Wal-Mart Symbol of U.S. Economic Condition

Companies / Retail Sector Oct 21, 2015 - 12:18 PM GMTBy: BATR

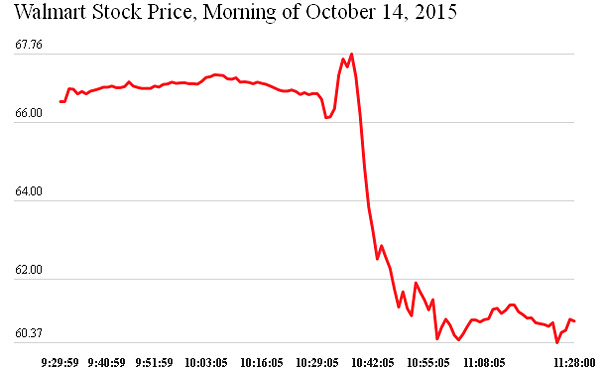

Whether you love it or hate it, Wal-Mart is a goliath among giants. It employs 1.4 Million Americans or 1% of the work force. As a gauge of economic activity, financial analyses weigh the performance, sales and consumer attitudes closely. So with the historic stock crash of 10% in one trading day and 22% overall, quite a lot of attention was reported. Most noteworthy comes from The Street; Did Wal-Mart’s CEO Just Drop a Major Bombshell?

Whether you love it or hate it, Wal-Mart is a goliath among giants. It employs 1.4 Million Americans or 1% of the work force. As a gauge of economic activity, financial analyses weigh the performance, sales and consumer attitudes closely. So with the historic stock crash of 10% in one trading day and 22% overall, quite a lot of attention was reported. Most noteworthy comes from The Street; Did Wal-Mart’s CEO Just Drop a Major Bombshell?

“CEO Doug McMillon may be preparing to take drastic action to reverse the giant retailer's slumping stock price and pressured profits.

"We are more than open to re-shaping our portfolio," said McMillon at the company's 22nd Annual Investment Community Day on Wednesday. McMillon added the company continues to "evaluate its portfolio" of assets, and pointed to Wal-Mart's history of exiting non-strategic assets and closing underperforming stores.”

The mere mention of closing stores may well be forecasting a long and lasting recession. Yet some see another reason why Walmart may be undergoing readjustment factors not normally experienced; namely, competition.

TIME online offers the following in the column; This Is Why Amazon Is Dominating Walmart Now.

“As online retail growth surpassed that of Walmart’s traditional retail model, a rivalry emerged between Walmart and Amazon, as price wars broke out. Today, Walmart’s revenue is still much larger–although only 5 times larger now–and Amazon’s revenue per employee ($623,000) is nearly three times that of Walmart.”

Rather than expressing worry, the folks at TIME continue to spin the drop as a wake-up call, Why Walmart’s Plunging Stock Price Is a Good Sign for Walmart Shoppers.

“Improving the situation for its understaffed, underpaid, unmotivated workforce should help Walmart address many of these issues. That’s the idea anyway. When workers are paid better—and when there are just plain enough of them to deal with the tasks at hand—they’ll do a better job of restocking shelves, handling customer needs, and keeping stores clean and inviting. Higher wages should help scale back worker turnover too, and Walmart would eliminate some business costs if it had a more stable roster of employees.”

Let’s call a time out and remind that customers are the driving component behind sales. If they like the products offered at a fair price and a consumer friendly shopping experience, they will likely buy. However, this formula is based upon the prospects that they have the money to pay for the transaction. Well, at least as long as their credit cards are not maxed out.

Much fanfare has captured the media about Walmart’s decision to raise wages. The Unintended Consequence of Wal-Mart’s Raise: Unhappy Workers, provides one assessment.

“Giving additional raises to employees already making close to the new minimum wage would cost Wal-Mart about $400 million, said Jeannette Wicks-Lim, an assistant research professor at the University of Massachusetts, Amherst. She based her calculation on raises the retail industry has handed out after past increases to state and federal minimum wages.

Wal-Mart has said about 500,000 of its 1.3 million U.S. employees are getting raises as part of the new pay policy and all employees will be able to benefit from the new scheduling and training programs.”

Well, merely paying workers a buck or two more will never lift them out of the 99%. When business growth declines, the packaging and the ribbons will not tap the disposable incomes of consumers when they are fixed upon maintaining their very survival and buying just necessities.

View the video, Walmart: Killing The Heart Of America for an overview.

Walmart is just the most visible of retailers to get a swift kick in the behind from a deflationary economy that is caught in the catch-22 dilemma of rising operational costs.

So what does a corporatist multinational do to gin up the business transaction cycle? One method follows a familiar pattern. Wal-Mart Putting the Screws to the Competition, keeps the money flowing.

“Little news can sometimes have hidden implications, as we should all know by now. Wal-Mart has just announced that they will be “helping” some of their suppliers by allowing them to use their AA credit rating. In the deal, Wal-Mart’s suppliers can essentially “sell” their Wal-Mart invoices to Wells Fargo and Citigroup for basically instant cash.”

Anyone who ever sold products to Walmart knows that getting paid for your supply chain delivery could take a long time. Improving cash flow is certainly not new for big operations that perfected the stall payment system. However, Walmart has always been better than most at using other people’s money.

Has the Walmart phenomena run its course and is destined to become the Woolworths of the 21the Century? Of course the retailer, that Sam Walton built, will survive as long as brick and mortar shopping is conducted from minivans in parking lots. Whether it is a promising stock play is another matter.

When Wall Street announces that Walmart's entire business model is crumbling, just maybe the wizards of finance have lost touch with Middle America.

"New guidance reflects that Walmart's competitive edge — historically largely assortment and price — has faded relative to purveyors of extreme value (warehouse clubs, hard discounters) or extreme convenience (dollar stores, hard discounters), as e-commerce has neutralized the impact of selection," Goldman Sachs analyst Matthew Fassler wrote in a note to clients.”

Not everyone is looking for a Starbuck latte to be delivered. However, the time may be coming for the reemergence of the main street retailer in shopping districts that provide a destination experience instead of a UPS box drop off or a self scanned checkout line.

Less intelligent consumers forget, for the corporatist, it is all about turning the cash receipts into money centered financial instruments that can be pumped back into the hedging casino for paper profits in a digital computer account.

Both the consumer and employee workers are mere necessary inconveniences until the dawn of robot retailing becomes the next hot IPO. If that day ever comes, just how many will reminisce about the “good old days” of the Walmart retail monopoly? Until then, check your pocketbook, you may be staying away because your purse is empty.

Source: http://www.batr.org/corporatocracy/102115.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2015 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.