London Property Bubble Set To Burst – UBS and Deutsche Warn

Housing-Market / UK Housing Oct 29, 2015 - 12:21 PM GMTBy: GoldCore

The London property market is being increasingly recognised as a bubble and now even leading international banks are warning that the bubble may be set to burst.

The London property market is being increasingly recognised as a bubble and now even leading international banks are warning that the bubble may be set to burst.

Today, UBS has warned that London’s property market is “frothing” and last week Deutsche Bank were the property party pooper “calling time” on the London property “party.”

According to a new UBS report, England’s capital is home to the most significantly overvalued housing market of any major city in the world – and that means there’s a risk the bubble is close to bursting.

“When inexpensive financing is combined with bullish expectations, real estate prices eventually uncouple from the real economy,” said UBS head of global real estate Claudio Saputelli.

“We have seen this in the current cycle, particularly in the world’s leading financial centers, where housing prices are now, in many cases, fundamentally unjustified. The risk of a real estate bubble in these cities has risen sharply. While it is not always possible to prove conclusively the existence of a bubble, it remains essential to identify the signs of one early on.”

Deutsche bank’s research as seen in the latest edition of its Konzept magazine last week warned that:

“The dinner-party perception that prices for prime London property have always gone up is potentially a reason to worry. That everyone strongly believes they will continue to go up further is a cause for anxiety. Still, timing any turn is hard and it has long been a losing battle to call an end to the froth in this market. But perhaps we are close to the turning point.”

Deutsche describes previous examples of house-price slumps, notably in Hong Kong and Japan:

There are multiple catalysts to suggest that 2015 is the turning point [for London]. The most significant are: impending higher interest rates, tighter macro-prudential policies and a deepening politicisation of the housing issue. Again, all that needs to happen is for investors to think price outcomes are asymmetric, with low upside and large downside.

There is growing political risk embedded in prime London housing. It is not that prices cannot rise further. It is that the more they rise the greater the chance of a political backlash against further gains.

What’s more…

Valuations are high relative to history, falling interest rates cannot provide further support, and given current affordability home ownership cannot rise materially. London’s property is unlikely to enjoy the next 30 years as it did the last.

We clearly warned in December 2014, that the London property bubble looks set to burst. According to a host of different measures it appears overvalued and indeed severely overvalued.

Indeed, we were one of the few brokerages and advisers to warn regarding the global property bubble prior to the global financial crisis. Our analysis of property markets led to growing concerns in 2004 and 2005 about the very high levels of mortgage and total debt being seen in the UK, U.S. and internationally.

Our research clearly warned regarding property bubbles in the UK, Ireland and the U.S. and we warned readers and especially clients about the risks this would pose to the global financial system and economy and the risks of a global financial crisis.

Now is a good time to reduce allocations to overvalued property markets in many leading international cities such as New York, Hong Kong, Singapore, London and elsewhere and to diversify into physical gold.

A bursting of property bubbles in London and New York would be expected to have an impact on national economies and indeed on national property markets. Sentiment would be badly impacted.

Caution should be the order of the day.

Download Essential Guide To Storing Gold Offshore

DAILY PRICES

Today’s Gold Prices: USD 1159.00, EUR 1057.38 and GBP 759.28 per ounce.

Yesterday’s Gold Prices: USD 1171.50, EUR 1058.98 and GBP 765.94 per ounce.

(LBMA AM)

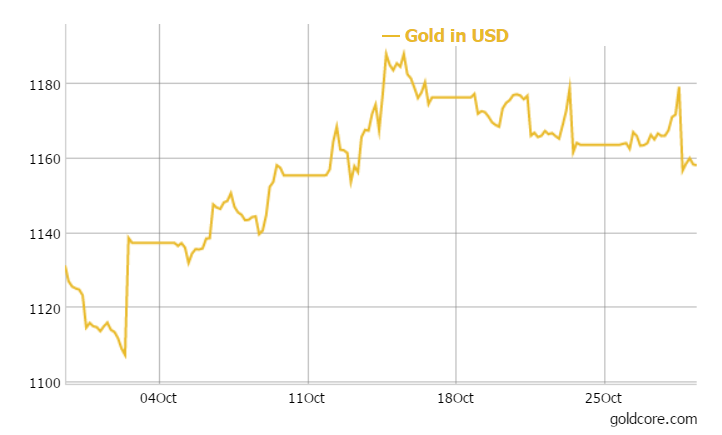

Gold in USD – 1 Month

Gold lost $9.60 yesterday, closing at $1156.80. Silver closed at $15.99, a gain of $0.11. Platinum gained $14 to $998.

Gold has recovered some lost ground this morning, climbing 0.2% after they slid from two-week highs yesterday following a Fed statement that put a potential December rate hike back on the table … once again.

Interestingly silver, platinum and palladium held up very well yesterday and avoided the losses seen in gold, but are down slightly today.

Download 7 Key Storage Must Haves

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.