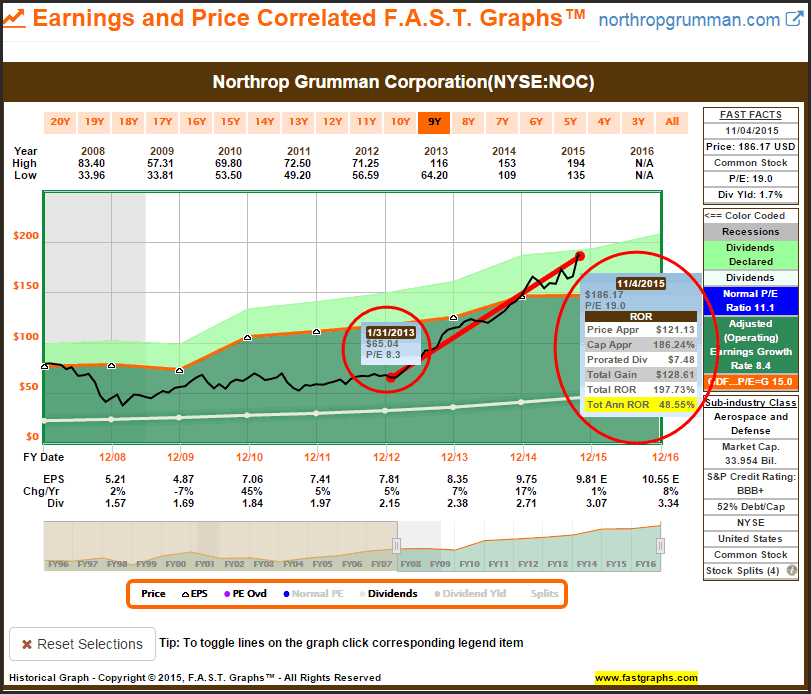

This represents a classic example of the turbo-charging effect I referenced above. Northrop Grumman’s P/E ratio more than doubled from 8.3 on January 31, 2013 to its current blended P/E ratio of approximately 19. Remarkably, Northrop Grumman’s shareholders were rewarded with a total annualized rate of return of 48.55% from January 31, 2013 to November 4, 2015. This accelerated return resulted from the company’s stock price inevitably moving back into alignment with fair value and then beyond. Clearly, patience predicated on the fundamental strength was richly rewarded.

Northrop Grumman Powerful Performance 1/31/2013 to 11/4/2015

Defense Stocks: Undervaluation Resulting from Investor Pessimism

The principle of patience of being rewarded in the long run by investing in fundamentally-healthy undervalued stocks is clearly revealed by what happened with leading companies in the defense industry since The Budget Control Act was passed in 2011. Clearly, investors were fearful that the fortunes of these companies were in dire straits. However, time has proven that those fears were generally overblown.

