Bitcoin Price Surges 55% In Month – Chinese Moving Capital Into Bitcoin and Gold

Currencies / Bitcoin Nov 05, 2015 - 01:13 PM GMTBy: GoldCore

Bitcoin has been surging in value since mid October and gained more than 20% yesterday alone. At one point, it hit a yearly high of more than $491 (see chart).

Bitcoin has been surging in value since mid October and gained more than 20% yesterday alone. At one point, it hit a yearly high of more than $491 (see chart).

CoinTelegraph

In August, bitcoin fell to a low for 2015 near $200 amid turmoil in the Chinese and global stock markets. But bitcoin transaction volume has been growing. Blockchain.info data shows that unique bitcoin wallet addresses—which are how users manage and trade bitcoin—are at an all-time high. Some have multiple bitcoin addresses, but such a spike suggests there are new users as well.

It’s not entirely clear what’s driven the most recent price gains. There is an assertion in an article on the front page of the FT today that the gains are due to Chinese people flocking to bitcoin in a giant pyramid scheme run on a Russian fraudsters website:

The price of the cryptocurrency bitcoin surged on Wednesday to its highest in more than a year amid a wave of Chinese testimonials for a “social financial network” called MMM, which bears the hallmarks of a pyramid scheme.

New members of MMM have to buy bitcoins to join the scheme, which is the brainchild of Sergey Mavrodi, a former Russian parliamentarian since jailed for fraud.

Although the article is unbalanced and simplistic, the truth regarding the root cause of the price movement of any market is of course much more complex – and there are many supply and demand issues to be considered.

Source: CoinDesk

Most bitcoin experts once again see Chinese demand as key. As China has been devaluing its currency, the yuan, throughout the year and the Chinese are aware of the growing risks posed to the yuan and indeed the dollar and other fiat currencies.

Also, their recent experience of the stock market crash has made bitcoin and, of course, gold more attractive again. Hence the surge in demand for gold in China again. China’s gold buying rose 7.83% year on year to 814 tons in the first three quarters, industry data from the China Gold Association (CGA) showed yesterday.

There are increasing concerns of capital controls in China and Chinese investors and companies are seeking to diversify internationally and move savings and capital out of China.

Bitcoin is an easy way for people to swap out of yuan. Goldman Sachs analysts estimated earlier this year that 80% of bitcoin volume is exchanged in and out of the Chinese yuan. Once converted to bitcoin, the owners can then swap back into other fiat currencies and indeed, physical gold.

We see value in having an allocation to bitcoin and see it as complementary to owning physical gold and silver. It is clearly more volatile than gold and even silver and is not proven as a hedging instrument and safe haven asset. Therefore, it is more speculative and merits having a lower allocation than gold and silver bullion.

DAILY PRICES

Today’s Gold Prices: USD 1107.30, EUR 1024.40 and GBP 724.75 per ounce.

Yesterday’s Gold Prices: USD 1118.00, EUR 1024.09 and GBP 724.99 per ounce.

(LBMA AM)

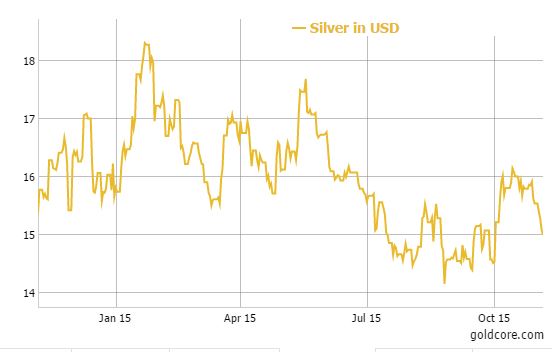

Gold lost $10.20 yesterday to close at $1107.50. Silver was also down by $0.20 for the day closing at $15.09. Platinum lost $8 to $953.

Download Essential Guide To Storing Gold In Switzerland

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.