Stock Market 6-7% Pull Back Likely, Gold Still Going Down

Stock-Markets / Stock Markets 2015 Nov 06, 2015 - 06:02 AM GMTBy: Brad_Gudgeon

The stock market's recent advance has been nothing less than spectacular. Caveat emptor: the rally was mainly in the large cap stocks. The FED's determination to raise interest rates in December is predicated on the upcoming economic data. One of the most important releases comes out on November 6th, the jobs report.

The stock market's recent advance has been nothing less than spectacular. Caveat emptor: the rally was mainly in the large cap stocks. The FED's determination to raise interest rates in December is predicated on the upcoming economic data. One of the most important releases comes out on November 6th, the jobs report.

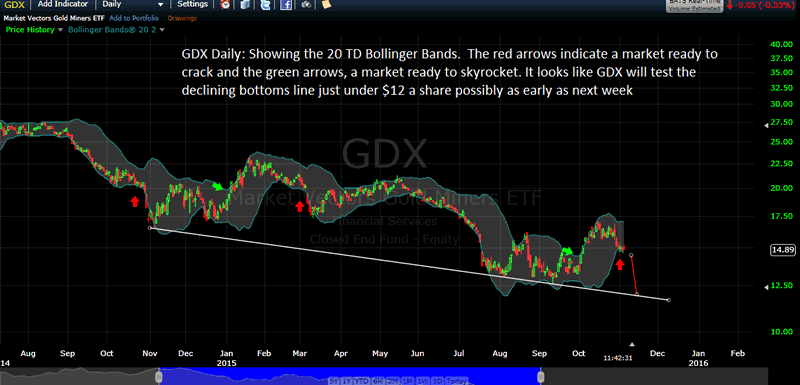

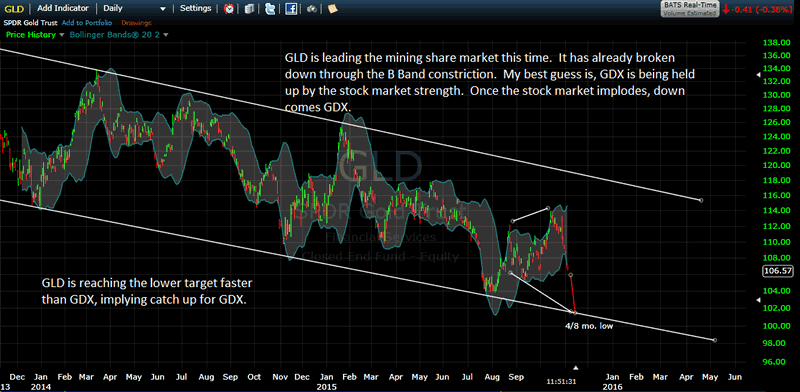

Gold has been falling, and we are still short the miners expecting blood to run on Friday on GDX and very likely the SPX too. Good news is likely to be bad news.

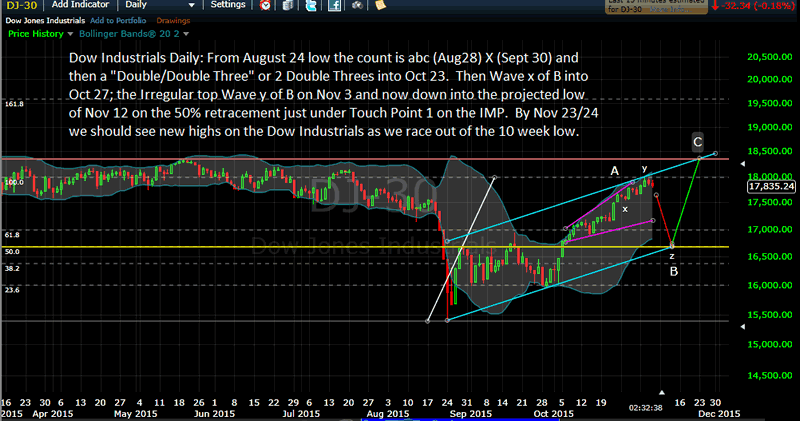

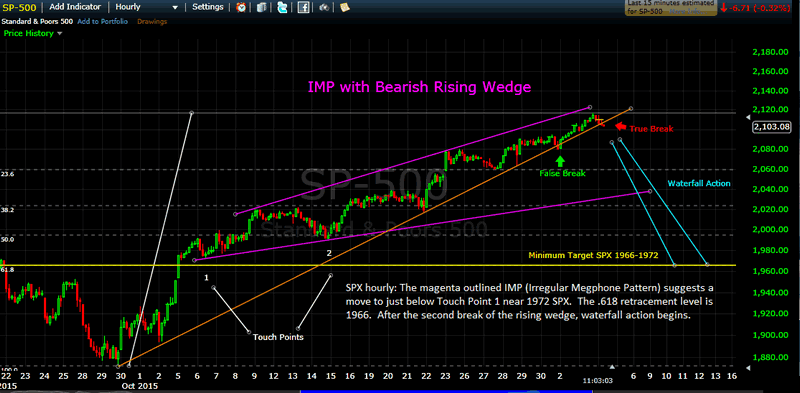

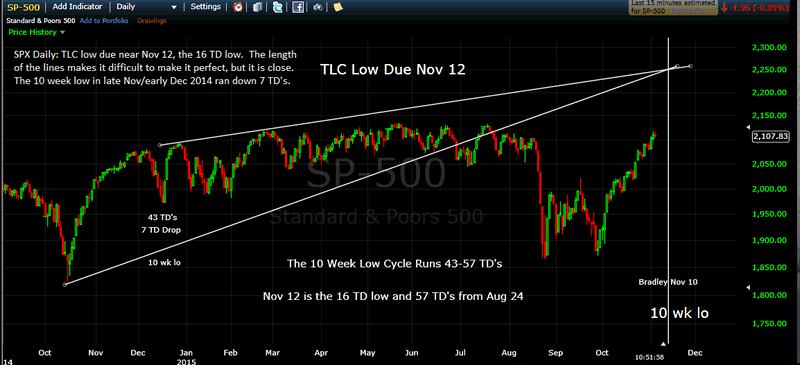

Cutting to the chase, the charts below tell the tale: a 6-7% drop in the SPX and Dow Industrials expected and further blood in the miners into the ideal November 12 date. GDX could easily fall below $12 this time and SPX should go below 1972 according to the IMP. We have a Rising Wedge also that has been broken and Thursday formed a spinning top in a down trend, which often precede big moves.

Technical divergences on the SPY include: stochastics, money flow, OBV and momentum amongst others. The daily MACD turned down today for the first time in a few weeks. E-wave analysis suggests that after this pull back, a faster, more powerful up-wave should develop and take at least the Dow Industrials to all time new highs soon. The whipsaws are likely to continue as uncertainty about the FED's intentions stay on the burner for a while.

Dow Jones Daily Chart

S&P500 Hourly Chart

S&P500 Daily Chart

GDX Daily Chart

GLD Daily Chart

The last 4 of these charts was written on November 4 and much has come to pass already with GDX breaking down the door of the daily Bollinger Band. The FED's hinting last week will likely come to haunt us on Friday this week, a delayed reaction.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com Copyright 2015. All Rights Reserved

Copyright 2015, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.