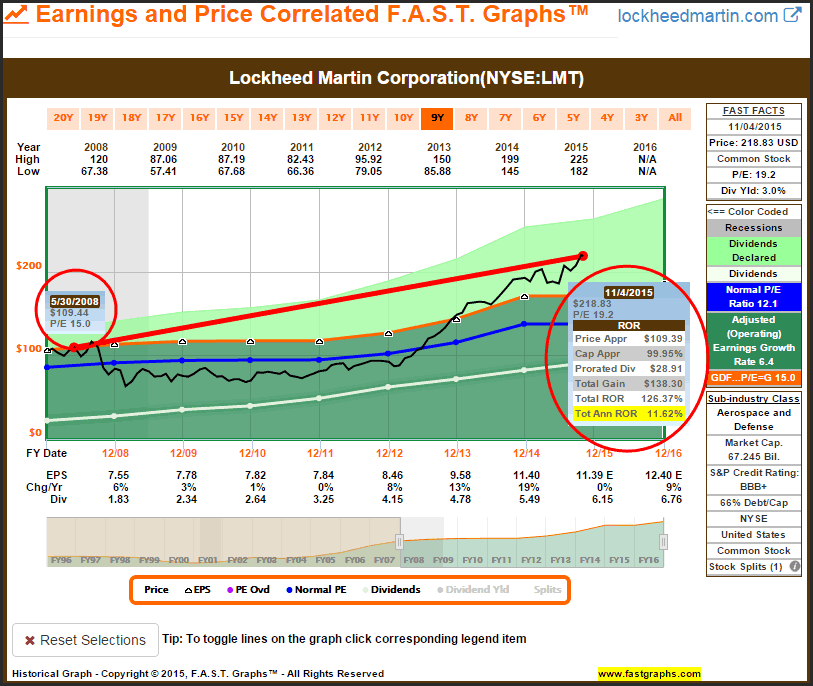

Companies in the defense sector did experience a slowdown in earnings growth since 2011. However, the premiere companies in this sector remained profitable, and most importantly, continued to increase their dividends. Ironically, after suffering through a long period of undervaluation, I do believe that most companies in this sector have gone from deep undervaluation to moderate overvaluation currently. Lockheed Martin Corporation is a second example of the same principles of undervaluation in action as we saw with Northrop Grumman above.

Lockheed Martin (LMT)

Understanding Valuation Bonus: Live Fully Functioning F.A.S.T. Graphs™ on General Dynamics

I consider General Dynamics Corporationoneof the highest quality, if not the highest quality company in the aerospace and defense sector. It has an A+ S&P credit rating and a low debt to capital ratio of 20%. Moreover, the company has raised its dividend for 24 consecutive years placing it one year away from entering the prestigious Dividend Champions status listing prepared by fellow Seeking Alpha author David Fish.

Additionally, General Dynamics represents a quintessential example of how a company’s stock price tracks earnings over the long run. Since this article is focused on both the power and importance of the principle of valuation, I thought it would also be interesting to use it as a teaching tool on how value investing works, and how this principle can be applied to everyday investing strategies. Therefore, as a bonus, I offer the following live fully functioning earnings and price correlated F.A.S.T. Graphs™ on General Dynamics.

In order to get maximum benefit from this exercise, I offer the following tips on how to utilize and navigate the live graph. At the top of the graph there are orange rectangles representing different historical timeframes. For example, you can click on the orange rectangle 10Y and the graph will automatically draw a 10 calendar year graph on General Dynamics. Therefore, you can quickly move from one timeframe to the next and evaluate changes in earnings growth rates and historical normal P/E ratio valuations over each respective timeframe. There is also a scrollbar at the bottom of the graph that allows you to focus on any historical timeframe of your choosing.

At the bottom of the graph there is a long orange rectangle that allows you to take the graph apart or rebuild it by simply clicking on any of the words. For example, if you click on the word “Price,” monthly closing stock prices will be taken off of the graph and you can replace them by simply clicking on the word “Price” again. You can do this with all of the items located in the orange rectangle.

But most importantly as it relates to the thesis of this article (valuation) the graph also has a built-in performance calculation feature. Simply point and click your mouse on any price point on the graph (the black line) until a red dot appears. Then simply move your mouse to any other price point on the graph and click it and a pop-up will appear with the calculation of the performance over the timeframe you chose. To erase the calculation, simply point and click on your second red dot and you will be ready to perform another calculation. Note: all these calculations are based on purchasing and holding one share of the company’s stock.

I suggest that the reader utilizes this calculation function feature in order to evaluate the effects that valuation has on long-term performance. You can measure periods of time from high valuation to low valuation (when price is above the orange valuation reference line), from low valuation (when price is below the orange valuation reference line) to high valuation, etc. As you perform these calculations, notice the effect that various levels of valuation have on long-term performance over time. I hope you have fun performing these various calculation exercises, but more importantly, I hope they reveal and solidify the important effect that valuation has on long-term returns.

