Deflationary Debt Deleveraging Hurricanes to Hit US and UK

Economics / Deflation Jun 30, 2008 - 12:45 PM GMTBy: Mike_Shedlock

Congratulations (of sorts) go to the UK as British household debt is highest in history .

Congratulations (of sorts) go to the UK as British household debt is highest in history .

British households are now more indebted than those of any other major country in recorded history, it has emerged.

Families in the UK now owe a record 173pc of their incomes in debts, official figures have shown. The ratio of debt to income is higher than any other country in the Group of Seven leading industrialised economies, and is sharply higher than the 129pc of incomes it was five years ago.

Michael Saunders of Citigroup warned that - at 173pc of household incomes - the debt burden is higher even than Japan's when it peaked in 1990, before more than a decade of deflation. Philip Shaw of Investec said: "Although we take the view that the economy will avoid a recession , our confidence is ebbing."

Avoid A Recession?

It will be hard for the US and UK to avoid a depression.

What started as a tropical storm called "Subprime" has intensified in magnitude to engulf Alt-A, HELOCs, credit cards, commercial real estate, municipal bonds, corporate bonds, and the stock market, just as baby boomers are headed for retirement.

If you prefer, you can think of this as Many Hurricanes, Many Eyes .

Barclays Warns Of Financial Storm

Most do not even understand the nature of the storm that is about to hit. Barclays is right at the top of the list. Please consider Barclays warns of a financial storm as Federal Reserve's credibility crumbles .

Barclays Capital has advised clients to batten down the hatches for a worldwide financial storm, warning that the US Federal Reserve has allowed the inflation genie out of the bottle and let its credibility fall "below zero".

"We're in a nasty environment," said Tim Bond, the bank's chief equity strategist. "There is an inflation shock underway. This is going to be very negative for financial assets. We are going into tortoise mood and are retreating into our shell. Investors will do well if they can preserve their wealth."

Barclays Capital said in its closely-watched Global Outlook that US headline inflation would hit 5.5pc by August and the Fed will have to raise interest rates six times by the end of next year to prevent a wage-spiral. If it hesitates, the bond markets will take matters into their own hands. "This is the first test for central banks in 30 years and they have fluffed it. They have zero credibility, and the Fed is negative if that's possible. It has lost all credibility," said Mr Bond.

No Wage Price Spiral

Wage price spirals happen when corporations get into bidding wars over employees, not when they are shoving them out the door by the hundreds of thousands. Mr. Bond must be reporting from Bizarro World. The odds of a wage price spiral in the US are essentially zero as credit is drying up and overcapacity is everywhere you look. Massive Government and Private Sector Job Cuts Are Coming .

This is not Bizarro World, nor it is 1970.

If Barclays is betting on six interest rates hikes in the US with its own money it will likely get carted out in a coffin. Property values are crashing, unemployment is rising, wages are falling, global wage arbitrage is king, and most importantly Peak Credit Has Arrived .

It is impossible to get inflation out of that mix. Berananke could cut interest rates to zero tomorrow and it would not cause inflation, at least as properly defined: a net expansion of money and credit. Banks are strapped for cash. They cannot lend. Businesses do not want to borrow. There is overcapacity everywhere. The Shopping Center Economic Model Is History .

I struggle to see how anyone can get inflation out of that mix. Last Thursday when the stock markets were in a freefall, I asked Is The Inflation Scare Over Yet? Well, I guess it's not.

Fed Has Lost Credibility

However, I will grant Mr. Bond one thing. "The Fed has lost all credibility." I discussed that idea in Things That Have Not Yet Happened in response to Bernanke's absurd claim "Danger of downturn appears to have waned."

Bernanke made that statement on June 9th. On June 26, Bernanke was openly soliciting private equity firms to invest in banks. I discussed this in Fed Looking To Bend Rules To Aid Banks .

Crack-Up Boom In Asia

Actually, I see another statement from Mr. Bond that I agree with, and it is an important one: "Inflation is out of control in Asia. Vietnam has already blown up."

Inflation is indeed out of control in Asia, notably China, India, and Vietnam. That inflation stems from Asia central bankers printing local currency to buy US dollars, in an attempt to keep their export machines going.

Bernanke foolishly calls this a savings glut. Printing money to buy dollars does not constitute savings. It is amazing that a Fed governor does not understand this simple truth.

Besides, it is virtually impossible to have "too much savings". The construct does not even exist!

Peak oil, in conjunction with a crack up inflationary boom in China is masking deflation in the US and pending deflation in the UK. Those focused on rising energy and food prices are missing the boat.

