Dow Death Cross is Not a Bearish Signal for the Stock Market

Stock-Markets / Stock Markets 2015 Nov 02, 2015 - 06:54 PM GMTBy: Sol_Palha

People who cannot recognize a palpable absurdity are very much in the way of civilization.- Agnes Repplier

People who cannot recognize a palpable absurdity are very much in the way of civilization.- Agnes Repplier

One of the common themes we have spotted it that many of the readily available tools don’t provide their users with any meaningful edge. If the indicator is easy to use and easy to master, that means a plethora of individuals will be relying on it to give them some edge over the masses. What they fail to understand is that they are the part of the mass, they are trying to outwit. A lot of chatter has sprung about lately regarding the death cross. First it was the Dow, and now there is talk about the U.S dollar. This indicator like the “Hindenburg Omen” is far from perfect and could lead to more harm than good if utilized consistently, other than the cool names they carry, they offer little in terms of value: they are both easy to master and understand and this, in essence, renders them useless.

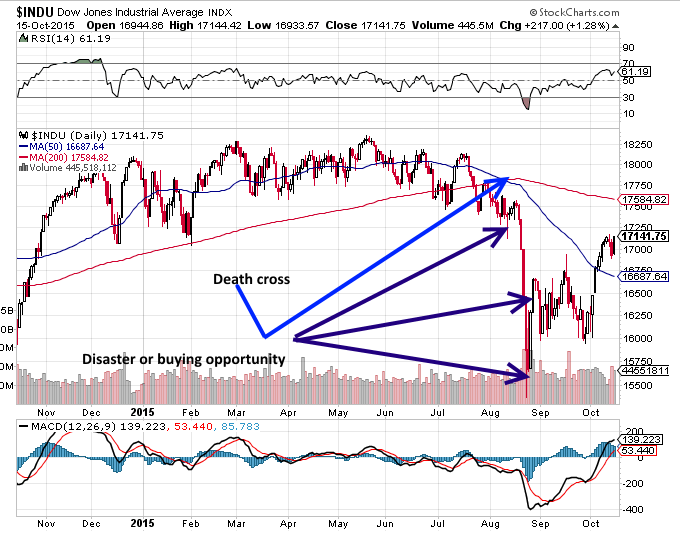

For those not familiar with the term death cross, it is a technical indicator, and it occurs when an index or stock’s 50-day moving average falls below its long-term moving average, which is usually the 200-day moving average. The talking heads would have you believe that the end of the world was nigh. As usual when this occurred this year, they came out of the woodwork screaming bloody murder. Like a broken clock, they appeared to be right for a moment of time, but then reality hit, the illusion vanished, and they ran back into the woodwork when the market reversed course. Take a look and determine what it represents to you, disaster or opportunity.

When we look at it, we do not see anything dangerous or anything to fear. Once fear takes over you are paralyzed and rather than acting in a way that produces rewards, the result is usually failure and loss. Now to be fair, if you are nimble, then one could make money shorting the markets, but you would have to be pretty agile; something that is easier said than done. Look how fast the market reversed course. Using the Dow as an example, if one had shorted the Dow based on the so-called “death cross pattern”, the outcome would have in most cases been far from perfect. You would have jumped in based on the signal, but what would have been your signal to jump out. If you did not move quickly or were waiting for a trigger to nullify the “death cross”, you would have lost of the potential gains, and this is assuming that you managed to get in at the precise moment the signal was triggered. We believe that time would be better spent by making a list of stocks to buy, for the upside gains usually dwarf those made from shorting. History is on your side too. Over time markets trend upwards, and not downwards.

At the Tactical Investor, a death cross is a buying event, time to break out a bottle of champagne and celebrate, while the masses are busy chanting death to the markets. Many will not agree with our stance, but then again, if one is to be a contrarian, one must get used to this. When people agree with you or pat you on the back, caution is warranted and vice versa.

From a contrarian and mass psychology perspective, disaster is the code name for opportunity. Be happy when the masses panic, and panic when the masses are happy.

A hallucination is a fact, not error; what is erroneous is a judgment based upon it.

Bertrand Russell

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2015 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.