General Dynamics Corporation (GD) Live Fully-Functional FAST Graph

The Same Principles Apply to Overvaluation But as a Mirror Image

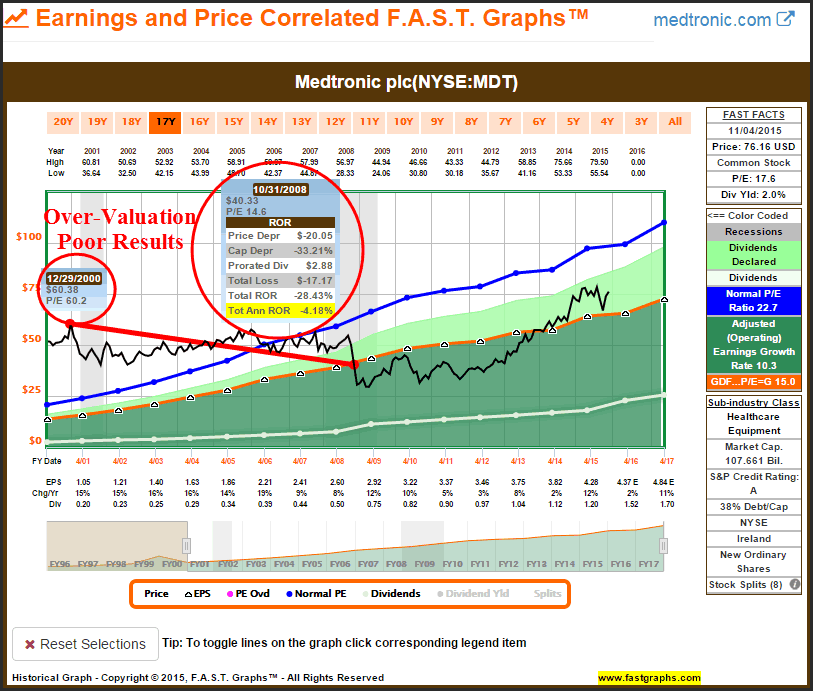

Accomplished value investors possess the discipline to avoid investing in a stock when it’s overvalued, as much or more than they appreciate the opportunity of investing in an undervalued company. The following earnings and price correlated graph on Medtronic illustrates the damaging effect that overvaluation has on long-term returns, even when the company’s operating performance is good. Additionally, a close examination of this example also illustrates how good performance can be when the same company is purchased at more attractive valuation levels.

Medtronic (MDT) Solid Earnings, Overvaluation, Poor Results

Low Valuation Can Reward the Patient Value Investor Even When Fundamentals Are Weak

The principle of investing in a company when it is undervalued is a powerful strategy that can even be rewarding when investing in a weakening company. Although this is not an approach I recommend, as I will soon illustrate, investing in a weak company at attractive valuations supports the power and protection of the value investing strategy. However, before I do I would like to support and share some wisdom from legendary value investor Warren Buffett:

“It is far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

The point is that value investing works best when you do in fact get the opportunity of finding a wonderful company at a substantial discount to its intrinsic value. This principle applies to the examples I previously cited above. However, with that said, you can in fact buy a fair company at a wonderful price and not lose money over the long run. Moreover, if valuation is low enough, you can even generate reasonably positive long-term returns.

