The Stock Market Big Picture

Stock-Markets / Stock Markets 2015 Nov 03, 2015 - 12:54 PM GMT Good Morning!

Good Morning!

The SPX Premarket is down, but around 8:30 a rally has been launched to attempt to take SPX higher. How far the central banks and primary dealer banks can push it is yet to be determined. I recalculated the targets for the three formations and was surprised at how closely they all agree.

Two of the three formations are invalidated if SPX rises above 2134.72. However, there is a backup Wave structure should that happen.

Now I wish to discuss the significance of the targets mentioned above. The upper trendline of the Orthodox Broadening Top cuts across at or slightly above 1600.00. A decline that cannot pierce the trendline may invalidate this structure, suggesting a blow-off top. But first, the lows must be tested.

Once a rally overshoots the upper trendline of an Orthodox Broadening Top, the average target is 34% higher, or 2144.00. We may know very soon whether the May 20 high satisfies that target or not.

A likely target for the next decline may be near monthly mid-Cycle support at 1449.42.

The second part of this equation is whether the decline goes beneath 1600.00. For good measure, it should decline beneath 1576.09, its 2007 high. Should that happen, we may have the largest bear market in history, since the downside target of this Orthodox Broadening Top is beneath 450.00.

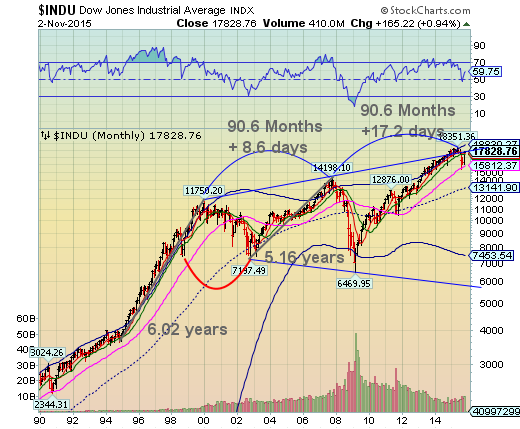

The Dow did not reach escape velocity above its upper trendline and is now retesting it from beneath. It may not succeed. If so, the chances are high that monthly Long-term support at 15812.37 may not hold, since it has already been tested on August 24. The next level of support is the monthly mid-Cycle support at 13141.90.

Back to the present, TNX has reached its Primary Cycle Pivot high today, as the Model has indicated. Having completed its Wave structure and reached its Cycle top at 22.02,, we are likely to see a reversal take place fairly quickly. This should also give us a good indication that liquidity is now flowing back out of stocks and into bonds.

All the best,

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.