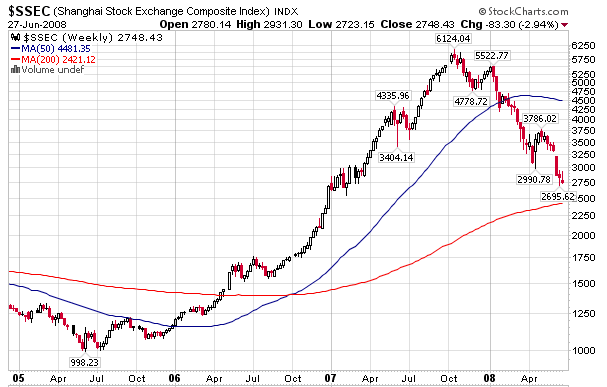

However, I suspect China is going to slam on the brakes after the Olympics. The Shanghai Stock Exchange Index sure acts as if something is coming down the pike.

$SSEC Weekly Chart

Who's In Control?

Ben Bernake at the Fed, Mervyn King at the Bank of England, and Jean-Claude Trichet at the ECB are not in control of what is about to happen. When it comes to commodity prices,peak oil and China's willingness to allow its economy to overheat are going to be the driving forces. Trichet can hike all he wants and it will not matter much to the price of oil. However, it may crush individual economies in the EU.

This does not mean hiking is wrong (although it likely is), it simply means that hiking to rein in gasoline and food prices, two rather inelastic needs, is beyond silly.

Implications of Peak Credit

When it comes to the collapse in credit, the above Central Banks are powerless to do a thing about it. This is to be expected now that we are on the backside of Peak Credit .

The saturation point has been reached. It took decades but we have finally arrived. None of the financial engineering jobs that fueled this credit boom will ever be needed again. SIVs, Conduits, Toggle Bonds, Covenant Lite loans are all dead for years, more likely decades to come. Add to that liar loans, Pay Option Arms, insane leverage, and numerous other ridiculous lending arrangements. And if those things are not coming back, we do not need Wall Street shills to securitize that garbage and pitch it to unsuspecting suckers.

In addition to financial engineering jobs, there was a boom in commercial real estate, home depots, remodeling companies, landscaping, furniture, appliances, plumbing, heating, air conditioning, restaurants, and even things like grass seed.

There is no source of jobs to replace what has been lost and what will be lost. Discretionary spending is dead. Boomers about to retire are about to get religion . Sadly, it's too late. Savings they thought they had in their house, have now vanished into thin air. It was all a mirage in the first place, but mountains of credit has been extended on the basis of that mirage. Trillions of dollars of imagined wealth has gone up in smoke. Trillions of dollars more are about to.

Deflation Has Set In

It is amusing that in the face of this carnage, many are still screaming inflation, stagflation, or even hyperinflation simply because food and energy prices are rising. Deflation is here and now in the US. Deflation is knocking on the door of the UK and Eurozone. And there is nothing that can be done about it.

Can The Fed Print Its Way Out?

Some will insist that I am wrong, that the Fed can print. Well the Fed can print, but the Fed cannot spend. In addition, the Fed cannot give money away, nor would the Fed even if it could. Finally, the Fed cannot force banks to lend or businesses or consumers to borrow.

Bank credit is contracting with the Fed Funds rate at 2%. Bank credit would not be going much of anywhere even at 0% in my estimation. The reason is simple: banks are insolvent!

The Fed is like the powerless man behind the curtain in the Wizard of Oz. Once peak credit sets in, all the Fed can do is bluff. The notion of a helicopter drop is pure nonsense.

What About A Crack-Up Boom?

We had a crack-up-boom. What else can you call the financial engineering that went with SIVs, Conduits, Toggle Bonds, Covenant Lite loans, Pay Option ARMs, etc., etc? That crack-up-boom is over. And just like every credit boom in history, the backside, once the credit boom ends is deflation. Previous examples include Tulip Mania, the South Sea Bubble, John Law Mississippi scheme, the Great Depression, and the property bust in Japan.

Weimar Germany was not a credit boom, but an example of hyperinflation caused by massive printing to pay for war reparations. Zimbabwe is another example of hyperinflation caused by printing.

What About Congress?

Congress, unlike the Fed, can indeed spend money it does not have. They have already done so with an ill-advised stimulus package. There will indeed be more stimulus packages just as there was in Japan. However, nothing can match the sheer number of jobs created in the housing and commercial real estate booms. And nothing can replace the destruction of wealth that is now taking place in housing and the equity markets.

Attitudes Lead The Way

It took nearly 80 years for people to get as reckless as they did in 1929. 80 years! Few are still alive that went through the great depression. That is the nature of the game. People have to forget what a depression is like to bring about the conditions that cause them. And they did. And they made the same mistakes over again, except larger.

The madness of crowds, however, can only go so far. A significant reversal is now underway. The secular peak in consumption has been reached. A reversal in attitudes towards consumption started with houses, but it's spreading to cars, boats, and even Starbucks coffee. It will take a long time for attitudes to get back to equilibrium. And attitudes, like pendulums, will not stop at equilibrium once they get there.

The odds of a significant bout of inflation now are about the same as they were in 1929. Next to none. History is about to repeat.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.