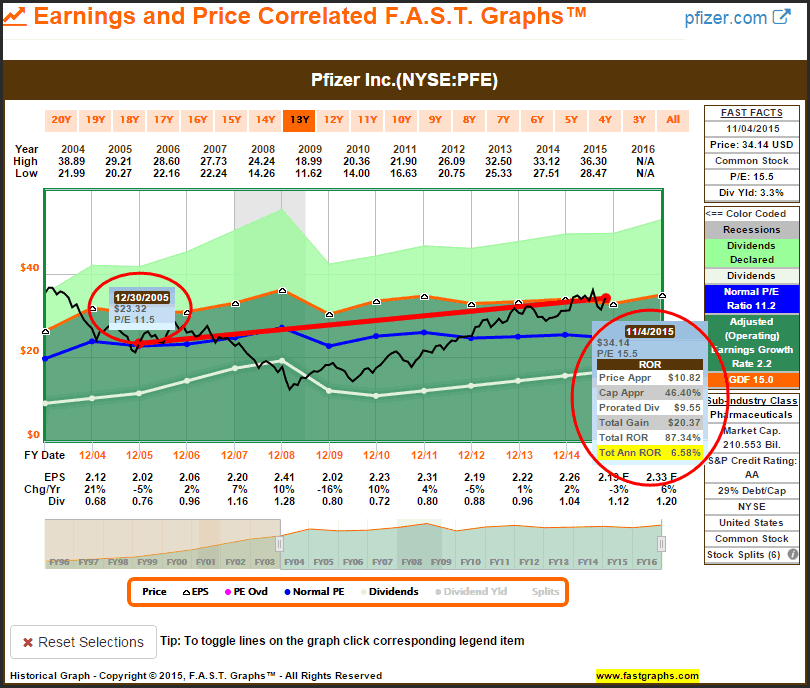

The pharmaceutical giant Pfizer Inc represents a case in point. After achieving significant growth, and a ridiculous level of overvaluation on its stock price up to 2004, the company entered a period of sustained low earnings growth rates. Since 2004 Pfizer has remained profitable, but has only been capable of growing earnings at the rather mediocre rate of 2.2% per annum. Consequently, Pfizer’s share price fell approximately 60% by the end of February 2009. However, positive albeit weak earnings performance drove their stock price and its valuation to unjustified low levels. On February 27, 2009, Pfizer shares were trading at a mere P/E ratio of 5.2.

However, for the conservative dividend growth investor, especially those in retirement, matters became even worse. In 2009, Pfizer cut their dividend by 38% from $1.28 per share to $.80 per share, and followed that with an additional 10% cut in 2010 from $.80 per share to $.72. A dividend cut is an unforgivable sin to most dividend growth investors. However, starting in 2011, Pfizer commenced raising their dividend again at an average rate that has exceeded 9% per annum.

Nevertheless, and in spite of weakening operating results and the dividend cut, had you purchased Pfizer on December 30, 2005 when its P/E ratio has fallen to a below intrinsic value of 11.5, and held on through thick and thin, your long-term total annual return would have averaged 6.79%. Interestingly, that rate of return would have essentially matched the S&P 500’s return of 6.84% over that same time period. But even more interesting, Pfizer would have generated approximately twice as much dividend income as the S&P 500.

To repeat and clarify, I am not in favor of investing in a company that was going through the situation like we saw with Pfizer. However, this does represent a clear example of the power of investing in stocks when they are undervalued relative to their fundamentals, even weakening fundamentals.

Pfizer Inc (PFE) Fair Company, Low Valuation

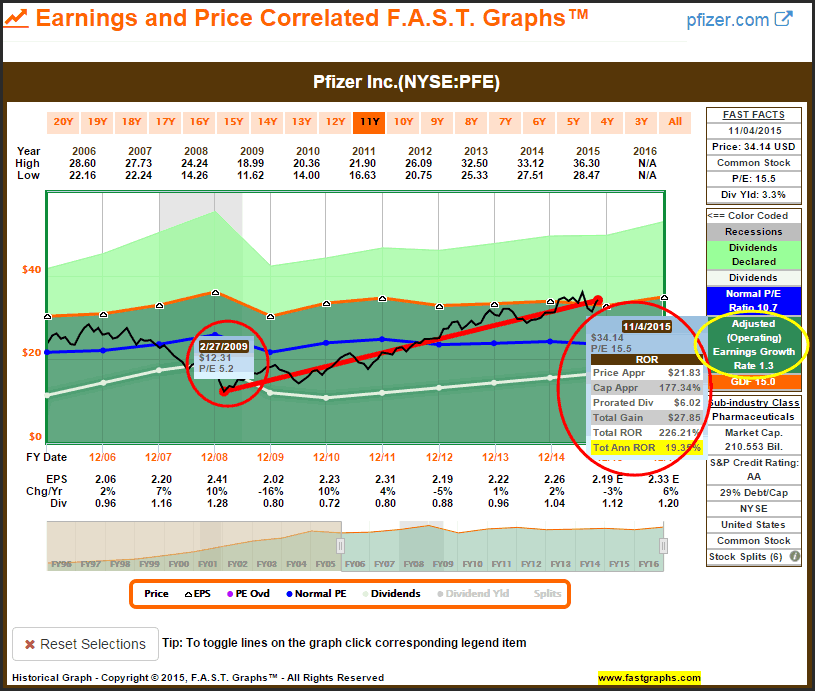

In order to drive home the true power, protection and advantage of investing in a stock at extremely low valuations, let’s look at the returns that Pfizer shareholders would have enjoyed had they purchased Pfizer when its P/E ratio had fallen to 5.2. Over that timeframe, this huge pharmaceutical company generated a long-term rate of return exceeding 19% per annum. Of course, this is an extreme example that assumes the foresight to purchase at the bottom, which is rarely accomplished. On the other hand, it does illustrate the power and advantage of value investing.

