Precious Metals Starting To Produce Some Winners

Commodities / Gold and Silver Stocks 2015 Oct 26, 2015 - 05:59 PM GMTBy: John_Rubino

Everybody who’s owned gold and silver mining shares through a couple of cycles has their favorite story of the stock that took off and ran away. There was Glamis Gold, which rose from $1 to $40 in the space of a few years before selling out to Goldcorp. And Silver Wheaton, which soared from $3.45 in 2008 to over $40 in 2011. And many, many more.

Everybody who’s owned gold and silver mining shares through a couple of cycles has their favorite story of the stock that took off and ran away. There was Glamis Gold, which rose from $1 to $40 in the space of a few years before selling out to Goldcorp. And Silver Wheaton, which soared from $3.45 in 2008 to over $40 in 2011. And many, many more.

That’s how mining shares — which are, as the industry likes to say, leveraged plays on gold and silver — behave when the underlying metals start to rise. And you only need to find and ride a few such moonshots to justify a lifetime of obsessing over your investments.

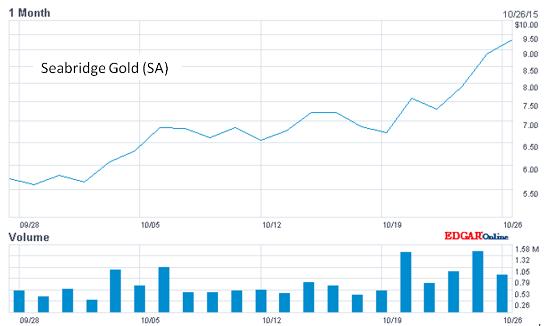

Now, after a brutal and interminable bear market, a few of the better miners and streaming companies are starting to show signs of that famous upside potential. Three examples:

There’s no way to know whether this is a head fake in an ongoing bear market or the start of another epic rise — which, this time, we don’t want to miss! But when that epic rise does come, its initial stage will look like these charts. So the current action at least bears watching.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.