Pfizer Inc – Fair Company, Wonderful Price

Investing In a Wonderful Business At a Low Valuation Is Even Better

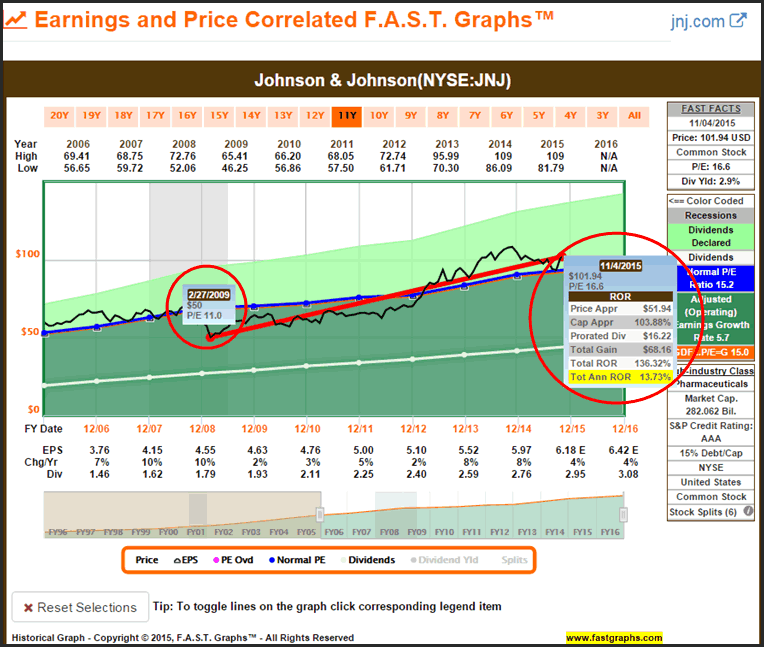

Although I totally agree with Warren Buffett about investing in a wonderful business at a fair price, it’s even better to invest in a wonderful business at a low valuation. AAA rated Johnson & Johnson is widely considered as one of the highest quality dividend growth stocks on the planet. And as such, it is very rare to find this blue-chip trading at an attractive valuation - and even rarer to find it undervalued. However, the Great Recession presented that opportunity, and the long-term results for those that took advantage would have been amazing. Value investing is a powerful and productive investment strategy indeed.

Johnson & Johnson (JNJ) – Wonderful Company, Wonderful Price

Beware of Value Traps

The essence of value investing is identifying fundamentally strong companies that are trading below their intrinsic value. The key phrase in that last sentence is “identifying fundamentally strong companies.” As previously stated, the key to implementing a successful value strategy is to focus more on fundamental strength than on stock price activity, especially in the short run. However, value investors are often admonished to beware of value traps. However, those admonitions are often misguided because they are predicated on short-run price volatility. In my humble opinion, for a stock to be a true value trap, it has to be associated with real deteriorating fundamentals.

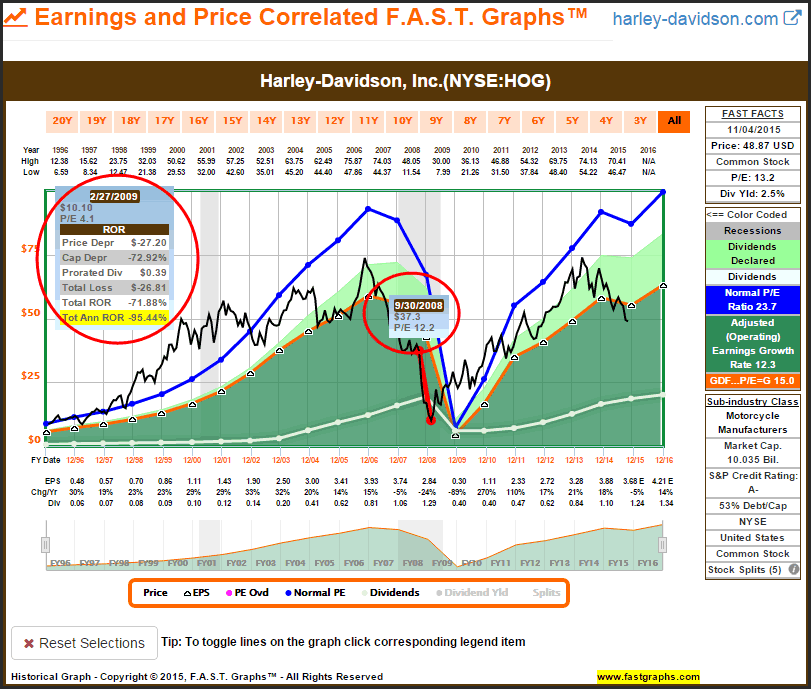

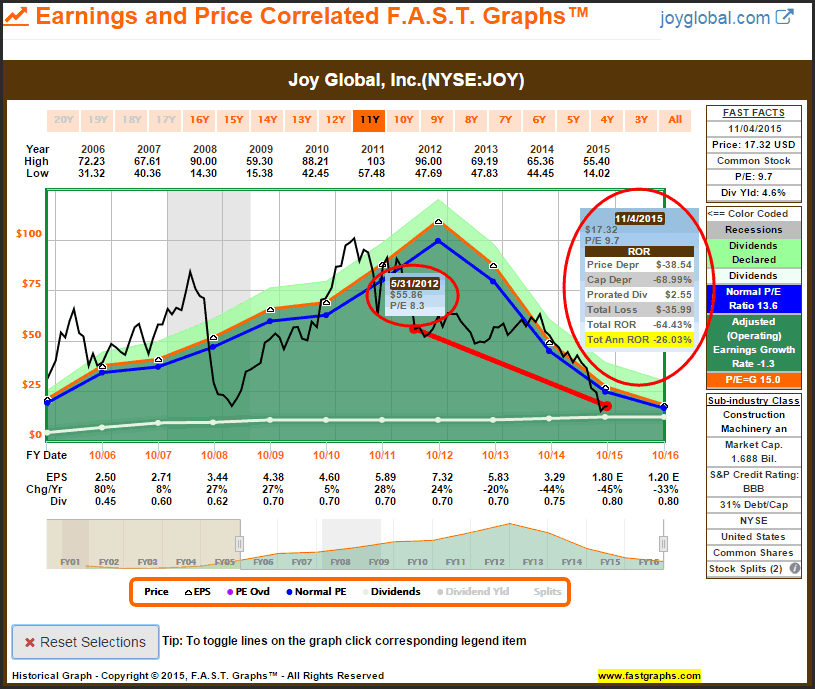

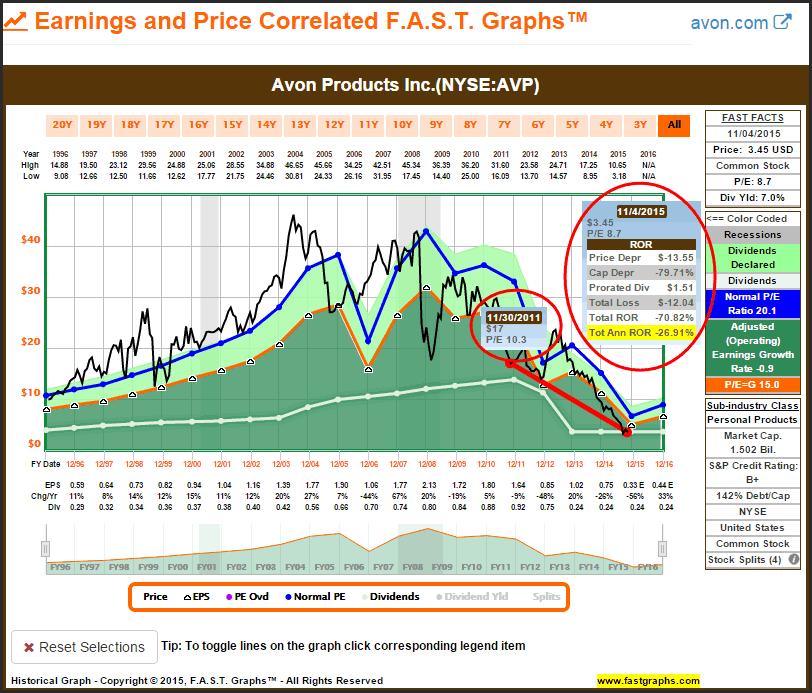

The following represent 3 examples of what I would consider true value traps. In each case, I ran calculations from when the companies were trading at below average current price earnings ratios. However, what made these value traps, in my mind at least, was the severe and continued deterioration in fundamentals primarily represented by collapsing earnings, and in 2 of the examples drastic cuts in their dividends that followed.

I will let the graphic’s speak for themselves, however, the primary principle here is that fundamentals were deteriorating in concert with stock price. A falling stock price onto itself does not represent a value trap. Instead, as illustrated with my previous examples, a falling stock price that occurs when fundamentals remain strong and attractive represents opportunity.

Harley-Davidson Inc (HOG) – Value Trap

Joy Global Inc (JOY) – Value Trap

Avon Products Inc (AVP) Value Trap

The Advantage of Value Investing in Dividend Growth Stocks

To me, value investing into blue-chip dividend growth stocks might be the most appropriate and advantageous utilization of this proven common stock investing approach. The advantage stems from the growing dividend income stream that pays the value investor to wait for eventual price appreciation. This is especially appropriate to retired investors whose primary objective is to earn a current and a growing future income stream. Investing for income in retirement is almost by definition, most appropriately a long-term approach and strategy. This works in concert with value investing because it works best when it is applied over the longer run.

Valuation oriented dividend growth investors are often criticized with refrains that goes something like this: What good does it do me to receive a dividend when I’ve lost 2 years’ worth of dividends from the price drop? To my way of thinking, everything I’ve written thus far answers that question. However, there is an additional insight that is worth mentioning here. A short-term drop in the price of a stock represents an unrealized loss. This only turns into a realized loss if, in fact, you sell out of the position.

In other words, a loss does not become a true loss until and unless it is actually taken. As I illustrated with many examples in this article, the advantage of applying value investing to dividend growth stocks comes from the growing dividend income stream that is paying you to wait for better prices. If fundamentals remain strong, and even if they temporarily weaken a little bit, a truly undervalued stock will inevitably return to fair valuation, and once it gets in favor again, it often rises beyond fair value. I call this natural leverage, which I earlier referred to as turbo-charging long-term performance.

Summary and Conclusions

Value investing is a proven strategy and produces above-average long-term returns. However, it does require what I call intelligent patience. This simply means the willingness to wait for the price of a wonderful business to reward you in accordance with its underlying fundamental strength. It’s much easier to exercise patience when you focus on fundamentals first and foremost. Growing earnings and a rising dividend income stream are worth waiting for. At the end of the day, value investing is about focusing on earnings yield. The lower the price you pay for earnings, the more yield each dollar’s worth of earnings provide you. In the long run, that tends to pay off handsomely with both a growing income stream, and eventually strong price performance.

In this Part 1, I primarily covered value investing as it applies to dividend paying stocks. In Part 2 I will turn my attention to applying value investing principles to high-growth stocks. The underlying principle of valuation being supported by fundamentals holds true. However, due to the power of compounding, growth stocks can, and rightfully so, command higher valuations and still be considered attractive or even undervalued.

Disclosure: Long PFE,GD,MDT,JNJ

By Chuck Carnevale

Charles (Chuck) C. Carnevale is the creator of F.A.S.T. Graphs™. Chuck is also co-founder of an investment management firm. He has been working in the securities industry since 1970: he has been a partner with a private NYSE member firm, the President of a NASD firm, Vice President and Regional Marketing Director for a major AMEX listed company, and an Associate Vice President and Investment Consulting Services Coordinator for a major NYSE member firm. Prior to forming his own investment firm, he was a partner in a 30-year-old established registered investment advisory in Tampa, Florida. Chuck holds a Bachelor of Science in Economics and Finance from the University of Tampa. Chuck is a sought-after public speaker who is very passionate about spreading the critical message of prudence in money management. Chuck is a Veteran of the Vietnam War and was awarded both the Bronze Star and the Vietnam Honor Medal.

© 2015 Copyright Charles (Chuck) C. Carnevale - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Chuck Carnevale Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.